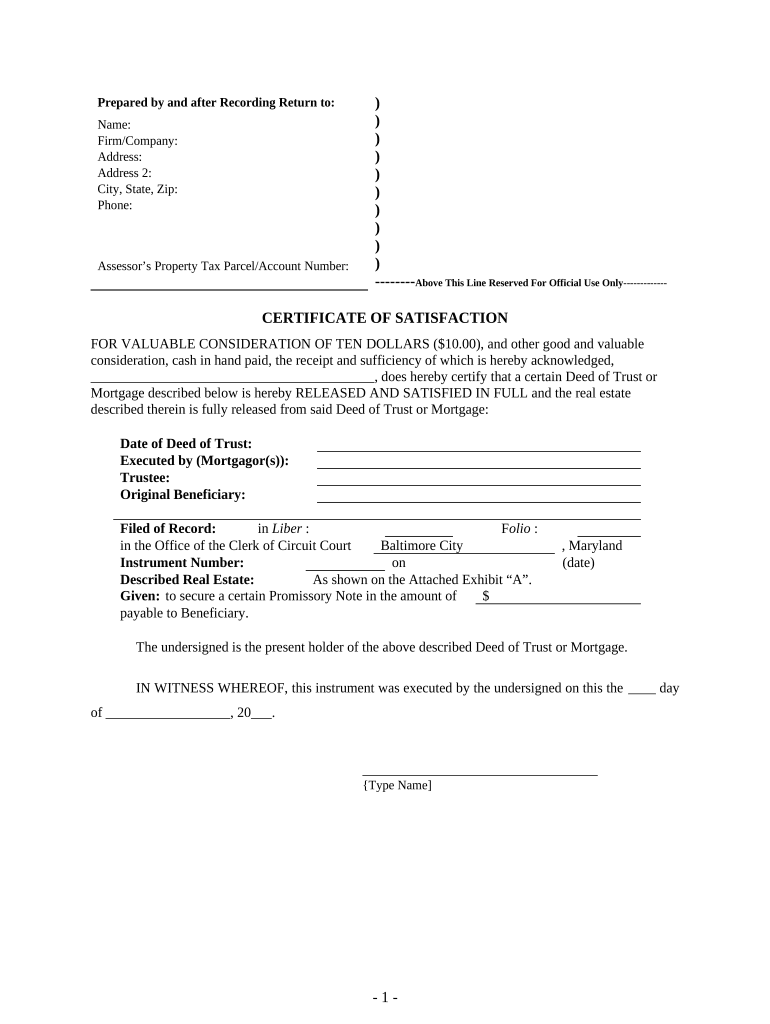

Maryland Deed Trust Form

What is the Maryland Deed Trust

The Maryland deed trust is a legal document that establishes a trust to hold property for the benefit of designated beneficiaries. This type of trust allows property owners to transfer their assets into the trust while retaining certain rights over the property during their lifetime. Upon the owner's death, the property is transferred directly to the beneficiaries without going through probate, simplifying the process and potentially saving on estate taxes. The deed trust outlines the terms of the trust, including the roles of the trustee and beneficiaries, and serves as a crucial tool for estate planning in Maryland.

Key elements of the Maryland Deed Trust

Understanding the key elements of a Maryland deed trust is essential for effective estate planning. The main components include:

- Trustee: The individual or entity responsible for managing the trust and its assets.

- Beneficiaries: The individuals or entities designated to receive the benefits from the trust.

- Trust Property: The assets placed into the trust, which can include real estate, financial accounts, and personal property.

- Trust Terms: The specific instructions regarding how the trust is to be managed and distributed.

These elements work together to ensure that the trust operates according to the grantor's wishes and provides for the beneficiaries as intended.

Steps to complete the Maryland Deed Trust

Completing a Maryland deed trust involves several important steps to ensure its validity and effectiveness. Here is a concise guide:

- Choose a Trustee: Select a reliable individual or institution to manage the trust.

- Identify Beneficiaries: Clearly list all individuals or entities who will benefit from the trust.

- Draft the Trust Document: Create a legally binding document that outlines the terms and conditions of the trust.

- Transfer Property: Officially transfer ownership of the property into the trust, which may require additional paperwork.

- Sign and Notarize: Ensure that the trust document is signed by the grantor and notarized to validate the agreement.

Following these steps helps to establish a clear and enforceable deed trust in Maryland.

Legal use of the Maryland Deed Trust

The legal use of a Maryland deed trust is primarily for estate planning purposes. It allows individuals to manage their assets during their lifetime and dictate how these assets should be distributed after their death. By using a deed trust, property owners can avoid the lengthy probate process, ensuring that their beneficiaries receive their inheritance more quickly and efficiently. Additionally, the trust can provide asset protection and may offer tax advantages, making it a valuable tool for those looking to secure their financial legacy.

How to use the Maryland Deed Trust

Using a Maryland deed trust involves several practical steps to ensure that it serves its intended purpose. First, the property owner must decide which assets to place into the trust. Next, they should work with a legal professional to draft the trust document, ensuring that all legal requirements are met. Once the trust is established, the owner can transfer the property into the trust. It is important to keep the trust document updated as circumstances change, such as the addition or removal of beneficiaries. Regular reviews with a legal advisor can help maintain the trust's effectiveness.

State-specific rules for the Maryland Deed Trust

Maryland has specific regulations governing the creation and management of deed trusts. These include requirements for the trust document to be in writing and signed by the grantor. Additionally, Maryland law mandates that the trust must be funded with property to be valid. It is also essential to comply with local laws regarding the recording of the trust deed, which may involve filing with the county clerk's office. Understanding these state-specific rules is crucial for ensuring that the deed trust is legally enforceable and meets all necessary legal standards.

Quick guide on how to complete maryland deed trust 497310595

Complete Maryland Deed Trust effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without delays. Handle Maryland Deed Trust on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to alter and eSign Maryland Deed Trust seamlessly

- Find Maryland Deed Trust and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Maryland Deed Trust and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Maryland deed trust?

A Maryland deed trust is a legal arrangement where a property title is held by a trustee for the benefit of the trust's beneficiaries. This structure can provide benefits such as asset protection and estate planning advantages. Understanding how a Maryland deed trust works is crucial for effective property management in the state.

-

How does airSlate SignNow facilitate the creation of a Maryland deed trust?

airSlate SignNow offers a user-friendly platform that simplifies the creation and signing of a Maryland deed trust. With intuitive templates and easy document sharing, users can streamline the legal process without the need for extensive legal knowledge. This efficiency saves time and reduces paperwork.

-

What are the key benefits of using airSlate SignNow for a Maryland deed trust?

Using airSlate SignNow for a Maryland deed trust provides several benefits, including enhanced security for sensitive documents and the ability to track the signing process in real-time. Additionally, the platform is cost-effective, making it accessible for individuals and businesses alike. This ensures a smoother experience in managing trust documents.

-

Is there a cost associated with creating a Maryland deed trust through airSlate SignNow?

Yes, while airSlate SignNow is a cost-effective solution, there are associated service fees depending on your usage and subscription plan. The pricing is transparent, allowing you to choose a plan that fits your budget and needs related to creating a Maryland deed trust. It's ideal for both personal and professional uses.

-

Can I integrate airSlate SignNow with other software to manage my Maryland deed trust?

Absolutely! airSlate SignNow can be integrated with various software applications, enhancing your workflow for managing a Maryland deed trust. Popular integrations include CRM systems and document management platforms, which provide a seamless and efficient process for document handling.

-

What features does airSlate SignNow offer for automating the Maryland deed trust signing process?

airSlate SignNow includes features such as electronic signatures, document templates, and automated reminders to streamline the signing process for a Maryland deed trust. This automation reduces manual tasks, ensuring that all parties can complete their signatures efficiently. Such features facilitate timely and secure document processing.

-

How can a Maryland deed trust benefit my estate planning?

A Maryland deed trust can signNowly enhance estate planning by providing clear instructions on how assets will be managed and distributed after one’s passing. It can also help avoid probate, ensuring a quicker transfer of assets to beneficiaries. By utilizing airSlate SignNow, you can create and manage your Maryland deed trust conveniently.

Get more for Maryland Deed Trust

- Cpic forms

- Fixed deposit form 397968807

- Form 0153 the school district of palm beach county palmbeachschools

- Sample corrective action report form

- Certificate of value form st charles county

- Interstate compact offender application in form

- Car leasing agreement template form

- Car joint ownership agreement template form

Find out other Maryland Deed Trust

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself