Ma Resident Income Tax Form 1 Instructions 2017

What is the Massachusetts Resident Income Tax Form 1?

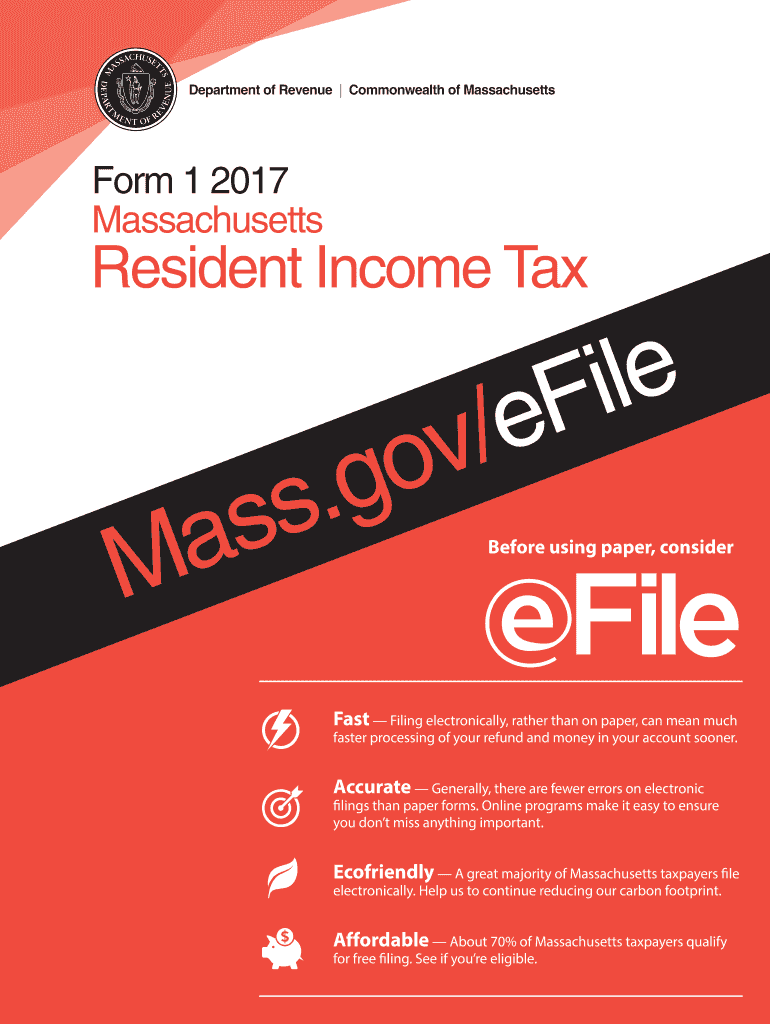

The Massachusetts Resident Income Tax Form 1 is a crucial document used by individuals residing in Massachusetts to report their income and calculate their state tax obligations. This form is designed for full-year residents and includes sections for reporting various types of income, deductions, and credits. Understanding the purpose of this form is essential for ensuring compliance with state tax laws and accurately reporting financial information.

Steps to Complete the Massachusetts Resident Income Tax Form 1

Completing the Massachusetts Resident Income Tax Form 1 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income by entering amounts from various sources as specified on the form.

- Claim any deductions and credits you are eligible for to reduce your taxable income.

- Calculate your total tax liability and any payments made throughout the year.

- Review the completed form for accuracy before signing and dating it.

Key Elements of the Massachusetts Resident Income Tax Form 1

The Massachusetts Resident Income Tax Form 1 consists of several key elements that taxpayers must understand:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: You must report all sources of income, including wages, dividends, and interest.

- Deductions and Credits: Taxpayers can claim various deductions and credits to lower their tax burden.

- Tax Calculation: This section helps determine the total tax owed based on reported income and applicable rates.

- Signature: A signed form is required to validate the submission.

How to Obtain the Massachusetts Resident Income Tax Form 1

The Massachusetts Resident Income Tax Form 1 can be obtained through several methods:

- Visit the Massachusetts Department of Revenue website to download a PDF version of the form.

- Request a physical copy through the mail by contacting the Massachusetts Department of Revenue.

- Access the form at local public libraries or tax preparation offices that provide tax resources.

Legal Use of the Massachusetts Resident Income Tax Form 1

The Massachusetts Resident Income Tax Form 1 must be used in accordance with state tax laws. It is legally binding once signed and submitted. Taxpayers must ensure that all information provided is accurate and complete to avoid penalties or legal issues. Understanding the legal implications of this form is essential for compliance and to protect oneself from potential audits or disputes with the Massachusetts Department of Revenue.

Filing Deadlines for the Massachusetts Resident Income Tax Form 1

Filing deadlines for the Massachusetts Resident Income Tax Form 1 are crucial for taxpayers to remember:

- The standard deadline for filing is April 15 of each year.

- If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day.

- Taxpayers may request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete ma law 112917 retroactively taxes all 3rd pty paypal

Your assistance manual on preparing your Ma Resident Income Tax Form 1 Instructions

If you are looking to understand how to finalize and dispatch your Ma Resident Income Tax Form 1 Instructions, here are a few brief guidelines to simplify the tax submission process.

To begin, you merely need to establish your airSlate SignNow account to transform the way you handle documents digitally. airSlate SignNow is an exceedingly user-friendly and effective document management system that enables you to modify, create, and finalize your tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures, and revert to modify responses as necessary. Enhance your tax administration with advanced PDF editing, electronic signing, and straightforward sharing.

Complete the steps below to finish your Ma Resident Income Tax Form 1 Instructions in just a few minutes:

- Create your account and start managing PDFs in a matter of minutes.

- Utilize our library to access any IRS tax document; browse through various formats and schedules.

- Click Obtain form to launch your Ma Resident Income Tax Form 1 Instructions in our editor.

- Populate the necessary fillable fields with your information (text, figures, check marks).

- Employ the Signature Tool to add your legally-valid eSignature (if needed).

- Examine your document and correct any errors.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that submitting via paper can lead to return discrepancies and delays in refunds. Obviously, before e-filing your taxes, review the IRS website for filing regulations in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct ma law 112917 retroactively taxes all 3rd pty paypal

Create this form in 5 minutes!

How to create an eSignature for the ma law 112917 retroactively taxes all 3rd pty paypal

How to generate an eSignature for your Ma Law 112917 Retroactively Taxes All 3rd Pty Paypal in the online mode

How to generate an eSignature for the Ma Law 112917 Retroactively Taxes All 3rd Pty Paypal in Chrome

How to create an eSignature for signing the Ma Law 112917 Retroactively Taxes All 3rd Pty Paypal in Gmail

How to make an electronic signature for the Ma Law 112917 Retroactively Taxes All 3rd Pty Paypal straight from your smartphone

How to make an electronic signature for the Ma Law 112917 Retroactively Taxes All 3rd Pty Paypal on iOS devices

How to create an electronic signature for the Ma Law 112917 Retroactively Taxes All 3rd Pty Paypal on Android devices

People also ask

-

What are the Ma Resident Income Tax Form 1 Instructions?

The Ma Resident Income Tax Form 1 Instructions provide detailed guidance on how to complete your Massachusetts resident income tax return. This includes information on required fields, deductions, and credits that you may be eligible for. Following these instructions ensures you accurately file your taxes and avoid potential penalties.

-

How can airSlate SignNow assist with filing the Ma Resident Income Tax Form 1?

airSlate SignNow offers a streamlined eSigning solution that simplifies the process of filing the Ma Resident Income Tax Form 1. You can easily upload your completed form, send it for signatures, and securely store your documents, all within our platform. This saves you time and reduces the hassle of traditional paper-based filing.

-

Is there a cost associated with using airSlate SignNow for Ma Resident Income Tax Form 1?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs, starting with a free trial. Our cost-effective solutions provide access to essential features that help you manage and eSign documents, including the Ma Resident Income Tax Form 1. You can choose a plan that suits your business size and frequency of use.

-

What features does airSlate SignNow offer for handling tax forms like Ma Resident Income Tax Form 1?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows that enhance the management of tax documents like the Ma Resident Income Tax Form 1. Additionally, you can track document status and receive notifications, ensuring you stay organized and compliant during tax season.

-

Can I integrate airSlate SignNow with other applications for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as QuickBooks and Google Drive, making it easier to access and manage your Ma Resident Income Tax Form 1 alongside your other financial documents. This integration enhances your workflow and ensures all your tax-related tasks are interconnected.

-

What benefits does eSigning provide for the Ma Resident Income Tax Form 1?

Using eSigning for the Ma Resident Income Tax Form 1 offers numerous benefits, including increased efficiency and reduced turnaround time. You can sign documents from anywhere, eliminating the need for in-person meetings or mail delays. This convenience allows you to file your taxes quicker, ensuring you meet deadlines with ease.

-

Is airSlate SignNow secure for handling sensitive tax documents like the Ma Resident Income Tax Form 1?

Yes, airSlate SignNow prioritizes security and compliance, providing a safe platform for handling sensitive documents like the Ma Resident Income Tax Form 1. We utilize advanced encryption and adhere to industry standards to protect your information during transmission and storage. You can trust us to keep your data secure.

Get more for Ma Resident Income Tax Form 1 Instructions

Find out other Ma Resident Income Tax Form 1 Instructions

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free