Mo Llc Form

What is the Mo LLC?

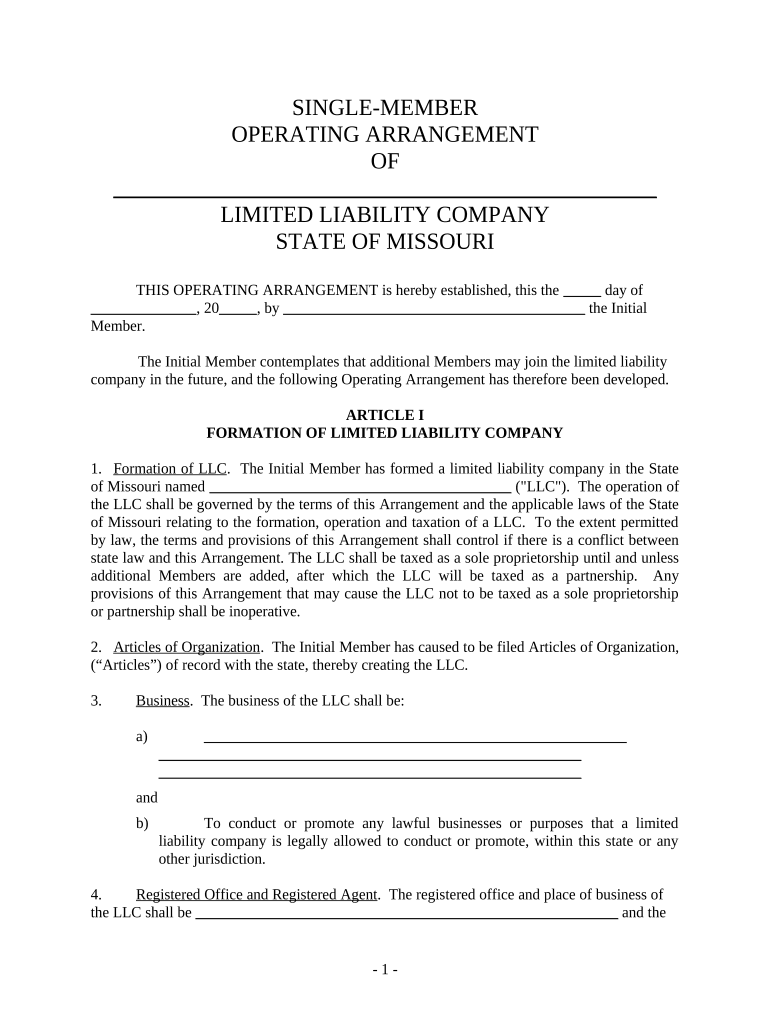

The Mo LLC, or Missouri Limited Liability Company, is a unique business structure that combines the benefits of both a corporation and a partnership. This legal entity provides limited liability protection to its owners, known as members, shielding their personal assets from business debts and liabilities. In Missouri, forming an LLC is a popular choice for entrepreneurs and small business owners due to its flexibility and relatively simple management requirements.

Steps to Complete the Mo LLC

Completing the Mo LLC involves several key steps to ensure compliance with Missouri state laws. Here is a structured approach:

- Choose a unique name for your LLC that complies with Missouri naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Articles of Organization with the Missouri Secretary of State, including necessary details such as the LLC's name, registered agent, and business address.

- Pay the required filing fee, which is typically around 50 dollars.

- Create an Operating Agreement outlining the management structure and operating procedures of the LLC.

- Obtain any necessary licenses or permits required for your specific business activities.

Legal Use of the Mo LLC

The Mo LLC is legally recognized in Missouri and can be used for various business purposes. It allows members to conduct business activities while enjoying limited liability protection. This means that personal assets are generally protected from lawsuits or debts incurred by the business. However, it is essential for members to adhere to state regulations and maintain proper business practices to uphold this legal protection.

Required Documents

To successfully form a Mo LLC, several documents are required:

- Articles of Organization: This document officially registers the LLC with the state.

- Operating Agreement: Although not mandatory, this document outlines the management structure and operational guidelines for the LLC.

- Employer Identification Number (EIN): This is necessary for tax purposes and can be obtained from the IRS.

- Any applicable business licenses or permits specific to your industry.

Eligibility Criteria

To form a Mo LLC, certain eligibility criteria must be met:

- At least one member is required to establish the LLC.

- Members can be individuals or other business entities.

- The chosen name for the LLC must be distinguishable from existing businesses registered in Missouri.

IRS Guidelines

When operating a Mo LLC, it is essential to comply with IRS guidelines. LLCs are typically treated as pass-through entities for tax purposes, meaning that profits and losses are reported on the members' personal tax returns. Members must also be aware of self-employment tax obligations and may need to file additional forms, such as Schedule C, depending on the business structure and income.

Quick guide on how to complete mo llc

Effortlessly Prepare Mo Llc on Any Device

Digital document management is gaining traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Mo Llc on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Mo Llc with Ease

- Locate Mo Llc and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or obscure sensitive information with specific tools provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your updates.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Mo Llc and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for conducting a mo company search?

To conduct a mo company search, simply visit our platform and enter the relevant company name or registration number. Our service will retrieve comprehensive information about the business, including its status, registered agents, and other vital details. The user-friendly interface ensures that you can easily navigate through the results.

-

How does airSlate SignNow enhance the mo company search experience?

airSlate SignNow enhances the mo company search experience by offering a seamless integration of document management and eSigning features. Businesses can send the necessary documents for verification and swiftly obtain signatures, streamlining the entire process. This efficiency allows for faster business decisions and actions.

-

What pricing plans are available for mo company search services?

Our mo company search services come with various pricing plans tailored to fit different business needs. You can choose from monthly subscriptions or annual plans that provide cost-effective solutions, depending on the volume of searches you anticipate. Each plan includes full access to our features to make your searches efficient and thorough.

-

Are there any hidden fees associated with the mo company search?

No, there are no hidden fees associated with our mo company search services. We believe in transparency, so the pricing you see is the pricing you pay. Our goal is to provide you with effective solutions without any unexpected costs, allowing you to budget effectively for your business needs.

-

Can I integrate airSlate SignNow with other tools for mo company searches?

Yes, airSlate SignNow allows for easy integrations with various tools to enhance your mo company search experience. You can connect our service with popular CRM systems, document storage solutions, and other business applications to streamline workflows. Integration helps ensure that all your processes are interconnected, making data management much smoother.

-

What benefits can I expect from using airSlate SignNow for mo company search?

Using airSlate SignNow for your mo company search offers numerous benefits, including quick access to critical company information and the ability to manage documents efficiently. The ease of eSigning and document sharing enhances collaboration and expedites the decision-making process. Additionally, our customer support team is always available to assist you with any inquiries.

-

Is airSlate SignNow secure for performing a mo company search?

Absolutely! airSlate SignNow ensures top-level security for all your transactions and searches within the platform. Our encryption protocols and compliance with data protection regulations guarantee that your information remains confidential during a mo company search. You can trust us to safeguard your business data.

Get more for Mo Llc

Find out other Mo Llc

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors