Assignment of Mortgage by Individual Mortgage Holder Minnesota Form

What is the Assignment Of Mortgage By Individual Mortgage Holder Minnesota

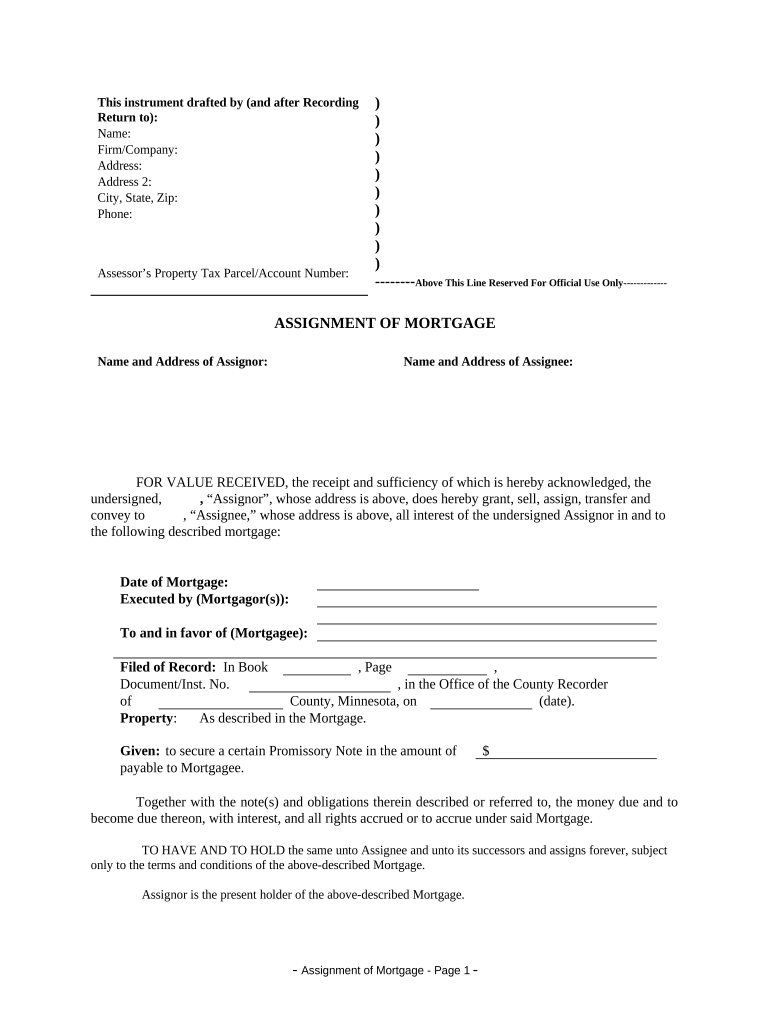

The Assignment of Mortgage by Individual Mortgage Holder in Minnesota is a legal document that transfers the rights and obligations of a mortgage from one party to another. This process is essential for ensuring that the new mortgage holder has the authority to collect payments and enforce the terms of the mortgage agreement. The assignment must be properly executed to be valid, typically requiring signatures from both the original mortgage holder and the new holder, along with notarization. Understanding this document is crucial for individuals involved in real estate transactions or refinancing processes.

How to Use the Assignment Of Mortgage By Individual Mortgage Holder Minnesota

Using the Assignment of Mortgage by Individual Mortgage Holder involves several steps to ensure it is executed correctly. First, the current mortgage holder must complete the form with accurate information regarding the property and the parties involved. Next, both the assignor and assignee should sign the document in the presence of a notary public to validate the signatures. After signing, the assignment should be filed with the appropriate county office to make the transfer official. This process helps protect the rights of all parties and ensures compliance with Minnesota state laws.

Steps to Complete the Assignment Of Mortgage By Individual Mortgage Holder Minnesota

Completing the Assignment of Mortgage by Individual Mortgage Holder involves specific steps to ensure its legality:

- Gather necessary information, including the original mortgage document and details about the property.

- Fill out the assignment form, including the names and addresses of the assignor and assignee.

- Ensure all information is accurate and complete to avoid delays.

- Sign the document in front of a notary public to ensure authenticity.

- File the completed document with the local county recorder’s office to finalize the assignment.

Legal Use of the Assignment Of Mortgage By Individual Mortgage Holder Minnesota

The legal use of the Assignment of Mortgage by Individual Mortgage Holder in Minnesota is governed by state laws that dictate how mortgages can be assigned. This document must comply with the Minnesota Statutes regarding real estate transactions. It is essential that the assignment is executed properly to protect the rights of the new mortgage holder and to ensure that the assignment is enforceable in court. Failure to follow legal guidelines can result in disputes over mortgage payments and ownership rights.

Key Elements of the Assignment Of Mortgage By Individual Mortgage Holder Minnesota

Several key elements must be included in the Assignment of Mortgage by Individual Mortgage Holder to ensure its validity:

- Names of the parties: Clearly state the names of both the assignor and assignee.

- Property description: Provide a detailed description of the property associated with the mortgage.

- Original mortgage details: Include information about the original mortgage, such as the loan number and date of execution.

- Signatures: Both parties must sign the document, and it must be notarized.

- Filing information: Indicate where the assignment will be filed for public record.

State-Specific Rules for the Assignment Of Mortgage By Individual Mortgage Holder Minnesota

In Minnesota, specific rules govern the Assignment of Mortgage by Individual Mortgage Holder. These include requirements for notarization, the necessity of filing the assignment with the county recorder’s office, and adherence to state statutes regarding mortgage assignments. It is important for individuals to be aware of these regulations to ensure compliance and avoid potential legal issues. Additionally, local county offices may have specific forms or procedures that must be followed, so checking with them is advisable.

Quick guide on how to complete assignment of mortgage by individual mortgage holder minnesota

Easily Prepare Assignment Of Mortgage By Individual Mortgage Holder Minnesota on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Handle Assignment Of Mortgage By Individual Mortgage Holder Minnesota on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Effortlessly Modify and eSign Assignment Of Mortgage By Individual Mortgage Holder Minnesota

- Obtain Assignment Of Mortgage By Individual Mortgage Holder Minnesota and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Assignment Of Mortgage By Individual Mortgage Holder Minnesota and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'Assignment Of Mortgage By Individual Mortgage Holder Minnesota'?

The 'Assignment Of Mortgage By Individual Mortgage Holder Minnesota' refers to the process in which a mortgage holder assigns their rights and obligations to another party. This legal document can be crucial for transferring ownership interests and ensures that all parties are clear on their responsibilities. Understanding this process can help individuals make informed decisions regarding their mortgage agreements.

-

How does airSlate SignNow support the 'Assignment Of Mortgage By Individual Mortgage Holder Minnesota'?

airSlate SignNow provides a seamless solution for electronically signing and managing the 'Assignment Of Mortgage By Individual Mortgage Holder Minnesota' documents. With our user-friendly platform, you can easily create, send, and eSign essential documents securely. This streamlines the mortgage assignment process, making it more efficient for individual mortgage holders.

-

What are the costs associated with using airSlate SignNow for mortgage assignments?

Pricing for using airSlate SignNow to process the 'Assignment Of Mortgage By Individual Mortgage Holder Minnesota' is competitive and varies based on the subscription plan you choose. We offer various options tailored to your business's needs while ensuring cost-effectiveness. You can find detailed pricing information on our website to select the best plan for your needs.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes robust features for handling the 'Assignment Of Mortgage By Individual Mortgage Holder Minnesota'. These features include customizable templates, real-time tracking of document status, and easy sharing options. Additionally, our integrated tools enhance the overall experience by simplifying the documentation process.

-

Can I integrate airSlate SignNow with other software for my business operations?

Yes, airSlate SignNow can be integrated with various business applications to enhance your workflow. This is particularly beneficial when managing documents like the 'Assignment Of Mortgage By Individual Mortgage Holder Minnesota'. Our integrations help streamline processes and keep your operations efficient.

-

What benefits can I expect from using airSlate SignNow for mortgage assignments?

By utilizing airSlate SignNow for the 'Assignment Of Mortgage By Individual Mortgage Holder Minnesota', you benefit from enhanced security, reduced paperwork, and faster transactions. The ability to eSign documents remotely adds convenience, ensuring that you can complete transactions wherever you are. Additionally, our platform saves time and reduces costs associated with traditional signing methods.

-

Is airSlate SignNow secure for handling sensitive mortgage documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, including the 'Assignment Of Mortgage By Individual Mortgage Holder Minnesota'. We implement advanced encryption and secure storage solutions to protect your data. You can trust that your documents are handled with the utmost care and compliance with legal standards.

Get more for Assignment Of Mortgage By Individual Mortgage Holder Minnesota

- Form 10a reply

- Surface water sampling form

- Form 31 103f2

- Mcfarland high school student teacher conference form

- Unofficial transcript request uc irvine university registrar form

- Permit required confined space entry form

- Admissions requirements for homeschooled students form

- University of miami cognate form the cognates program

Find out other Assignment Of Mortgage By Individual Mortgage Holder Minnesota

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy