Michigan Lien Form

Understanding the Michigan Lien

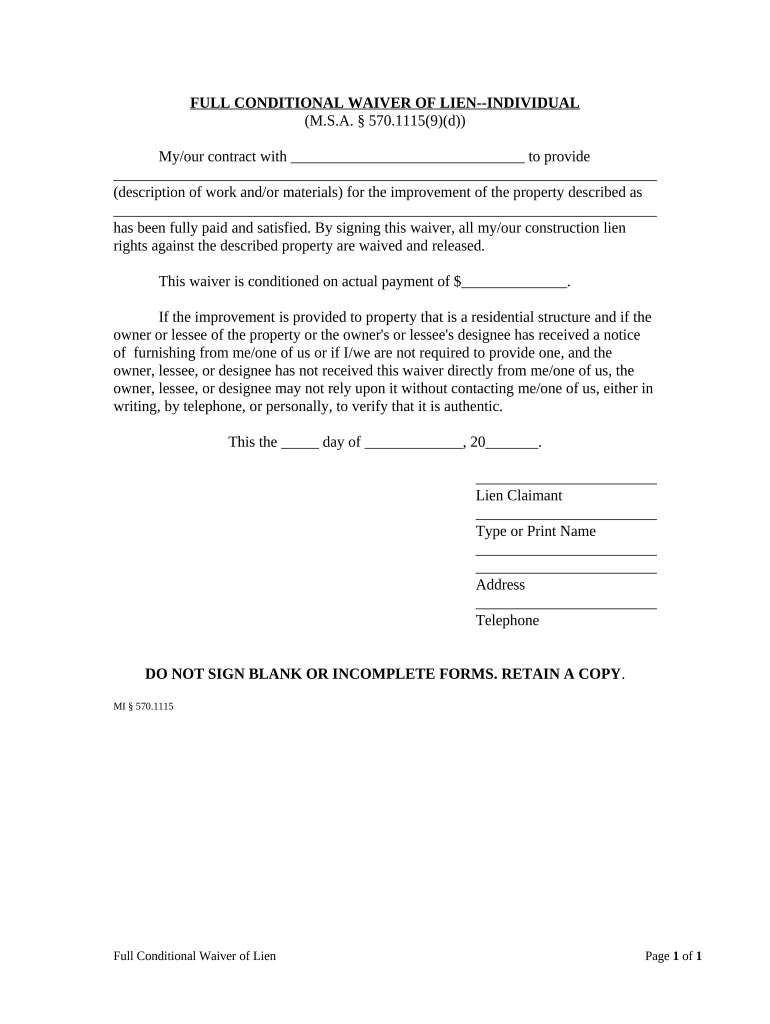

The Michigan lien serves as a legal claim against a property, ensuring that contractors, subcontractors, and suppliers receive payment for services rendered or materials provided. It is particularly relevant in the construction industry, where disputes over payments can arise. This form is crucial for protecting the rights of those who contribute to a project, allowing them to secure their financial interests in the event of non-payment.

Steps to Complete the Michigan Lien

Completing the full lien form requires careful attention to detail to ensure its validity. Here are the essential steps:

- Gather necessary information, including the property owner's details, the nature of the work performed, and the amount owed.

- Clearly describe the services or materials provided, ensuring that all relevant dates and amounts are included.

- Sign the form in the presence of a notary public to validate the document.

- File the completed lien with the appropriate county register of deeds office within the specified time frame.

Legal Use of the Michigan Lien

The legal framework surrounding the Michigan lien is designed to protect the rights of those who contribute to property improvements. To be enforceable, the lien must be filed within a specific period, typically within 90 days after the last work was performed or materials were supplied. Compliance with state regulations is essential to ensure that the lien is recognized in court, should disputes arise.

Key Elements of the Michigan Lien

Several key elements must be included in the full lien form to ensure its effectiveness:

- The name and address of the property owner.

- A detailed description of the work performed or materials supplied.

- The total amount due for the services rendered.

- The date when the last work was performed or materials were supplied.

- The signature of the claimant, preferably notarized.

State-Specific Rules for the Michigan Lien

Michigan has specific regulations regarding the filing and enforcement of liens. It is important to understand these rules, as they dictate the timeline for filing and the necessary documentation. For instance, the lien must be filed within 90 days of the last service or material delivery, and it must be recorded in the county where the property is located. Familiarity with these regulations can prevent potential legal issues and ensure that the lien is enforceable.

Form Submission Methods

The full lien form can be submitted through various methods, depending on the preferences of the filer and the requirements of the county. Options typically include:

- Online submission through the county's official website, if available.

- Mailing the completed form to the county register of deeds office.

- In-person submission at the local county office.

Examples of Using the Michigan Lien

Practical examples of utilizing the Michigan lien can illustrate its importance. For instance, a contractor who has completed work on a residential property but has not received payment can file a lien against the property. This action not only secures the contractor's right to payment but also alerts potential buyers or lenders of the outstanding debt. Similarly, suppliers who provide materials can file a lien if they are not compensated, ensuring their financial interests are protected.

Quick guide on how to complete michigan lien 497311439

Complete Michigan Lien effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the instruments needed to create, modify, and eSign your documents swiftly without delays. Handle Michigan Lien on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Michigan Lien with ease

- Find Michigan Lien and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Michigan Lien and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a full lien form and how can it benefit my business?

A full lien form is a legal document that secures a debtor's property for a loan or obligation. By utilizing a full lien form, businesses can protect their financial interests and ensure they can claim payments through the property if necessary. It's crucial for maintaining liquidity and safeguarding assets.

-

How does airSlate SignNow facilitate the creation of a full lien form?

airSlate SignNow offers intuitive templates that enable users to create a full lien form quickly and efficiently. With its user-friendly interface, you can customize the document to meet your specific legal requirements and ensure compliance with local regulations. This streamlines the documentation process, saving time and reducing errors.

-

Is there a cost associated with using the full lien form feature on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Access to the full lien form feature comes included in all subscription tiers, making it a cost-effective solution for businesses of all sizes. Explore our pricing page to find the plan that best fits your requirements.

-

Can I eSign a full lien form using airSlate SignNow?

Absolutely! airSlate SignNow allows users to electronically sign a full lien form securely and legally. eSigning eliminates the need for printing and scanning, streamlining the process and ensuring that your document is ready for submission quickly and efficiently.

-

What integrations does airSlate SignNow offer for full lien forms?

airSlate SignNow integrates seamlessly with various business tools, including CRMs, cloud storage solutions, and productivity applications. This enables users to manage their full lien forms alongside other workflows efficiently. Check our integration directory for a complete list of compatible applications.

-

Are full lien forms legally binding when signed with airSlate SignNow?

Yes, full lien forms signed using airSlate SignNow are legally binding, provided that all parties involved adhere to electronic signature laws. airSlate SignNow ensures compliance with eSignature regulations, providing peace of mind for businesses using the platform. Always consult local regulations to confirm specific requirements.

-

What features does airSlate SignNow provide for managing full lien forms?

AirSlate SignNow comes equipped with a range of features, including document tracking, reminders, and customizable templates for full lien forms. These features enhance user experience by facilitating better document management and ensuring timely completion of necessary actions. This helps maintain organization and efficiency in your business operations.

Get more for Michigan Lien

Find out other Michigan Lien

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe