Individual Credit Application Maryland Form

What is the Individual Credit Application Maryland

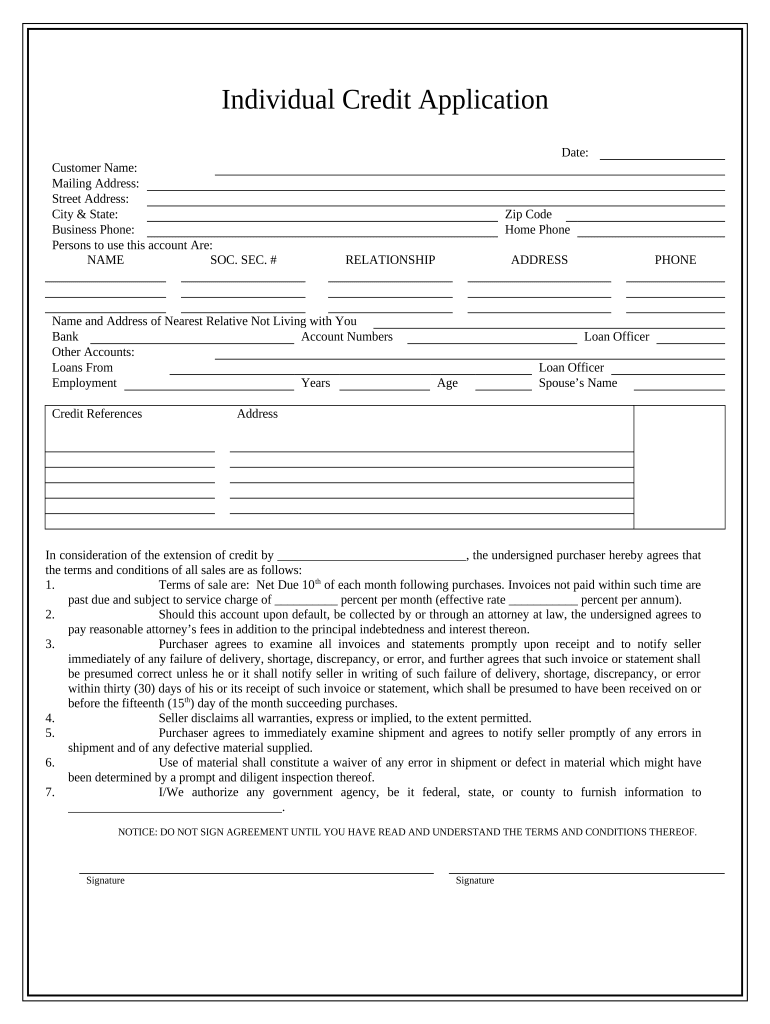

The Individual Credit Application Maryland is a formal document used by individuals seeking to apply for credit from financial institutions in Maryland. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically requires details such as the applicant's name, address, income, employment history, and any existing debts. The information provided helps lenders make informed decisions regarding credit approvals.

Steps to complete the Individual Credit Application Maryland

Completing the Individual Credit Application Maryland involves several key steps:

- Gather necessary documents, including proof of identity, income statements, and any existing credit information.

- Fill out the application form accurately, ensuring all personal details are correct.

- Provide financial information, including monthly income, expenses, and outstanding debts.

- Review the application for any errors or omissions before submission.

- Submit the completed application to the lender, either electronically or via mail.

Legal use of the Individual Credit Application Maryland

The legal use of the Individual Credit Application Maryland is governed by various federal and state regulations. To be considered valid, the application must comply with the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA). These laws ensure that lenders evaluate applications fairly and provide applicants with necessary disclosures regarding their credit information. Additionally, electronic submissions of the application must meet the requirements outlined in the ESIGN Act and UETA to ensure they are legally binding.

Key elements of the Individual Credit Application Maryland

Several key elements are essential in the Individual Credit Application Maryland:

- Personal Information: This includes the applicant's full name, address, date of birth, and Social Security number.

- Employment Details: Information about the applicant's current employer, job title, and duration of employment.

- Financial Information: Monthly income, other sources of income, and details about existing debts or loans.

- Consent for Credit Check: A section where the applicant authorizes the lender to perform a credit check.

How to obtain the Individual Credit Application Maryland

The Individual Credit Application Maryland can be obtained directly from financial institutions that offer credit services. Many lenders provide the application on their websites, allowing applicants to download, print, and complete it. Additionally, some institutions may offer the option to fill out the application online. It is advisable to check with the specific lender for their preferred method of application submission.

Eligibility Criteria

To be eligible for the Individual Credit Application Maryland, applicants typically need to meet certain criteria, which may include:

- Being at least eighteen years of age.

- Having a valid Social Security number.

- Demonstrating a stable source of income.

- Maintaining a reasonable credit history, though some lenders may consider applicants with limited or poor credit.

Quick guide on how to complete individual credit application maryland

Complete Individual Credit Application Maryland effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary format and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage Individual Credit Application Maryland on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to edit and eSign Individual Credit Application Maryland with ease

- Obtain Individual Credit Application Maryland and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to finalize your alterations.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, exhausting form searches, or errors that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Individual Credit Application Maryland and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Individual Credit Application Maryland process?

The Individual Credit Application Maryland process involves submitting personal financial information to assess creditworthiness. With airSlate SignNow, you can easily fill out and eSign your application online, ensuring a streamlined experience. This simplifies the tedious paperwork traditionally associated with a credit application.

-

How much does the Individual Credit Application Maryland cost?

Pricing for the Individual Credit Application Maryland can vary based on the service provider. airSlate SignNow offers competitive pricing plans tailored to meet your needs, ensuring affordability without compromising on quality. Check our website for detailed pricing information and potential discounts.

-

What features are included in the airSlate SignNow platform for Individual Credit Application Maryland?

airSlate SignNow offers various features for the Individual Credit Application Maryland, including template creation, customizable forms, and robust eSignature capabilities. Additionally, our platform provides secure storage for your documents and seamless collaboration tools. This enhances the overall efficiency of your application process.

-

What are the benefits of using airSlate SignNow for Individual Credit Application Maryland?

Using airSlate SignNow for your Individual Credit Application Maryland provides numerous benefits, such as increased efficiency and reduced processing time. Our user-friendly interface makes completing applications simple, while digital signatures ensure legality and authenticity. Ultimately, it helps you secure credit faster and more reliably.

-

Can I integrate airSlate SignNow with other tools for my Individual Credit Application Maryland?

Yes, airSlate SignNow offers multiple integrations with popular tools and applications to streamline your Individual Credit Application Maryland. You can connect it with CRM systems, cloud storage, and other third-party apps to enhance your workflow. This interconnectivity allows greater flexibility and efficiency in managing your documents.

-

What security measures does airSlate SignNow implement for Individual Credit Application Maryland?

airSlate SignNow prioritizes your security during the Individual Credit Application Maryland process by implementing advanced encryption protocols and secure access controls. All documents are stored in a secure environment, protecting sensitive information from unauthorized access. Our commitment to compliance ensures that your data is handled with the utmost care.

-

Is there customer support available for the Individual Credit Application Maryland process?

Absolutely! airSlate SignNow provides comprehensive customer support for the Individual Credit Application Maryland process. Our dedicated team is available to assist you with any questions or concerns you may have along the way. You can signNow out through various channels including email, chat, and phone support.

Get more for Individual Credit Application Maryland

Find out other Individual Credit Application Maryland

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile