W 8 Bene Form

What is the W-8BEN-E?

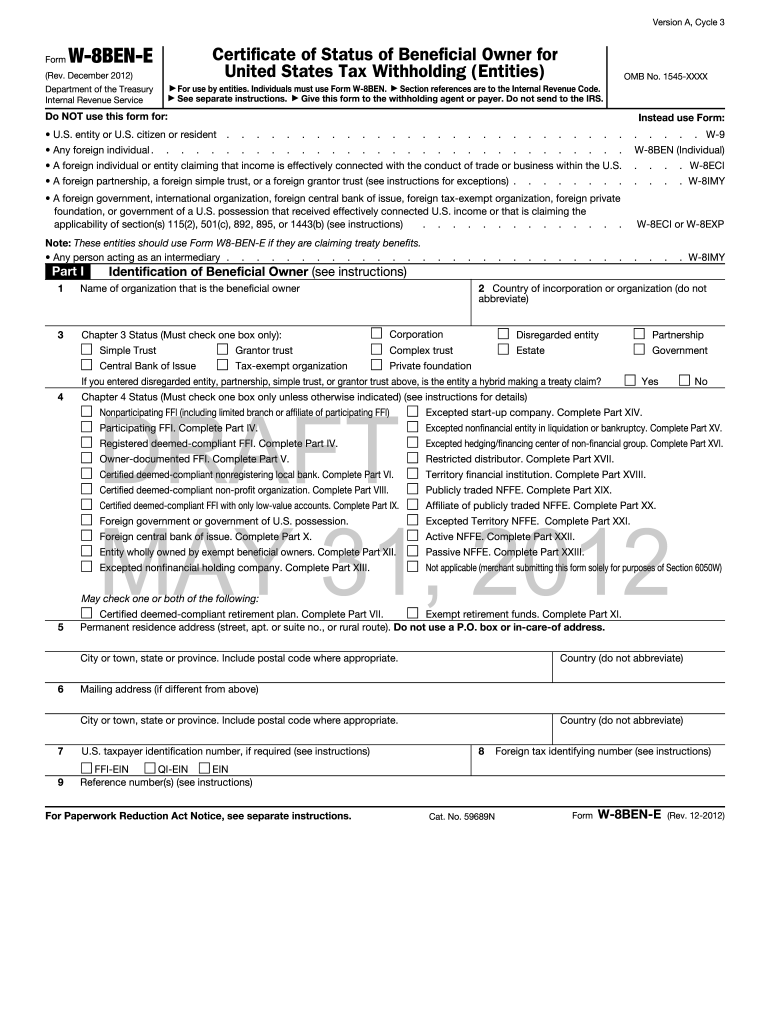

The W-8BEN-E form is a tax document used by foreign entities to certify their status as non-U.S. persons for tax withholding purposes. This form is essential for businesses and organizations that receive income from U.S. sources, such as dividends, interest, or royalties. By submitting the W-8BEN-E, foreign entities can claim a reduced rate of withholding tax under an applicable tax treaty between their country and the United States. Understanding this form is crucial for compliance with U.S. tax laws and for ensuring proper tax treatment of income received from U.S. entities.

Steps to Complete the W-8BEN-E

Completing the W-8BEN-E involves several key steps to ensure accuracy and compliance. Here’s a simplified guide:

- Identify the entity: Provide the legal name of the foreign entity and its country of incorporation.

- Claim tax treaty benefits: Indicate if the entity is eligible for tax treaty benefits by filling out the appropriate sections.

- Provide a U.S. taxpayer identification number (if applicable): If the entity has a U.S. TIN, include it; otherwise, leave it blank.

- Sign and date the form: An authorized representative must sign the form, certifying the information provided is accurate.

After completing the form, it should be submitted to the U.S. withholding agent or financial institution requesting it, not to the IRS.

Legal Use of the W-8BEN-E

The legal use of the W-8BEN-E is critical for foreign entities engaging in transactions with U.S. sources. This form helps establish the entity's foreign status and claim any applicable tax treaty benefits, reducing the withholding tax rate. Failure to provide a valid W-8BEN-E may result in the withholding agent applying the maximum tax rate on payments made to the foreign entity. It is important to ensure that the form is filled out correctly and submitted timely to comply with U.S. tax regulations.

IRS Guidelines for the W-8BEN-E

The IRS provides specific guidelines for completing the W-8BEN-E, emphasizing the importance of accuracy and completeness. Entities must ensure they are using the most current version of the form and understand the requirements for each section. The IRS outlines that the form must be renewed periodically, typically every three years, or sooner if there are changes in circumstances. Familiarizing oneself with IRS guidelines is essential for maintaining compliance and avoiding penalties.

Required Documents for the W-8BEN-E

When completing the W-8BEN-E, certain documents may be required to support the information provided. These can include:

- Proof of the entity's foreign status, such as incorporation documents.

- Tax identification numbers from the entity's home country.

- Any relevant tax treaties that apply to the entity's situation.

Having these documents ready can facilitate the completion of the form and ensure that all claims made are substantiated.

Form Submission Methods

The W-8BEN-E can be submitted through various methods, depending on the requirements of the U.S. withholding agent or financial institution. Common submission methods include:

- Online submission: Some financial institutions allow electronic submission of the form through their platforms.

- Mail: The form can be printed and sent via postal mail to the requesting party.

- In-person delivery: In certain cases, the form may be delivered directly to the withholding agent.

It is important to follow the specific instructions provided by the requesting entity regarding the preferred submission method.

Quick guide on how to complete w 8ben epdffillercom form

Complete W 8 Bene with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage W 8 Bene on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign W 8 Bene effortlessly

- Find W 8 Bene and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that reason.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or the need to print new copies due to mistakes. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Modify and electronically sign W 8 Bene and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Why do I have to fill out a W-8BEN form, sent by TD Bank, if I am an F1-student (from Canada) that is not working?

Of course you are not working. But the bank needs to notify the IRS of the account and it using the W-8BEN for to get the info it needs about you.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

Create this form in 5 minutes!

How to create an eSignature for the w 8ben epdffillercom form

How to generate an eSignature for the W 8ben Epdffillercom Form online

How to create an eSignature for the W 8ben Epdffillercom Form in Google Chrome

How to create an eSignature for putting it on the W 8ben Epdffillercom Form in Gmail

How to make an eSignature for the W 8ben Epdffillercom Form right from your mobile device

How to generate an electronic signature for the W 8ben Epdffillercom Form on iOS

How to create an eSignature for the W 8ben Epdffillercom Form on Android

People also ask

-

What is the W 8 Bene form and why do I need it?

The W 8 Bene form is essential for foreign individuals and entities to signNow their foreign status and claim beneficial tax treaty rates. If you're conducting business in the U.S. or dealing with U.S. clients, you'll likely need to fill out the W 8 Bene to avoid unnecessary tax withholding.

-

How can airSlate SignNow help me with the W 8 Bene form?

airSlate SignNow simplifies the process of completing and signing the W 8 Bene form electronically. With our easy-to-use platform, you can fill out, eSign, and send the form securely, ensuring compliance and efficiency in your business transactions.

-

Is airSlate SignNow free to use for the W 8 Bene form?

While airSlate SignNow offers a free trial, ongoing use of our platform for handling the W 8 Bene form and other documents is available through various pricing plans. These plans are designed to be cost-effective, allowing you to choose one that fits your needs and budget.

-

What features does airSlate SignNow offer for managing the W 8 Bene form?

airSlate SignNow provides a range of features specifically for handling the W 8 Bene form, including template creation, secure eSigning, and document tracking. These tools ensure that you can manage your forms efficiently and securely, enhancing your workflow.

-

Can I integrate airSlate SignNow with other applications to manage my W 8 Bene forms?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Salesforce, and others. This allows you to streamline your workflow and easily manage your W 8 Bene forms alongside your other business documents.

-

What are the benefits of using airSlate SignNow for the W 8 Bene form?

Using airSlate SignNow for the W 8 Bene form offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled quickly and safely, giving you peace of mind while you focus on your business.

-

How secure is airSlate SignNow for signing the W 8 Bene form?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When you eSign the W 8 Bene form through our platform, your sensitive information is protected, ensuring confidentiality and integrity.

Get more for W 8 Bene

- Alabama motion to declare marriage void ab initio and judgment of annulment form

- Al power attorney form

- Alabama general form

- Alabama warranty deed for parents to child with reservation of life estate form

- Arkansas deed form

- Warranty deed real form

- Arkansas quitclaim deed form

- Arkansas personal representative form

Find out other W 8 Bene

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney