Demand for Statement of Amount Unpaid Individual Michigan Form

What is the Demand For Statement Of Amount Unpaid Individual Michigan

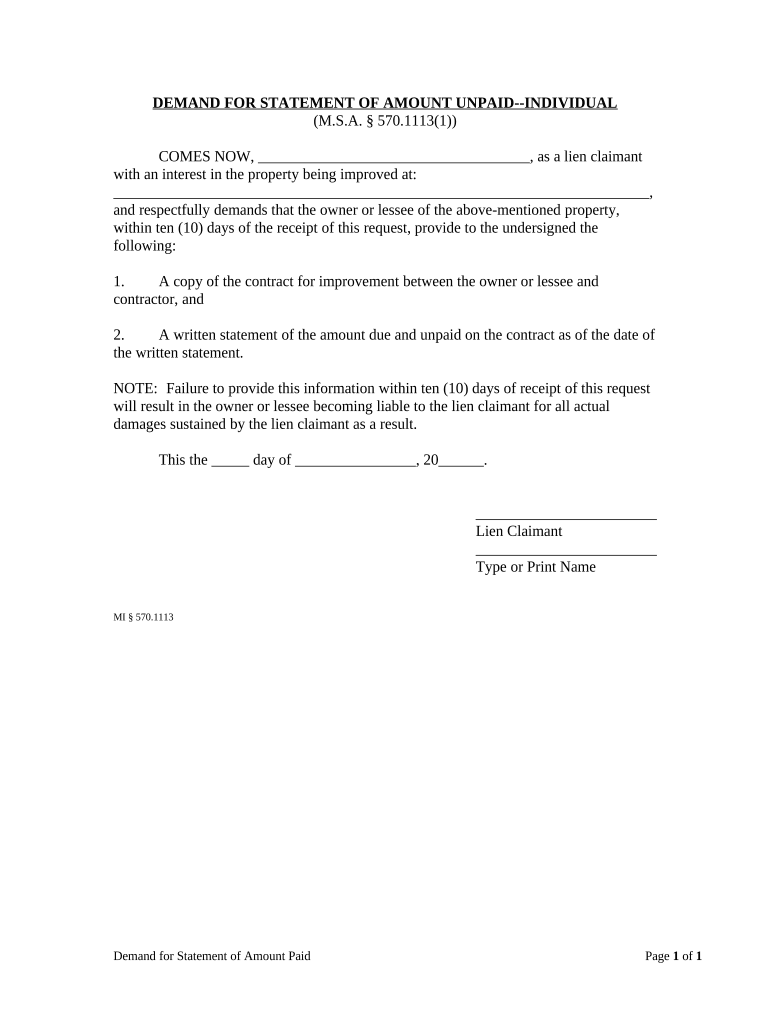

The Demand For Statement Of Amount Unpaid Individual Michigan is a formal document used to request a detailed account of unpaid debts owed by an individual in Michigan. This form serves as a crucial tool for creditors seeking to clarify outstanding balances and initiate collection processes. It outlines the necessary information required to substantiate the claim, such as the debtor's identity, the amount owed, and any relevant dates associated with the debt. Understanding this form is essential for both creditors and debtors to ensure transparency and compliance with state regulations.

How to use the Demand For Statement Of Amount Unpaid Individual Michigan

Using the Demand For Statement Of Amount Unpaid Individual Michigan involves a few straightforward steps. Initially, the creditor must fill out the form accurately, providing all required details about the debtor and the outstanding amount. Once completed, the form should be sent to the debtor, typically via certified mail, to ensure receipt. The debtor is then expected to respond within a specified time frame, providing the necessary information or disputing the claim. This process helps maintain clear communication and can facilitate resolution between both parties.

Steps to complete the Demand For Statement Of Amount Unpaid Individual Michigan

Completing the Demand For Statement Of Amount Unpaid Individual Michigan involves several key steps:

- Gather necessary information about the debtor, including their full name, address, and any relevant account numbers.

- Clearly state the amount owed, including any applicable interest or fees.

- Include dates related to the debt, such as the date the debt was incurred and the date of the last payment.

- Provide your contact information as the creditor for any follow-up inquiries.

- Review the form for accuracy before sending it to the debtor.

Key elements of the Demand For Statement Of Amount Unpaid Individual Michigan

Several key elements must be included in the Demand For Statement Of Amount Unpaid Individual Michigan to ensure its effectiveness:

- Debtor Information: Full name and address of the individual owing the debt.

- Amount Due: A clear statement of the total amount owed, including any additional charges.

- Account Details: Relevant account numbers or identifiers to help the debtor recognize the debt.

- Payment Terms: Information regarding payment methods and deadlines for response.

- Signature: The creditor's signature to authenticate the document.

Legal use of the Demand For Statement Of Amount Unpaid Individual Michigan

The Demand For Statement Of Amount Unpaid Individual Michigan is legally recognized as a formal request for payment. It is important for creditors to utilize this form correctly to comply with state laws governing debt collection practices. The document can serve as evidence in legal proceedings if the debtor fails to respond or disputes the claim. By following the proper procedures outlined in Michigan law, creditors can ensure that their demand is enforceable and that they have taken the necessary steps to recover outstanding debts.

State-specific rules for the Demand For Statement Of Amount Unpaid Individual Michigan

In Michigan, specific rules govern the use of the Demand For Statement Of Amount Unpaid Individual Michigan. Creditors must adhere to the Fair Debt Collection Practices Act, which outlines acceptable methods of communication and the rights of debtors. Additionally, the form must be sent in a manner that allows for proof of delivery, such as certified mail. It is also essential to provide the debtor with a reasonable timeframe to respond, typically within thirty days, to comply with state regulations and ensure fair treatment.

Quick guide on how to complete demand for statement of amount unpaid individual michigan

Complete Demand For Statement Of Amount Unpaid Individual Michigan effortlessly on any device

Online document administration has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Demand For Statement Of Amount Unpaid Individual Michigan on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Demand For Statement Of Amount Unpaid Individual Michigan with ease

- Locate Demand For Statement Of Amount Unpaid Individual Michigan and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Demand For Statement Of Amount Unpaid Individual Michigan and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Demand For Statement Of Amount Unpaid Individual Michigan?

A Demand For Statement Of Amount Unpaid Individual Michigan is a legal document used to formally request the statement of any unpaid debts or amounts owed by an individual in Michigan. This document is essential for initiating further collection actions and ensuring that all parties are aware of the outstanding amount.

-

How can airSlate SignNow help with creating a Demand For Statement Of Amount Unpaid Individual Michigan?

airSlate SignNow offers an intuitive platform to quickly create and customize a Demand For Statement Of Amount Unpaid Individual Michigan. Utilizing our eSigning features, you can easily gather signatures and ensure the document is legally binding without the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for my Demand For Statement Of Amount Unpaid Individual Michigan?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. We offer a cost-effective solution for creating a Demand For Statement Of Amount Unpaid Individual Michigan, allowing users to choose a plan that fits their budget while enjoying all essential features.

-

What features are available when using airSlate SignNow for legal documents like Demand For Statement Of Amount Unpaid Individual Michigan?

airSlate SignNow includes features such as document templates, eSignature capabilities, real-time tracking, and secure cloud storage, making it perfect for generating a Demand For Statement Of Amount Unpaid Individual Michigan. These features ensure that your documents are handled efficiently and securely.

-

How do I integrate airSlate SignNow with other applications for my Demand For Statement Of Amount Unpaid Individual Michigan?

airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and more. This allows you to effortlessly manage your Demand For Statement Of Amount Unpaid Individual Michigan alongside your existing workflow tools for enhanced productivity.

-

What are the benefits of using airSlate SignNow for my Demand For Statement Of Amount Unpaid Individual Michigan?

Using airSlate SignNow for your Demand For Statement Of Amount Unpaid Individual Michigan streamlines the document creation and signing process, reduces time spent on administrative tasks, and ensures compliance with legal standards. This makes it a valuable resource for businesses and individuals handling unpaid debt statements.

-

Can I track the status of my Demand For Statement Of Amount Unpaid Individual Michigan with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking, allowing you to monitor the status of your Demand For Statement Of Amount Unpaid Individual Michigan. You will receive notifications when the document is viewed and signed, ensuring you stay updated throughout the process.

Get more for Demand For Statement Of Amount Unpaid Individual Michigan

- Is this evaluation based on a time when the child form

- Lutheran rosary pdf form

- Florida pollutant license form

- A plant puzzle answer key form

- Community and date of birth certificate form

- Standing anesthesia orders pacu form

- Form 741 kentucky fiduciary income tax return comm

- Import export agency agreement template form

Find out other Demand For Statement Of Amount Unpaid Individual Michigan

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order