Form 01 117

What is the Form 01 117

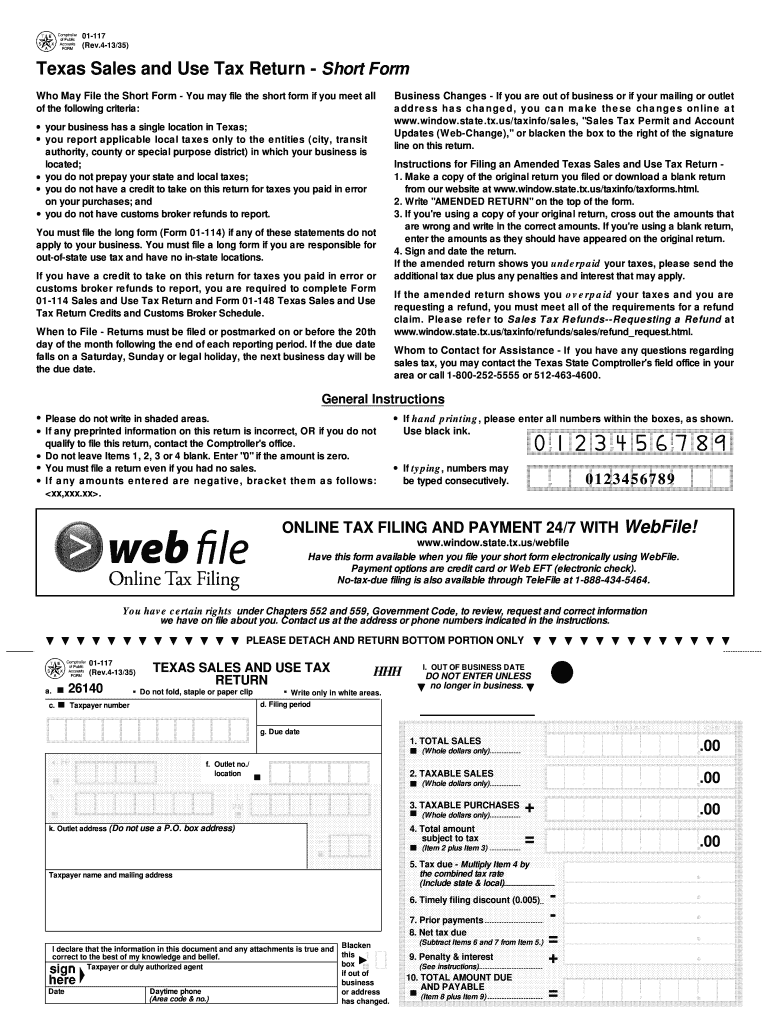

The Form 01 117, also known as the Texas Sales and Use Tax Return Short Form, is a document used by businesses to report and remit sales and use tax to the Texas Comptroller of Public Accounts. This form is specifically designed for businesses with a straightforward tax situation, allowing them to file their returns efficiently. The form captures essential information about taxable sales, exempt sales, and the total amount of tax due. It is crucial for maintaining compliance with Texas tax laws and ensuring that businesses fulfill their tax obligations accurately.

Steps to complete the Form 01 117

Completing the Form 01 117 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including receipts and invoices. Next, follow these steps:

- Enter your business information, including name, address, and Texas sales tax permit number.

- Report total sales for the period, distinguishing between taxable and exempt sales.

- Calculate the total sales tax due based on the applicable tax rate.

- Include any adjustments or credits, if applicable.

- Sign and date the form, certifying that the information provided is accurate.

Review the completed form for any errors before submission to avoid penalties or delays.

How to use the Form 01 117

The Form 01 117 is used primarily for reporting sales and use tax in Texas. To utilize this form effectively, businesses should follow these guidelines:

- Determine eligibility for the short form based on sales volume and complexity.

- Ensure all sales transactions are accurately recorded and categorized.

- File the form by the designated deadline to avoid late fees.

- Keep a copy of the submitted form for your records.

Using this form correctly helps businesses remain compliant with Texas tax regulations while simplifying the filing process.

Key elements of the Form 01 117

The Form 01 117 includes several critical elements that businesses must complete accurately. Key components of the form are:

- Business Information: Name, address, and Texas sales tax permit number.

- Total Sales: Breakdown of taxable and exempt sales.

- Sales Tax Calculation: Total tax due based on reported sales.

- Adjustments: Any credits or adjustments that affect the total tax owed.

- Signature: A declaration certifying the accuracy of the information provided.

Each of these elements plays a vital role in ensuring that the form is processed correctly and that the business remains compliant with tax laws.

Form Submission Methods

The Form 01 117 can be submitted to the Texas Comptroller in various ways, providing flexibility for businesses. The available submission methods include:

- Online Submission: Businesses can file the form electronically through the Comptroller's webfile system, which streamlines the process and allows for immediate confirmation of submission.

- Mail: The form can be printed and mailed to the appropriate address provided by the Comptroller. Ensure that postage is applied and allow sufficient time for delivery.

- In-Person Submission: Businesses may also choose to submit the form in person at designated Comptroller offices.

Selecting the appropriate submission method can enhance efficiency and ensure timely filing.

Filing Deadlines / Important Dates

Timely filing of the Form 01 117 is essential to avoid penalties. The typical filing deadlines are as follows:

- Monthly filers must submit their returns by the 20th day of the month following the reporting period.

- Quarterly filers have a deadline of the 20th day of the month following the end of the quarter.

- Annual filers should submit their returns by January 20 of the following year.

It is important to stay informed about any changes in deadlines to ensure compliance and avoid late fees.

Quick guide on how to complete how to fill the form texas sales and use tax return form 01 117rev4 1335

Effortlessly Prepare Form 01 117 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without any delays. Manage Form 01 117 across any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Form 01 117 with Ease

- Locate Form 01 117 and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important parts of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 01 117 and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the how to fill the form texas sales and use tax return form 01 117rev4 1335

How to generate an eSignature for the How To Fill The Form Texas Sales And Use Tax Return Form 01 117rev4 1335 online

How to make an electronic signature for your How To Fill The Form Texas Sales And Use Tax Return Form 01 117rev4 1335 in Google Chrome

How to create an electronic signature for signing the How To Fill The Form Texas Sales And Use Tax Return Form 01 117rev4 1335 in Gmail

How to generate an eSignature for the How To Fill The Form Texas Sales And Use Tax Return Form 01 117rev4 1335 from your smart phone

How to generate an eSignature for the How To Fill The Form Texas Sales And Use Tax Return Form 01 117rev4 1335 on iOS devices

How to create an eSignature for the How To Fill The Form Texas Sales And Use Tax Return Form 01 117rev4 1335 on Android OS

People also ask

-

What is the airSlate SignNow solution for filling out tax forms?

airSlate SignNow provides an efficient digital platform to manage electronic signatures and documents. It simplifies how to fill out the Texas sales and use tax return short form, allowing you to send and sign documents seamlessly online. This enhances efficiency and ensures compliance with tax requirements.

-

How does airSlate SignNow help with Texas tax compliance?

With airSlate SignNow, businesses can easily navigate the process of submitting the Texas sales and use tax return short form. The platform ensures that all necessary documentation is properly filled out and signed, reducing the risk of errors and enhancing compliance with Texas tax regulations. This tool is essential for ensuring accurate filing.

-

Is there a free trial available to test airSlate SignNow features?

Yes, airSlate SignNow offers a free trial which allows users to explore its features, including guidance on how to fill out the Texas sales and use tax return short form. This trial gives you insight into the convenience of electronic document management and signing, helping you determine if it fits your needs.

-

What features does airSlate SignNow include for tax return preparation?

airSlate SignNow includes features like document templates, real-time editing, and secure electronic signatures. These tools streamline the process of how to fill out the Texas sales and use tax return short form, allowing users to collaborate easily and efficiently complete their tax documentation.

-

Can airSlate SignNow integrate with accounting software?

Yes, airSlate SignNow offers integrations with various accounting software solutions. These integrations simplify how to fill out the Texas sales and use tax return short form by automatically pulling in relevant financial data, making the process quicker and more accurate.

-

What benefits does airSlate SignNow provide for small businesses?

For small businesses, airSlate SignNow offers a cost-effective solution that simplifies document management. Understanding how to fill out the Texas sales and use tax return short form is much easier with its user-friendly interface, allowing small business owners to focus on growth rather than paperwork.

-

How secure is the airSlate SignNow platform?

airSlate SignNow prioritizes security with advanced encryption and compliance with international security standards. This ensures that your data is protected while you learn how to fill out the Texas sales and use tax return short form and manage sensitive tax documents securely.

Get more for Form 01 117

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction form

- Letter from landlord to tenant returning security deposit less deductions alaska form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return alaska form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return alaska form

- Letter from tenant to landlord containing request for permission to sublease alaska form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages alaska form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent alaska form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable alaska form

Find out other Form 01 117

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later