Revocation of Living Trust Maine Form

What is the Revocation Of Living Trust Maine

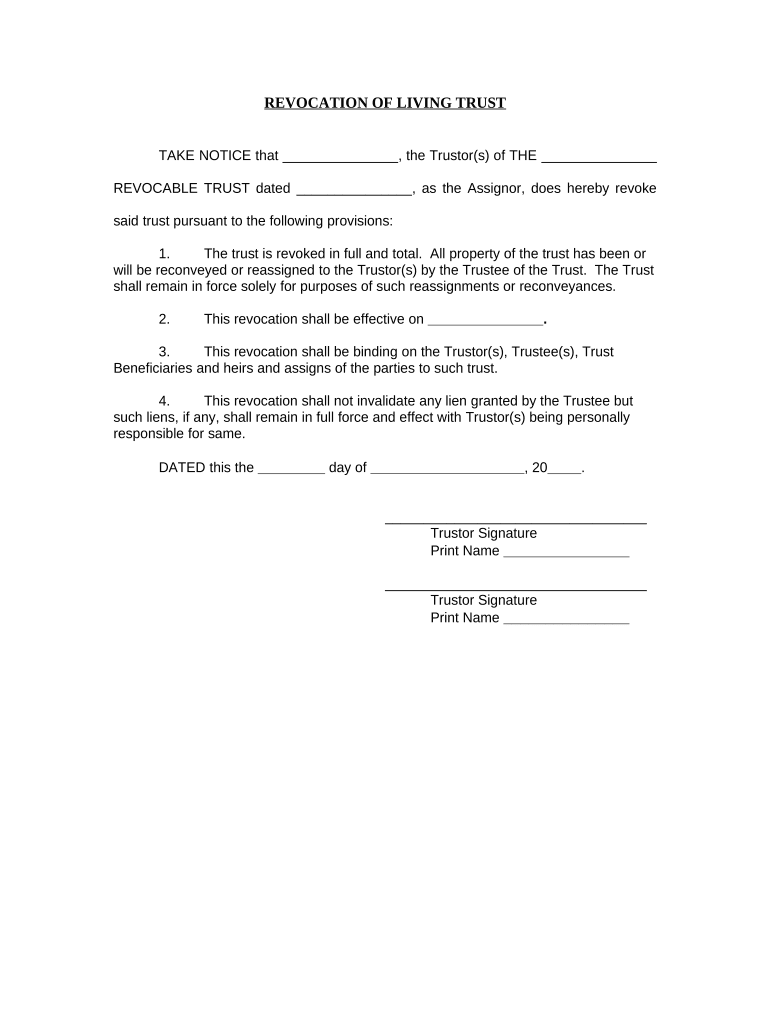

The Revocation of Living Trust Maine is a legal document that allows an individual to formally cancel a living trust they have previously established. This process is essential for individuals who wish to change their estate planning strategies or eliminate a trust that no longer meets their needs. The revocation effectively nullifies the trust's terms and transfers control of the assets back to the individual, allowing them to manage their property as they see fit.

Steps to Complete the Revocation Of Living Trust Maine

Completing the Revocation of Living Trust Maine involves several key steps to ensure that the document is legally binding and effective. Here are the main steps:

- Review the original trust document to confirm the terms of revocation.

- Prepare the revocation document, clearly stating the intent to revoke the trust.

- Sign the revocation in the presence of a notary public to validate the document.

- Distribute copies of the revocation to all relevant parties, including beneficiaries and financial institutions.

- Consider filing the revocation with the local court if required by state law.

Key Elements of the Revocation Of Living Trust Maine

Several critical components must be included in the Revocation of Living Trust Maine to ensure its legality:

- Identification of the Trust: Clearly state the name of the trust and the date it was created.

- Declarative Statement: Include a clear statement indicating the intent to revoke the trust.

- Signature: The document must be signed by the trustor, the individual who created the trust.

- Notary Acknowledgment: A notary public must acknowledge the signature to add an extra layer of authenticity.

Legal Use of the Revocation Of Living Trust Maine

The Revocation of Living Trust Maine is legally recognized when completed according to state laws. It serves to protect the trustor's interests and ensures that their assets are managed according to their current wishes. Legal use involves adhering to the specific requirements set forth by Maine law, including proper documentation and notarization. This process helps prevent disputes among beneficiaries and provides clarity regarding the management of the trust assets.

State-Specific Rules for the Revocation Of Living Trust Maine

Maine has specific regulations governing the revocation of living trusts. It is essential to comply with these rules to ensure the revocation is valid. Some key points include:

- The revocation must be executed in writing.

- Notarization is required to authenticate the document.

- All parties involved in the trust must be notified of the revocation.

How to Obtain the Revocation Of Living Trust Maine

Obtaining the Revocation of Living Trust Maine can be done through various means. Individuals can draft the document themselves, using templates available online, or seek assistance from an attorney specializing in estate planning. It is crucial to ensure that the document meets all legal requirements to avoid complications in the future. Consulting with a legal professional may provide additional peace of mind and ensure compliance with state laws.

Quick guide on how to complete revocation of living trust maine

Complete Revocation Of Living Trust Maine effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Manage Revocation Of Living Trust Maine on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign Revocation Of Living Trust Maine without hassle

- Locate Revocation Of Living Trust Maine and select Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize signNow parts of your documents or obscure confidential details using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Revocation Of Living Trust Maine while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for revocation of a living trust in Maine?

The process for the Revocation Of Living Trust Maine typically involves drafting a formal revocation document that clearly states the intent to revoke the trust. Once the document is executed, it should be provided to all relevant parties and, if necessary, recorded with the appropriate government office. This ensures clarity and legal compliance.

-

Are there any fees associated with revoking a living trust in Maine?

While there are generally no specific fees for the Revocation Of Living Trust Maine itself, associated costs may arise if legal counsel is sought. Additionally, recording fees could apply if the revocation document is filed with the court or local government. It's best to consult with an attorney for a full understanding of potential costs.

-

Can I revoke my living trust without legal assistance in Maine?

Yes, you can revoke your living trust without legal assistance in Maine, provided you follow the correct procedure. Ensure that the Revocation Of Living Trust Maine document is properly drafted and executed. However, consulting a legal professional can help avoid any mistakes that could impact your estate planning.

-

What should I include in the revocation document?

The revocation document for the Revocation Of Living Trust Maine should clearly identify the trust being revoked, the date of its creation, and your explicit intent to revoke it. Additionally, it's important to sign and date the document in accordance with Maine's legal requirements to ensure its validity.

-

Are there benefits to revoking a living trust in Maine?

Revocation of a living trust in Maine can provide several benefits, such as simplifying your estate plan or addressing changes in your personal circumstances. This action allows you to reorganize your assets and control how they are distributed according to your current wishes. It's an essential step for maintaining an effective estate plan.

-

How does revocation impact my estate plan in Maine?

The Revocation Of Living Trust Maine can signNowly impact your estate plan by removing assets from the trust and changing their distribution. This can lead to adjustments in how your estate is managed and distributed upon your passing. It's crucial to update your estate plan accordingly to reflect any changes resulting from the revocation.

-

Can I create a new trust after revoking my living trust in Maine?

Absolutely, after the Revocation Of Living Trust Maine, you can create a new trust to set up an estate plan that better reflects your intentions. It’s an opportunity to restructure your assets and designate new beneficiaries. When drafting the new trust, it’s advisable to consider your current financial and familial situation.

Get more for Revocation Of Living Trust Maine

Find out other Revocation Of Living Trust Maine

- How To Integrate eSign in Insurance

- How To Use eSign in Legal

- How To Set Up eSign in Legal

- How To Implement eSign in Legal

- How To Integrate eSign in Sports

- How To Use eSign in Sports

- How To Install eSign in Sports

- How To Add eSign in Sports

- How To Implement eSign in Sports

- How To Use eSign in Real Estate

- How To Install eSign in Police

- How Do I Implement eSignature in Plumbing

- How To Use Electronic signature in Banking

- How To Integrate Electronic signature in Banking

- How To Install Electronic signature in Banking

- How To Add Electronic signature in Banking

- How To Set Up Electronic signature in Banking

- How To Save Electronic signature in Banking

- How To Implement Electronic signature in Banking

- Can I Implement Electronic signature in Car Dealer