Affidavit of Motor Vehicle Gift Transfer14317 Rev 2024-2026

Understanding the Affidavit of Motor Vehicle Gift Transfer (Form 14-317)

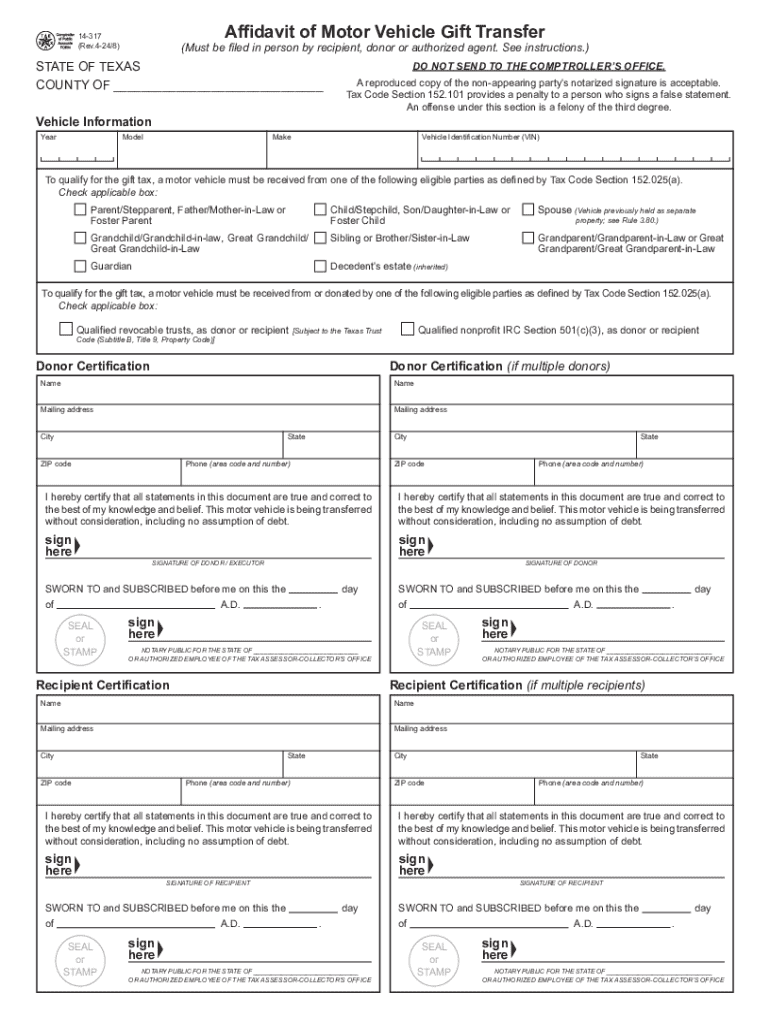

The Affidavit of Motor Vehicle Gift Transfer, commonly referred to as Form 14-317, is a legal document used in Texas to facilitate the transfer of a motor vehicle as a gift. This form is essential for individuals who wish to transfer ownership of a vehicle without a monetary exchange. By completing this affidavit, the donor confirms that the vehicle is being given as a gift, which may exempt the recipient from certain taxes typically associated with vehicle sales.

Steps to Complete the Affidavit of Motor Vehicle Gift Transfer (Form 14-317)

Completing the Affidavit of Motor Vehicle Gift Transfer involves a few straightforward steps:

- Obtain the form from the Texas Comptroller's website or through a local tax office.

- Fill out the required fields, including the donor's and recipient's information, vehicle details, and the reason for the transfer.

- Both the donor and recipient must sign the form in the presence of a notary public.

- Submit the completed form along with any other required documents to the Texas Department of Motor Vehicles (DMV) to finalize the transfer.

Legal Use of the Affidavit of Motor Vehicle Gift Transfer (Form 14-317)

The Affidavit of Motor Vehicle Gift Transfer is legally recognized in Texas and serves as proof of the gift transfer. It is important to ensure that the form is filled out accurately and signed to avoid any legal complications. This affidavit protects both parties by documenting the transaction and clarifying that the vehicle was not sold, which can have implications for taxes and registration.

Required Documents for the Affidavit of Motor Vehicle Gift Transfer (Form 14-317)

To successfully complete the Affidavit of Motor Vehicle Gift Transfer, the following documents are typically required:

- The signed and notarized Form 14-317.

- The vehicle's title, which must be signed over to the recipient.

- Proof of identity for both the donor and recipient, such as a driver's license or state ID.

- Any additional documentation required by the Texas DMV for vehicle registration.

Obtaining the Affidavit of Motor Vehicle Gift Transfer (Form 14-317)

The Affidavit of Motor Vehicle Gift Transfer can be obtained from various sources. It is available online through the Texas Comptroller's website, where users can download and print the form. Additionally, physical copies can be found at local tax offices or DMV locations throughout Texas. Ensuring that you have the most current version of the form is crucial for compliance with state regulations.

Examples of Using the Affidavit of Motor Vehicle Gift Transfer (Form 14-317)

There are various scenarios in which the Affidavit of Motor Vehicle Gift Transfer may be used:

- A parent gifting a vehicle to their child.

- A grandparent transferring ownership of a vehicle to a grandchild.

- Friends or family members exchanging vehicles as gifts during special occasions.

In each case, the affidavit serves to document the gift and clarify that no sale occurred, which can be beneficial for tax purposes.

Handy tips for filling out Affidavit Of Motor Vehicle Gift Transfer14317 Rev online

Quick steps to complete and e-sign Affidavit Of Motor Vehicle Gift Transfer14317 Rev online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Gain access to a GDPR and HIPAA compliant platform for optimum straightforwardness. Use signNow to electronically sign and send out Affidavit Of Motor Vehicle Gift Transfer14317 Rev for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct affidavit of motor vehicle gift transfer14317 rev

Create this form in 5 minutes!

How to create an eSignature for the affidavit of motor vehicle gift transfer14317 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tx form transfer and how does it work with airSlate SignNow?

A tx form transfer is a process that allows users to electronically transfer documents for signing and approval. With airSlate SignNow, you can easily upload your tx forms, send them to recipients, and track their status in real-time, ensuring a seamless signing experience.

-

How much does airSlate SignNow cost for tx form transfer services?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Depending on the features you require for tx form transfer, you can choose from different subscription tiers, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for tx form transfer?

airSlate SignNow includes a range of features for tx form transfer, such as customizable templates, automated workflows, and secure cloud storage. These features streamline the signing process, making it efficient and user-friendly for both senders and recipients.

-

Can I integrate airSlate SignNow with other applications for tx form transfer?

Yes, airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This allows for a more efficient tx form transfer process by connecting your existing tools and enhancing your workflow.

-

What are the benefits of using airSlate SignNow for tx form transfer?

Using airSlate SignNow for tx form transfer provides numerous benefits, including faster turnaround times, reduced paper usage, and improved document security. These advantages help businesses save time and resources while ensuring compliance with legal standards.

-

Is airSlate SignNow secure for tx form transfer?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your documents during tx form transfer. You can trust that your sensitive information remains safe throughout the signing process.

-

How can I get started with tx form transfer on airSlate SignNow?

Getting started with tx form transfer on airSlate SignNow is easy. Simply sign up for an account, upload your tx forms, and start sending them for eSignature. The intuitive interface guides you through each step, making the process straightforward.

Get more for Affidavit Of Motor Vehicle Gift Transfer14317 Rev

- Living trust property record utah form

- Utah trust 497427648 form

- Assignment to living trust utah form

- Notice of assignment to living trust utah form

- Revocation of living trust utah form

- Letter to lienholder to notify of trust utah form

- Utah timber sale contract utah form

- Utah forest products timber sale contract utah form

Find out other Affidavit Of Motor Vehicle Gift Transfer14317 Rev

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document