Line of Credit Promissory Note Template Form

What is the Line of Credit Promissory Note Template

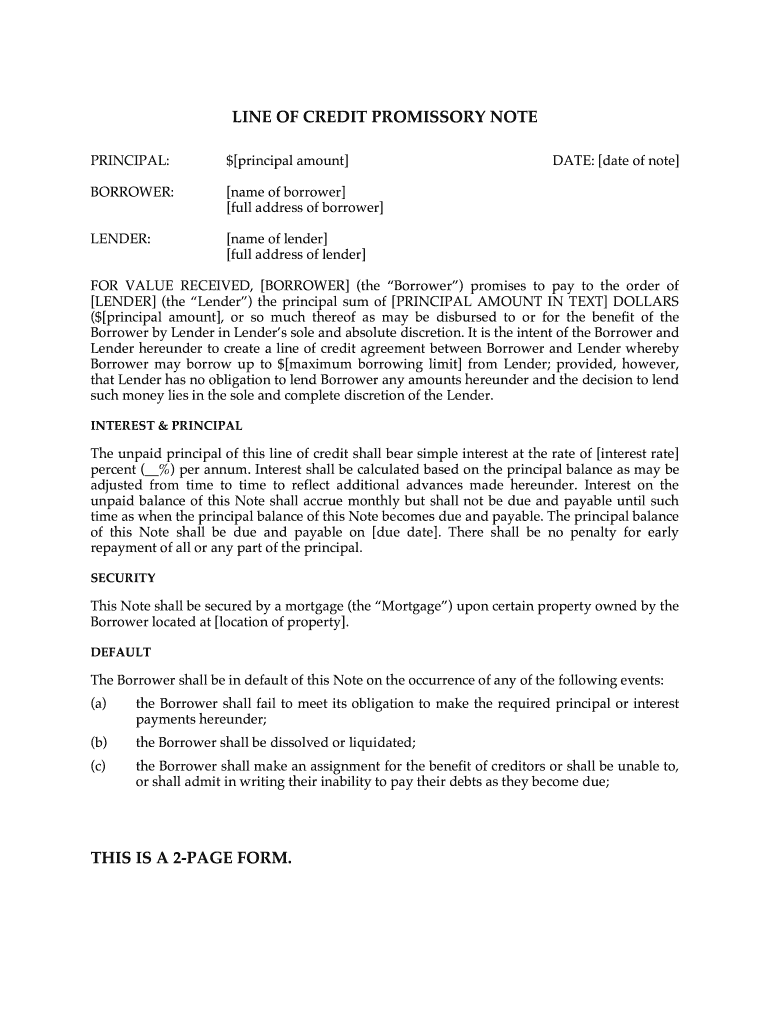

The line of credit promissory note template is a legal document that outlines the terms and conditions under which a borrower agrees to repay borrowed funds from a lender. This template serves as a formal agreement and includes essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. It is crucial for both parties as it provides clarity and legal protection in the event of disputes.

Key Elements of the Line of Credit Promissory Note Template

A well-structured line of credit promissory note template typically contains several key elements:

- Borrower and Lender Information: Names and contact details of both parties.

- Loan Amount: The total amount of credit extended to the borrower.

- Interest Rate: The percentage charged on the outstanding balance.

- Repayment Terms: Details on how and when payments should be made.

- Default Clauses: Conditions that define what happens if the borrower fails to repay.

- Governing Law: The state law that governs the agreement.

Steps to Complete the Line of Credit Promissory Note Template

Completing the line of credit promissory note template involves several straightforward steps:

- Download the Template: Obtain the official template from a reliable source.

- Fill in Borrower and Lender Details: Enter the names and contact information of both parties.

- Specify Loan Amount and Interest Rate: Clearly state the amount being borrowed and the applicable interest rate.

- Outline Repayment Terms: Define how often payments will be made and the due dates.

- Review and Sign: Both parties should review the document for accuracy before signing.

Legal Use of the Line of Credit Promissory Note Template

The line of credit promissory note template is legally binding once signed by both parties. It is essential to ensure that the document complies with state laws to be enforceable. Borrowers and lenders should keep a copy of the signed note for their records. In case of disputes, this document serves as evidence of the agreed terms and conditions.

How to Obtain the Line of Credit Promissory Note Template

The line of credit promissory note template can be obtained through various channels:

- Online Legal Document Services: Many websites offer customizable templates for download.

- Legal Professionals: Consulting with an attorney can provide tailored templates specific to individual needs.

- Financial Institutions: Some banks and credit unions may provide their own versions of the template.

Examples of Using the Line of Credit Promissory Note Template

Examples of using the line of credit promissory note template include:

- Personal Loans: Individuals borrowing money from friends or family can formalize the agreement.

- Business Financing: Small businesses may use this note to secure funds from investors or banks.

- Real Estate Transactions: Buyers may utilize a promissory note when financing property purchases.

Quick guide on how to complete line of credit promissory note form

The optimal method to obtain and sign Line Of Credit Promissory Note Template

At the level of your entire organization, ineffective workflows concerning document approval can consume a signNow amount of work hours. Signing papers such as Line Of Credit Promissory Note Template is an essential aspect of operations in any enterprise, which is why the effectiveness of each agreement’s journey impacts the overall performance of the company. With airSlate SignNow, signing your Line Of Credit Promissory Note Template is as straightforward and rapid as possible. This platform provides you with the latest version of nearly any form. Even better, you can sign it immediately without needing to install any external software on your device or print any hard copies.

Steps to obtain and sign your Line Of Credit Promissory Note Template

- Explore our library by category or use the search box to find the document you require.

- Click Learn more to preview the form and make sure it's the right one.

- Select Get form to start editing instantly.

- Fill out your form and include any necessary information using the toolbar.

- Once finished, click the Sign tool to sign your Line Of Credit Promissory Note Template.

- Choose the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Press Done to complete editing and move to document-sharing options as needed.

With airSlate SignNow, you have everything required to handle your documentation efficiently. You can find, complete, modify, and even send your Line Of Credit Promissory Note Template all in one tab without any trouble. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

Can you give a promissory note as a collateral to bail out of jail?

This is almost precisely what the business of a bail bondsman is. You pay the bondsman a fee and he pays the bond for you. If you fail to appear, the bondsman will go after you for the forfeited bond.The court will typically not accept an unsecured note in lieu of cash, but the court may accept a secured note backed by reasonably negotiable properties, such as real estate or marketable securities, in lieu of cash bond. The purpose of bond is to ensure the appearance of the defendant at trial, by making failure to appear expensive. Accepting an unsecured note does not serve this purpose.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Does the IRS require unused sheets of a form to be submitted? Can I just leave out the section of a form whose lines are not filled out?

This is what a schedule C I submitted earlier looks like :http://onemoredime.com/wp-conten... So I did not submit page 2 of the schedule C - all the lines on page 2 (33 through 48) were blank.

-

What are the best ways to build up my credit score?

Screw credit.It’s the biggest scam in history.But to answer your question, the recipe for good credit is simple:Pay off your debt.Yeah, I know, it’s a no brainer.You can do this in two ways:1) Start with the smallest balance and pay as much as you can towards it while making minimum payments on everything else. As you pay off each card, snowball that payment into other cards.2) Start with the card with the highest interest rate. Then do the same as above.While you’re doing that…Cut up your retail credit cards. Don’t use them again unless you get a kick out of paying 20% more for everything you buy.These cards are useless and the “rewards” you get aren’t even close to the amount of interest you’re paying.Keep one or two of your favorite cards and USE them. Pay them off each week/month, keeping a zero balance.I do this on Sundays. I transfer money from my checking to credit card each week. Each week is started with a zero balance.ProTip: Get a cash back reward card and pay it off each week/month. In other words, they’re paying you to use the card.Lower your debt to income ratio. The lower your total debt is compared to what you bring home, the better.Don’t max out your cards. The lower the amount you owe on your card compared to the amount you have available, boosts your credit.IF YOU’RE ALREADY LATE ON PAYMENTS:Don’t use settlement companies. Ever.Don’t use consolidation companies. Ever.Don’t use Payday loans. Ever.Don’t use title loans. Ever.Warning:If you have a savings account with a credit card you’re late on, the bank can (and will) take whatever you have saved.If by some miracle you qualify for a consolidation loan from your bank, then make damn sure you close the other lines of credit…otherwise you’ll “find yourself” with double the debt you had before.Rolling credit over to a new promotional interest rate card is dangerous. If you miss one payment, it can trigger a retroactive interest penalty and suddenly you have more debt that you did before the rollover.Banks are the taxi cabs of personal finance.Extinct, expensive and bad service. Banks nickel and dime you while “storing” your money. You’re basically paying for awful service while they use your money to make money.Screw that.Use a credit union.They are owned by the members. Credit unions have competitive rates. They are usually easier to deal with. Credit unions are now everywhere.Pick a good one, treat them right, pay on time and you’ll never hurt for money again.Credit is a scam.You've been brainwashed to think credit is the key to financial freedom.Credit is used to enslave you. It’s a trick to keep you in the debt game.Don’t play by the rigged rules.Take out too much, you’re penalized. Don’t use enough, you’re penalized. Something bad happens to you, you’re penalized.Know what’s crazy?I’ve gotten loans, cars, apartments, phones and utilities while having “bad credit” in the form of:A foreclosureLate paymentsNo paymentsAm I a bad consumer? No.In all three cases, my credit was being used as leverage to extract cash creditors had no right to.Foreclosure: The foreclosure was due to fraud and the bank, who accepted a forged signature, still tried to screw me. They wanted me to liquidate my savings and retirement just to end up broke and still have bad credit.What did I do? Nothing. I kept my money. Then I bought a sports car.Late payment: An old apartment complex moved a cleaning fee into collections because I was “late” on paying it. My bad…I left them a sparkling clean apartment.What did I do? Got a better apartment. Told the new property if they wanted a good resident then I’m ready to sign. If not, I have the money and means to go somewhere else.No payment: A medical bill was moved to collections because the insurance company and doctor’s office messed up the billing. But the collector wanted me to do the work of figuring out what someone else screwed up. Not. My. Job.What did I do? Got a physical. Then I told them to figure it out and never call me again.Unfortunately for the collectors, the bullying didn’t work because I made damn sure I was in good standing with my credit union.Bad credit? My credit union didn’t care. They got paid, so what?Keep in mind. Creditors use their leverage to drain the middle class of their savings.Some states have allowed creditors to place a lien on your home or garnish your wages to collect on unsecured debt. If you are unfortunate enough to live in one of these states, get rid of the debt, get rid of your bank, build up your emergency fund and move.For more info on your state, you can look here (I have no affiliation with the site and can’t vouch for the accuracy of the info).So how did I get my good credit back?I kept doing what I always did. I paid my credit union on time and was a good member.The funny thing about debt is…When I paid off my debt and started an easy budget, it felt like I had more money and more freedom than when I had no budget.Weird, right?So when you choose to live within your means, pay off your debt and build an emergency fund, you’ll never have to look at your credit again.And if you do want a loan, you can walk in to your credit union and get whatever you want.Why does this work?Because when in doubt, follow the golden rule.The guy with the gold rules.

Create this form in 5 minutes!

How to create an eSignature for the line of credit promissory note form

How to create an eSignature for the Line Of Credit Promissory Note Form online

How to create an eSignature for your Line Of Credit Promissory Note Form in Google Chrome

How to generate an electronic signature for signing the Line Of Credit Promissory Note Form in Gmail

How to make an eSignature for the Line Of Credit Promissory Note Form right from your smartphone

How to create an eSignature for the Line Of Credit Promissory Note Form on iOS

How to generate an electronic signature for the Line Of Credit Promissory Note Form on Android OS

People also ask

-

What is a line of credit and how does it work with airSlate SignNow?

A line of credit is a flexible loan option that allows you to borrow up to a specified amount as needed. With airSlate SignNow, businesses can use a line of credit to fund electronic signatures and document management processes without upfront costs, giving you financial flexibility.

-

How much does it cost to use airSlate SignNow for managing a line of credit?

airSlate SignNow offers competitive pricing plans designed to fit different business needs. Using a line of credit can help you access services without signNow upfront investments, ensuring that you only pay for what you use as you streamline your document signing process.

-

What features does airSlate SignNow offer for businesses using a line of credit?

airSlate SignNow provides essential features like easy document eSigning, workflow automation, and secure cloud storage. When you utilize a line of credit for these services, you can efficiently manage cash flow while ensuring seamless document transactions.

-

What are the benefits of using airSlate SignNow along with a line of credit?

Combining airSlate SignNow with a line of credit offers numerous benefits, including increased cash flow and enhanced operational efficiency. This allows your business to focus on growth without the stress of immediate payments, as you can finance your eSigning needs over time.

-

Can I integrate airSlate SignNow with my existing accounting software while using a line of credit?

Yes, airSlate SignNow seamlessly integrates with various accounting software and other tools. This integration allows businesses using a line of credit to manage documents and financial transactions more effectively, ensuring a smooth workflow.

-

Is support available for businesses using a line of credit with airSlate SignNow?

Absolutely! airSlate SignNow offers robust customer support for all users, including those utilizing a line of credit. Our team is available to assist you with any questions or concerns you may have regarding your account or services.

-

How can airSlate SignNow help me optimize my cash flow using a line of credit?

By using a line of credit, airSlate SignNow helps optimize your cash flow by allowing you to access funds when needed for document management. This ensures you can manage your business’s expenses efficiently while taking advantage of timely eSigning without immediate payment stresses.

Get more for Line Of Credit Promissory Note Template

- Written consent example form

- Puppy contract form

- Real property personal form

- Rental lease agreement form

- Representation agreement 481377667 form

- Contract video form

- Release and waiver of liability given in favor of nonprofit organization regarding allowing minor to ride horses on ranch form

- Change name back form

Find out other Line Of Credit Promissory Note Template

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement