Minnesota Release Mortgage Form

What is the Minnesota Release Mortgage

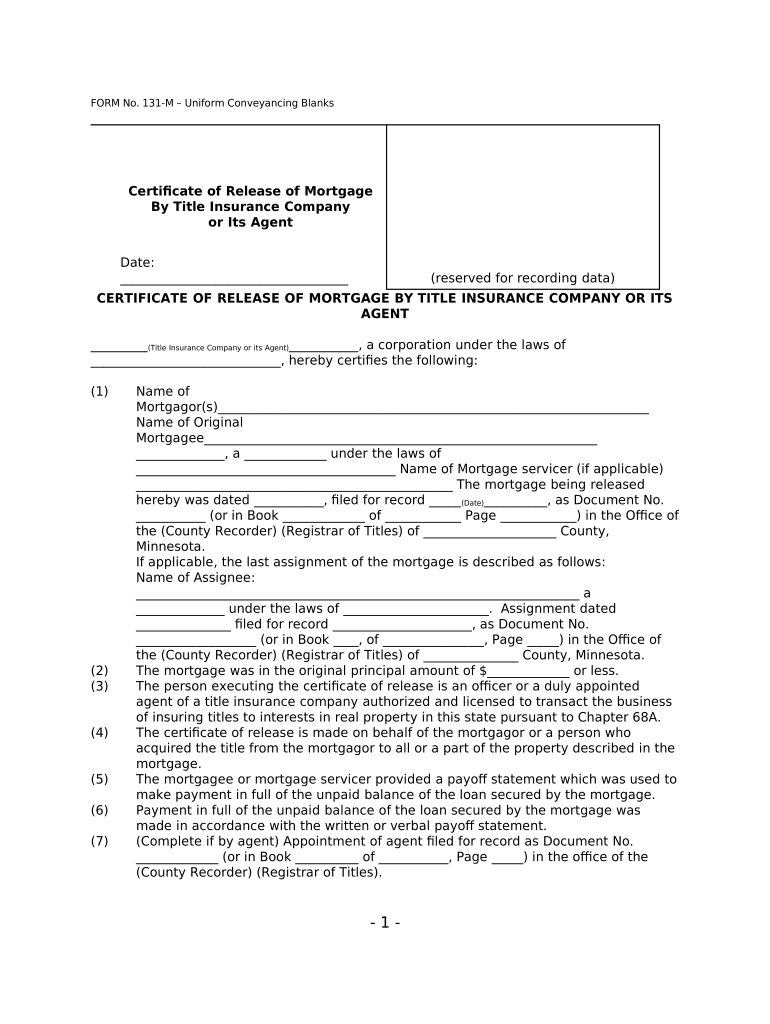

The Minnesota Release Mortgage is a legal document that signifies the release of a mortgage lien on a property. When a borrower pays off their mortgage, this form is essential to clear the title, allowing the property to be free of any claims from the lender. It serves as official proof that the borrower has fulfilled their obligations under the mortgage agreement, ensuring that the property can be sold or transferred without any encumbrances. This document is crucial for maintaining clear ownership and protecting the rights of property owners in Minnesota.

How to use the Minnesota Release Mortgage

Using the Minnesota Release Mortgage involves several key steps. First, ensure that the mortgage has been fully paid off. Once confirmed, the lender must complete the release form, including pertinent details such as the borrower’s name, property address, and mortgage information. After the form is completed, it should be signed and notarized by the lender. Finally, the completed release must be filed with the appropriate county recorder's office to officially document the release of the mortgage lien. This process is vital for protecting the homeowner's rights and ensuring the property title is clear.

Steps to complete the Minnesota Release Mortgage

Completing the Minnesota Release Mortgage involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Verify that the mortgage has been paid in full.

- Obtain the Minnesota Release Mortgage form from your lender or the county recorder's office.

- Fill out the form with the required information, including borrower and property details.

- Have the form signed by the lender and notarized.

- Submit the completed form to the county recorder's office for official recording.

Following these steps will help ensure that the mortgage release is processed correctly and that the property title is clear.

Legal use of the Minnesota Release Mortgage

The legal use of the Minnesota Release Mortgage is governed by state laws that outline the requirements for valid documentation. This form must be executed properly to be considered legally binding. It is essential that the lender provides a signed and notarized release to ensure that the document is enforceable in a court of law. Compliance with Minnesota statutes regarding mortgage releases is critical for protecting both the borrower’s and lender’s interests. Failure to follow these legal requirements may result in complications regarding property ownership and title clarity.

Required Documents

To complete the Minnesota Release Mortgage, specific documents are necessary. These typically include:

- The original mortgage agreement.

- Proof of payment in full, such as a payoff statement from the lender.

- The completed Minnesota Release Mortgage form.

- Identification for notarization purposes.

Having these documents ready will facilitate a smooth process for releasing the mortgage lien.

Who Issues the Form

The Minnesota Release Mortgage form is typically issued by the lender or financial institution that originally provided the mortgage. After the mortgage has been paid off, the lender is responsible for completing and signing the release form. It is crucial for borrowers to communicate with their lender to obtain the correct form and ensure that all necessary information is included. This step is vital for ensuring that the release is recognized and recorded appropriately.

Quick guide on how to complete minnesota release mortgage

Finish Minnesota Release Mortgage effortlessly on any gadget

Digital document administration has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, alter, and eSign your documents quickly without delays. Handle Minnesota Release Mortgage on any device using the airSlate SignNow Android or iOS applications and optimize any document-related task today.

The easiest way to modify and eSign Minnesota Release Mortgage without hassle

- Find Minnesota Release Mortgage and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Verify all details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Modify and eSign Minnesota Release Mortgage and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MN certificate title?

An MN certificate title is a legal document that proves ownership of a vehicle in Minnesota. It includes important details such as the vehicle identification number (VIN) and the owner's information. Utilizing airSlate SignNow allows you to electronically sign and manage your MN certificate title efficiently.

-

How can airSlate SignNow help with MN certificate title management?

airSlate SignNow simplifies the process of managing your MN certificate title by allowing you to prepare, send, and eSign documents securely online. With its user-friendly interface, you can easily track the status of your certificate title and ensure that all signatures are collected promptly. This streamlines the process and minimizes delays.

-

What are the pricing options for using airSlate SignNow for MN certificate title submissions?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, starting with a free trial to explore its features. For businesses that frequently handle MN certificate title documents, the cost-effective subscription plans can signNowly reduce operational expenses. Check the airSlate SignNow website for the latest pricing details.

-

What features does airSlate SignNow offer for processing MN certificate titles?

airSlate SignNow includes features like document templates, customizable workflows, and real-time tracking which are ideal for processing MN certificate titles. These features help in minimizing errors and ensuring that every document is completed correctly and efficiently. Additionally, it provides secure storage for all your signed documents.

-

Is airSlate SignNow compliant with state laws regarding MN certificate titles?

Yes, airSlate SignNow is compliant with state laws and regulations regarding MN certificate titles. The platform meets all electronic signature laws, ensuring that your signed documents hold up in court. This also adds a layer of legal protection when managing your MN certificate title electronically.

-

Can I integrate airSlate SignNow with other applications for managing MN certificate titles?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for managing MN certificate titles. You can connect it with CRM systems, document management software, and more, allowing for a streamlined experience in handling all your business documents.

-

What benefits does airSlate SignNow provide for using electronic signatures on MN certificate titles?

Using airSlate SignNow for electronic signatures on MN certificate titles offers numerous benefits, such as increased efficiency and reduced turnaround time. It eliminates the need for physical paperwork, making the process more eco-friendly and accessible from anywhere. Additionally, electronic signatures are legally binding, ensuring the integrity of your MN certificate title transactions.

Get more for Minnesota Release Mortgage

- Example of content based instruction lesson plan form

- Mv 217 form

- Form 3539

- Sunlife election of method of settlement form

- Apply aarons com form

- Arizona form 348

- Dyn6110 dyn6210 dyn6310 1 person 2 person and 3 person saunas owners manual for carbon model saunas for indoor use only dyn6110 form

- Child mediation agreement template form

Find out other Minnesota Release Mortgage

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation