Non Foreign Affidavit under IRC 1445 Massachusetts Form

What is the Non Foreign Affidavit Under IRC 1445 Massachusetts

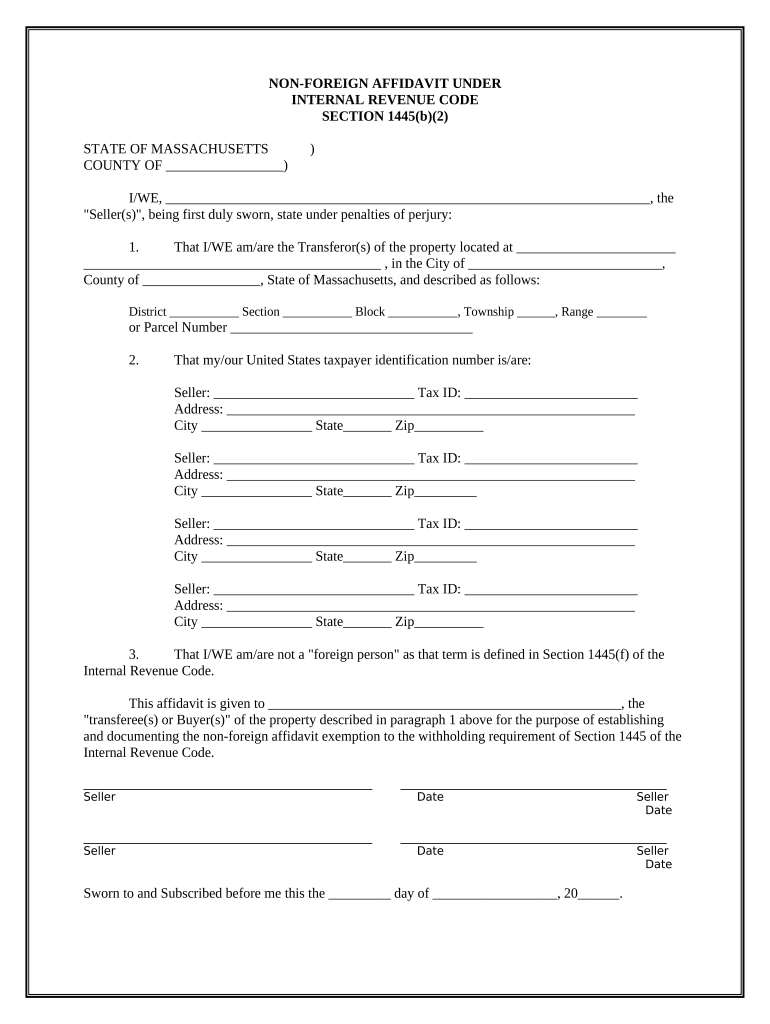

The Non Foreign Affidavit Under IRC 1445 is a legal document used in Massachusetts to certify that a seller of real property is not a foreign person as defined by the Internal Revenue Code. This affidavit is crucial in real estate transactions, as it helps ensure compliance with tax withholding requirements on the sale of U.S. real estate. By providing this affidavit, the seller affirms their status, which can affect the tax obligations of both the seller and the buyer.

How to use the Non Foreign Affidavit Under IRC 1445 Massachusetts

To use the Non Foreign Affidavit Under IRC 1445, the seller must fill out the form accurately, providing necessary personal information, including their name, address, and taxpayer identification number. This affidavit should be submitted to the buyer or their representative as part of the closing documents in a real estate transaction. It is essential to ensure that all information is correct to avoid potential penalties or complications during the sale process.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Massachusetts

Completing the Non Foreign Affidavit Under IRC 1445 involves several key steps:

- Obtain the affidavit form from a reliable source.

- Fill in your personal details, including your full name and address.

- Provide your taxpayer identification number, typically your Social Security Number or Employer Identification Number.

- Sign and date the affidavit, ensuring that all information is accurate.

- Submit the completed affidavit to the buyer or their agent during the closing process.

Key elements of the Non Foreign Affidavit Under IRC 1445 Massachusetts

The Non Foreign Affidavit Under IRC 1445 includes several key elements that must be addressed:

- Identification of the seller: Full name and address.

- Taxpayer identification: Social Security Number or Employer Identification Number.

- Certification statement: A declaration confirming that the seller is not a foreign person.

- Signature and date: The seller must sign and date the affidavit to validate it.

Legal use of the Non Foreign Affidavit Under IRC 1445 Massachusetts

The legal use of the Non Foreign Affidavit Under IRC 1445 is essential in real estate transactions to comply with federal tax laws. By providing this affidavit, sellers can avoid withholding taxes that would otherwise apply to foreign sellers. It serves as a protective measure for buyers, ensuring they are not liable for any tax obligations associated with the seller's foreign status. Proper completion and submission of this affidavit are vital to uphold its legal standing.

Required Documents

When preparing to complete the Non Foreign Affidavit Under IRC 1445, several documents may be required:

- Proof of identity, such as a driver's license or passport.

- Taxpayer identification number documentation.

- Any previous tax returns that may support the seller's claim of non-foreign status.

Quick guide on how to complete non foreign affidavit under irc 1445 massachusetts

Complete Non Foreign Affidavit Under IRC 1445 Massachusetts effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Non Foreign Affidavit Under IRC 1445 Massachusetts on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to modify and eSign Non Foreign Affidavit Under IRC 1445 Massachusetts seamlessly

- Find Non Foreign Affidavit Under IRC 1445 Massachusetts and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools tailored for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Non Foreign Affidavit Under IRC 1445 Massachusetts and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Massachusetts?

A Non Foreign Affidavit Under IRC 1445 Massachusetts is a document required by the IRS that certifies a seller is not a foreign person. This affidavit helps ensure that the buyer does not have to withhold taxes at the time of sale. Utilizing airSlate SignNow, businesses can easily create and eSign these affidavits to streamline their transactional processes.

-

How does airSlate SignNow help in creating a Non Foreign Affidavit Under IRC 1445 Massachusetts?

airSlate SignNow offers a user-friendly platform that simplifies the creation of a Non Foreign Affidavit Under IRC 1445 Massachusetts. Users can customize templates, sign documents electronically, and store them securely, all within a few clicks. This process not only saves time but also reduces the risk of errors in document preparation.

-

Are there any costs associated with using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Massachusetts?

airSlate SignNow provides various pricing plans that cater to different business needs. You can choose a plan that allows you to efficiently manage the document creation and signing process, including Non Foreign Affidavit Under IRC 1445 Massachusetts, ensuring ample features for your investment. Check our website for the latest pricing details and offers.

-

What are the benefits of using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445 Massachusetts?

Using airSlate SignNow for your Non Foreign Affidavit Under IRC 1445 Massachusetts provides numerous benefits, including faster processing times and increased document security. The electronic signature feature helps complete transactions promptly, while document storage ensures easy access to your affidavits when needed. This efficiency can signNowly enhance your business operations.

-

Can I integrate airSlate SignNow with other software to manage Non Foreign Affidavit Under IRC 1445 Massachusetts?

Yes, airSlate SignNow is designed to integrate seamlessly with various applications, enabling you to manage your Non Foreign Affidavit Under IRC 1445 Massachusetts alongside other business tools. This integration capability allows for better synchronization of documents and workflows, enhancing productivity across your organization.

-

Is it easy to obtain legal advice when creating a Non Foreign Affidavit Under IRC 1445 Massachusetts?

While airSlate SignNow provides tools for creating a Non Foreign Affidavit Under IRC 1445 Massachusetts, it's always advisable to seek legal advice to ensure compliance with IRS regulations. You can consult with a legal professional to review your affidavit, ensuring all necessary elements are present. This helps mitigate risks related to potential legal issues.

-

How secure is the data when using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445 Massachusetts?

airSlate SignNow prioritizes data security, using advanced encryption and secure storage options for all documents, including the Non Foreign Affidavit Under IRC 1445 Massachusetts. Your information is protected throughout the entire process, ensuring that sensitive data remains confidential and compliant with industry standards.

Get more for Non Foreign Affidavit Under IRC 1445 Massachusetts

- Beeg elterngeld antragpdffillercomeandbeeg form

- Unit volume homework 2 answer key form

- Backflow report form butler county ohio butlercountyohio

- Odsp income report form

- Anual frg informal fund report

- Promedica financial assistance form

- Alarm permit city of santa ana santa ana form

- Night dialectical journal form

Find out other Non Foreign Affidavit Under IRC 1445 Massachusetts

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT