Gift Deed from Two Grantors to a Non Profit Corporation as Grantee Maryland Form

What is the Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland

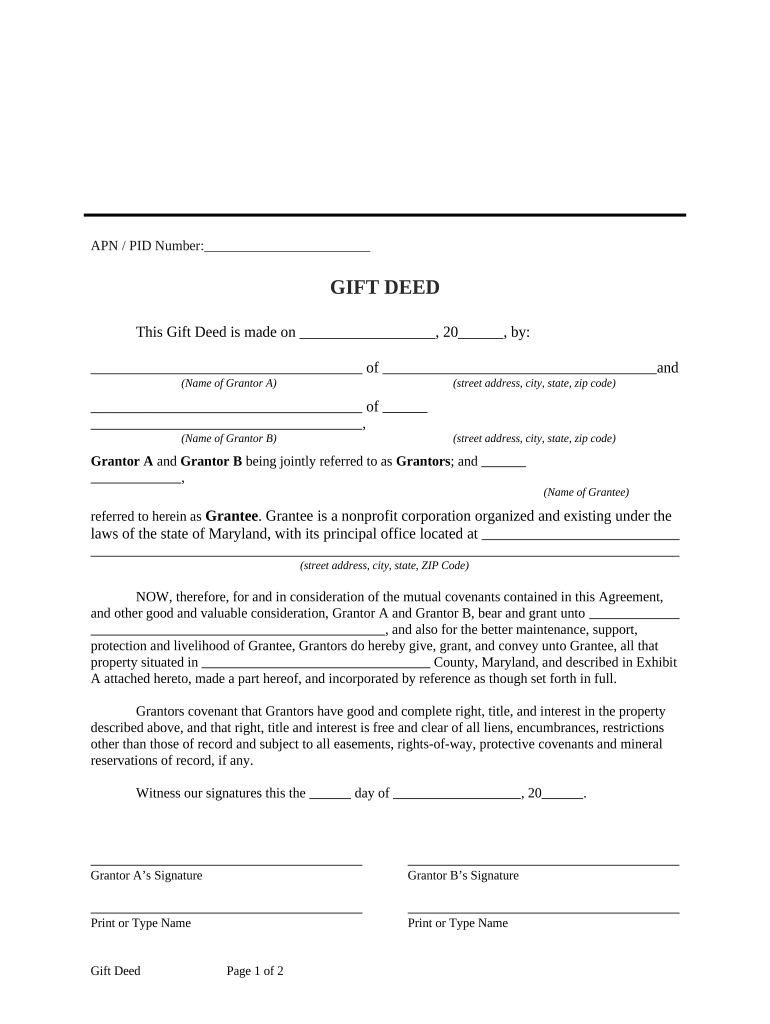

The Gift Deed from two grantors to a non-profit corporation as grantee in Maryland is a legal document that transfers ownership of property or assets from individuals (the grantors) to a non-profit organization (the grantee). This form is particularly significant in the context of charitable donations, allowing individuals to contribute to causes they support while ensuring that the transfer is legally recognized. The deed outlines the specifics of the gift, including the description of the property, the intent of the grantors, and any conditions attached to the gift.

Key Elements of the Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland

Several key elements must be included in the Gift Deed to ensure its validity. These elements typically include:

- Identification of Grantors and Grantee: Full names and addresses of the individuals making the gift and the non-profit organization receiving it.

- Description of the Property: A detailed description of the property being transferred, which may include real estate, personal property, or financial assets.

- Intent to Make a Gift: A clear statement indicating that the grantors intend to make a gift without expecting anything in return.

- Signatures: Signatures of both grantors, and possibly witnesses, to validate the deed.

- Date of Execution: The date when the deed is signed, which is important for legal purposes.

Steps to Complete the Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland

Completing the Gift Deed involves several important steps:

- Gather Information: Collect necessary details about the grantors, the non-profit corporation, and the property being gifted.

- Draft the Deed: Use a template or consult with a legal professional to draft the Gift Deed, ensuring all required elements are included.

- Review the Document: Carefully review the deed for accuracy and completeness. Ensure that all parties understand the terms.

- Sign the Deed: Have all grantors sign the deed in the presence of a notary or witnesses if required.

- Record the Deed: Depending on the type of property, you may need to file the deed with the appropriate local government office.

Legal Use of the Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland

The legal use of the Gift Deed is crucial for ensuring that the transfer of property is recognized under Maryland law. This document serves as proof of the transaction and can be used in legal proceedings if disputes arise. It is essential that the deed complies with state laws regarding property transfers, including any specific requirements for non-profit organizations. Proper execution and recording of the deed help protect the interests of both the grantors and the grantee.

State-Specific Rules for the Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland

Maryland has specific rules governing the execution and recording of Gift Deeds. These may include:

- Notarization: In Maryland, most deeds require notarization to be legally binding.

- Recording Requirements: The deed may need to be recorded with the local land records office if it involves real property.

- Tax Implications: Grantors should be aware of any potential tax implications related to the gift, including gift tax regulations.

How to Use the Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland

Using the Gift Deed effectively involves understanding its purpose and ensuring proper execution. Once the deed is completed and signed, it should be delivered to the non-profit organization. The organization should keep a copy for its records, as it may need to provide proof of the gift for tax purposes or during audits. Additionally, grantors should retain copies for their records to document the transaction.

Quick guide on how to complete gift deed from two grantors to a non profit corporation as grantee maryland

Easily prepare Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland on any device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can find the needed form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without holdups. Manage Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to modify and eSign Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland effortlessly

- Obtain Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact confidential information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland?

A Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland is a legal document that transfers property ownership from two individuals to a nonprofit corporation in Maryland without any financial exchange. This type of deed is essential for nonprofits seeking to receive gifts of real estate or other assets. Understanding this process can help organizations secure valuable resources to support their missions.

-

How can airSlate SignNow assist with creating a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland?

airSlate SignNow provides a user-friendly platform that simplifies creating a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland. Users can easily customize templates, add required information, and eSign the document securely. This saves time and ensures that the deed complies with Maryland's legal standards.

-

What are the benefits of using airSlate SignNow for a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland?

Using airSlate SignNow for a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland streamlines the document preparation process. Its cost-effective eSigning features allow for quicker transactions, reducing the need for physical paperwork. Additionally, the platform enhances collaboration among involved parties, ensuring everyone stays informed.

-

What pricing options does airSlate SignNow offer for creating a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland?

airSlate SignNow offers flexible pricing plans tailored to different organizational needs, including options for individuals, small businesses, and nonprofits. For creating a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland, users can choose from monthly or annual subscriptions that grant access to all features. Check the pricing page for the latest discounts and promotional offers.

-

Is airSlate SignNow easy to integrate with other software for handling a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland?

Yes, airSlate SignNow offers seamless integration with popular software applications commonly used for managing nonprofit operations. This includes CRM systems, project management tools, and cloud storage services. Such integrations facilitate smooth workflows when dealing with a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland.

-

What features does airSlate SignNow provide to ensure my Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland is secure?

airSlate SignNow implements advanced security measures such as end-to-end encryption and secure storage to protect sensitive information within a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland. Additionally, the platform offers audit trails to track document access and modifications, ensuring full transparency and compliance with legal requirements.

-

Can multiple grantors eSign the Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple grantors to eSign a Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland simultaneously or sequentially. This ensures that all parties involved can securely and conveniently sign the document, expediting the transfer process for nonprofit organizations.

Get more for Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland

Find out other Gift Deed From Two Grantors To A Non Profit Corporation As Grantee Maryland

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template