Financial Account Transfer to Living Trust Massachusetts Form

What is the Financial Account Transfer To Living Trust Massachusetts

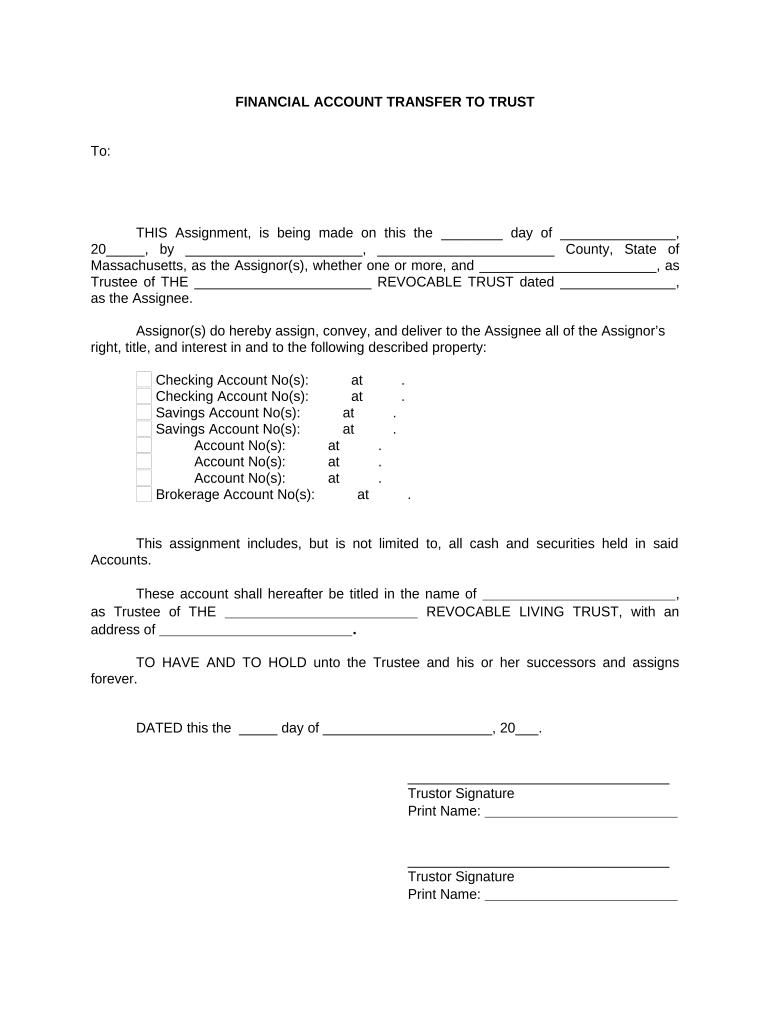

The Financial Account Transfer To Living Trust Massachusetts form is a legal document used to transfer ownership of financial accounts into a living trust. This process ensures that the assets are managed according to the trust's terms, providing benefits such as avoiding probate and ensuring a smoother transition of assets upon the grantor's death. In Massachusetts, this transfer must comply with state laws governing trusts and estate planning, making it essential for individuals to understand its implications and requirements.

Steps to complete the Financial Account Transfer To Living Trust Massachusetts

Completing the Financial Account Transfer To Living Trust Massachusetts involves several key steps:

- Review your living trust document to confirm that it is properly established and up to date.

- Gather all necessary financial account information, including account numbers and institution details.

- Fill out the transfer form accurately, ensuring that all details align with your trust document.

- Sign the form in accordance with Massachusetts law, which may require notarization or witness signatures.

- Submit the completed form to your financial institution, either online or in person, as per their requirements.

- Confirm that the transfer has been processed by checking your account statements or contacting the institution.

Legal use of the Financial Account Transfer To Living Trust Massachusetts

The legal use of the Financial Account Transfer To Living Trust Massachusetts form is critical for ensuring that the transfer of assets is recognized by financial institutions and courts. To be legally valid, the document must adhere to Massachusetts state laws regarding trusts and asset transfers. This includes proper execution, such as obtaining necessary signatures and, in some cases, notarization. Additionally, it is important to maintain compliance with federal regulations regarding estate planning and asset management.

Key elements of the Financial Account Transfer To Living Trust Massachusetts

Several key elements are essential for the Financial Account Transfer To Living Trust Massachusetts form to be effective:

- Trust Information: Details of the living trust, including the name of the trust and the trustee.

- Account Details: Information about the financial accounts being transferred, such as account numbers and types.

- Signatures: Signatures of the trustee and any required witnesses or notaries to validate the document.

- Compliance: Adherence to Massachusetts laws regarding trusts and asset transfers.

State-specific rules for the Financial Account Transfer To Living Trust Massachusetts

In Massachusetts, specific rules govern the transfer of financial accounts to a living trust. These include requirements for the trust to be properly established and funded, as well as the necessity for the transfer form to be executed in accordance with state laws. Additionally, financial institutions may have their own policies regarding documentation and verification, which must also be followed to ensure a smooth transfer process. Understanding these state-specific rules is crucial for avoiding potential legal complications.

Required Documents

To complete the Financial Account Transfer To Living Trust Massachusetts, several documents are typically required:

- Living Trust Document: The original or a certified copy of the living trust.

- Transfer Form: The specific form provided by the financial institution for transferring accounts.

- Identification: Valid identification for the trustee, such as a driver's license or passport.

- Signature Verification: Any additional documentation required by the financial institution to verify signatures.

Quick guide on how to complete financial account transfer to living trust massachusetts

Handle Financial Account Transfer To Living Trust Massachusetts effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without holdups. Manage Financial Account Transfer To Living Trust Massachusetts on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Financial Account Transfer To Living Trust Massachusetts with ease

- Locate Financial Account Transfer To Living Trust Massachusetts and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to store your alterations.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements with just a few clicks from any device of your choice. Modify and eSign Financial Account Transfer To Living Trust Massachusetts and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is involved in the Financial Account Transfer To Living Trust in Massachusetts?

The Financial Account Transfer To Living Trust in Massachusetts involves designating your financial assets into a living trust. This process typically requires the drafting of a trust document and updating title and account registrations. It can streamline the distribution of your financial assets after your passing and may help avoid probate.

-

How does airSlate SignNow facilitate the Financial Account Transfer To Living Trust Massachusetts process?

airSlate SignNow simplifies the Financial Account Transfer To Living Trust Massachusetts process by providing a digital platform for drafting and signing trust documents. Our eSignature solution ensures that all necessary documents are securely signed and finalized quickly and efficiently. This aids in expediting the transfers you need for your living trust.

-

Are there any additional costs associated with Financial Account Transfer To Living Trust Massachusetts services?

While airSlate SignNow offers cost-effective solutions for document management, there may be additional costs related to legal assistance or other professional services for the Financial Account Transfer To Living Trust Massachusetts. It's important to budget for any necessary consultations or filing fees that may arise during this process.

-

What benefits does transferring my financial accounts to a living trust provide in Massachusetts?

Transferring your financial accounts to a living trust in Massachusetts offers multiple benefits. It can help avoid probate, provide privacy for your financial matters, and allow for seamless management of your assets in the event of incapacity. Additionally, it often simplifies the process for your heirs after your passing.

-

Can I integrate airSlate SignNow with other platforms while managing my Financial Account Transfer To Living Trust in Massachusetts?

Yes, airSlate SignNow supports various integrations that can enhance your experience with Financial Account Transfer To Living Trust Massachusetts. You can seamlessly connect with popular applications and services to streamline your document workflows and ensure a more efficient transfer of financial accounts.

-

How long does the Financial Account Transfer To Living Trust process typically take in Massachusetts?

The timeline for the Financial Account Transfer To Living Trust Massachusetts process can vary depending on several factors, including the complexity of your accounts and whether legal assistance is needed. Generally, with airSlate SignNow, you can expect to complete the signing and document preparation quickly, often within a few days.

-

What types of financial accounts can be transferred to a living trust in Massachusetts?

A variety of financial accounts can be transferred to a living trust in Massachusetts, including bank accounts, investment accounts, and retirement accounts. Each type may have specific requirements for transfer. Consulting with a professional can help ensure you meet all necessary guidelines for a smooth transition.

Get more for Financial Account Transfer To Living Trust Massachusetts

Find out other Financial Account Transfer To Living Trust Massachusetts

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple