Living Trust for Husband and Wife with Minor and or Adult Children Minnesota Form

What is the Living Trust for Husband and Wife with Minor and or Adult Children in Minnesota

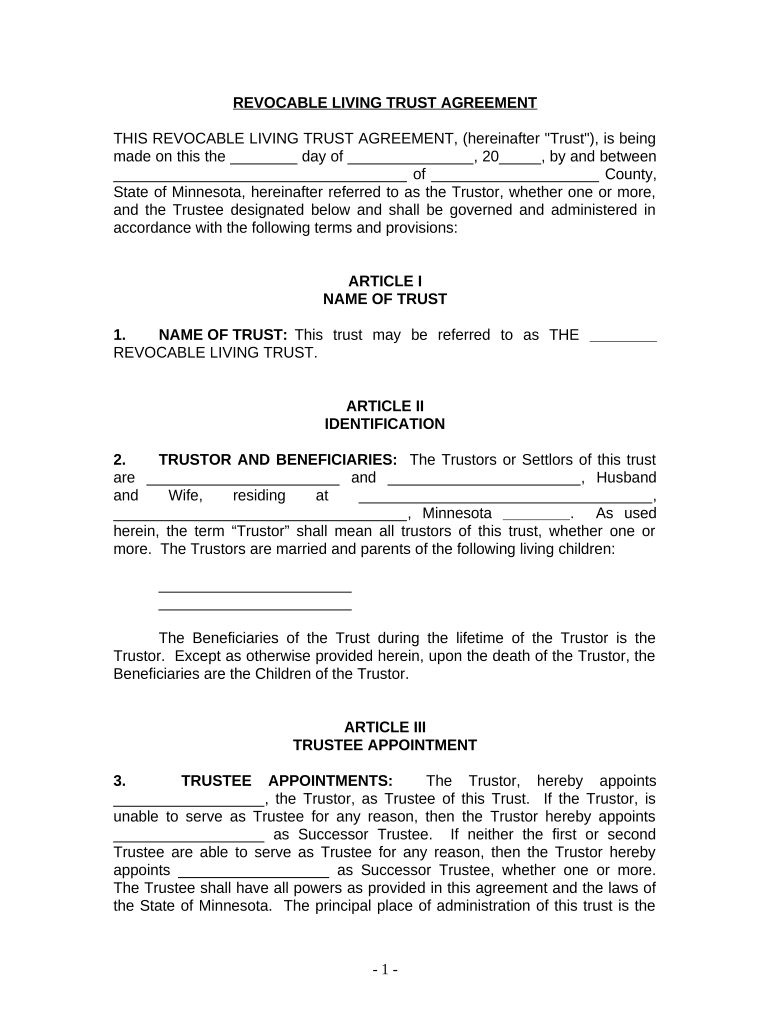

A living trust for husband and wife with minor and or adult children in Minnesota is a legal document that allows couples to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, ensuring a smoother transition of assets to beneficiaries. It is particularly beneficial for couples with children, as it allows them to provide for their minor children and designate guardianship, if necessary. The trust can also be structured to provide for adult children, ensuring their financial security while maintaining control over asset distribution.

Key Elements of the Living Trust for Husband and Wife with Minor and or Adult Children in Minnesota

Several key elements define a living trust for husband and wife with minor and or adult children in Minnesota:

- Trustee Designation: The couple typically serves as the initial trustees, managing the trust assets. They can also appoint a successor trustee to take over upon their death or incapacity.

- Beneficiary Designation: The trust specifies who will receive the assets upon the couple's death, including provisions for minor children and adult children.

- Asset Management: The trust outlines how assets will be managed during the couple's lifetime and how they will be distributed after death.

- Guardianship Provisions: If the couple has minor children, the trust can include provisions for appointing guardians to care for them in the event of both parents' death.

Steps to Complete the Living Trust for Husband and Wife with Minor and or Adult Children in Minnesota

Completing a living trust for husband and wife with minor and or adult children in Minnesota involves several steps:

- Gather Information: Collect details about assets, debts, and beneficiaries.

- Choose a Trustee: Decide who will manage the trust, either the couple or a third party.

- Draft the Trust Document: Create the trust document, outlining terms, conditions, and provisions for asset distribution.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its legal validity.

- Fund the Trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Living Trust for Husband and Wife with Minor and or Adult Children in Minnesota

The legal use of a living trust for husband and wife with minor and or adult children in Minnesota is governed by state laws. The trust must comply with Minnesota statutes regarding trusts, including proper execution and funding. It is essential for the trust to be clearly written to avoid ambiguity and potential disputes among beneficiaries. Additionally, the trust should be regularly reviewed and updated to reflect any changes in family circumstances or financial situations.

How to Obtain the Living Trust for Husband and Wife with Minor and or Adult Children in Minnesota

Obtaining a living trust for husband and wife with minor and or adult children in Minnesota can be done through several avenues:

- Legal Assistance: Consulting with an estate planning attorney can ensure that the trust is tailored to meet specific needs and complies with state laws.

- Online Resources: Various online platforms offer templates and guidance for creating a living trust, though it is advisable to have any document reviewed by a legal professional.

- Financial Institutions: Some banks and financial services companies provide trust services and can assist in establishing a living trust.

State-Specific Rules for the Living Trust for Husband and Wife with Minor and or Adult Children in Minnesota

In Minnesota, specific rules govern the creation and management of living trusts. These include:

- Witness Requirements: While not always necessary, having witnesses can strengthen the validity of the trust.

- Notarization: Trust documents should be notarized to ensure they are legally binding.

- Funding the Trust: Assets must be properly transferred to the trust to ensure they are managed according to the trust's terms.

- Tax Considerations: Understanding the tax implications of the trust is crucial, as it may affect estate taxes and income taxes for the trust beneficiaries.

Quick guide on how to complete living trust for husband and wife with minor and or adult children minnesota

Complete Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota effortlessly on any device

Digital document management has grown increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, alter, and eSign your documents swiftly without delays. Manage Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota on any device using airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to alter and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota effortlessly

- Locate Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in a few clicks from any device you choose. Alter and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota and guarantee exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota?

A Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota is a legal document that allows you to manage and distribute your assets while protecting your children's inheritance. This kind of trust can simplify the estate planning process and help avoid probate.

-

How does a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota benefit my family?

The main benefit of a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota is that it ensures your children, whether minor or adult, receive their inheritance without delays. Additionally, it provides flexibility in managing assets and can help reduce estate taxes.

-

What is the cost of setting up a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota?

The cost of setting up a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota can vary based on your needs and the complexity of your estate. Typically, you might expect to pay anywhere from a few hundred to a couple of thousand dollars for professional assistance.

-

Can I customize a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota?

Yes, a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota can be customized to reflect your specific wishes and instructions. You can outline how assets are to be managed and distributed, as well as appoint guardians for your minor children.

-

Does a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota prevent probate?

Yes, one of the key advantages of establishing a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota is that it helps avoid the probate process. Assets held in the trust pass directly to your beneficiaries, ensuring a quicker and more private distribution.

-

What should I consider when creating a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota?

When creating a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota, consider your family's unique needs and financial situation. It's important to identify all your assets, choose appropriate trustees, and determine how you want your assets to be distributed upon your passing.

-

Can airSlate SignNow assist me with my Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota?

Absolutely! airSlate SignNow provides a user-friendly platform that simplifies the process of drafting and managing a Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota. With eSign capabilities, you can easily sign and share essential documents.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota

- Sample of nce certificate 89993403 form

- 8821a form

- Zocalo donation request 100259514 form

- 2089 amendment to sale contract v01 132089 with sample qxd form

- Sibling relationship checklist form

- Cna supplementary statement verification form

- Lps walking field trip permission form loveland city schools lovelandschools

- Individual income tax return city of troy inc form

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children Minnesota

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free