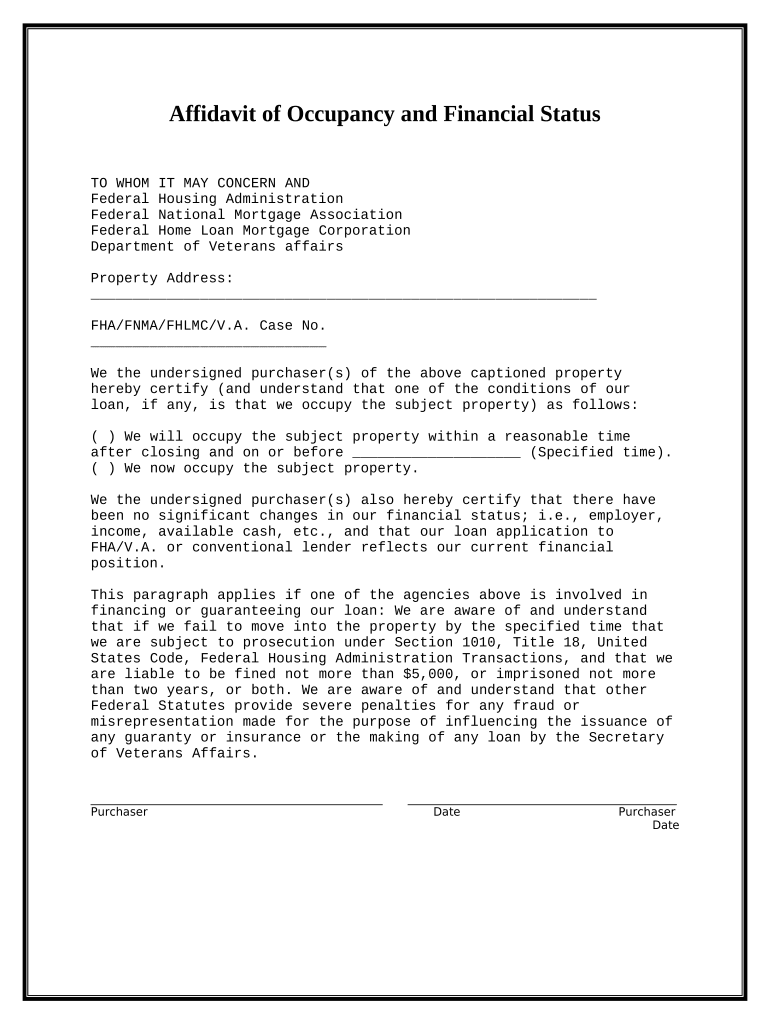

Affidavit of Occupancy and Financial Status Missouri Form

Understanding the affidavit of mortgage

The affidavit of mortgage is a legal document that provides a sworn statement regarding the details of a mortgage. It typically includes information about the borrower, the lender, the property in question, and the terms of the mortgage agreement. This document serves to confirm that the borrower has taken out a mortgage on the specified property and outlines any obligations associated with the mortgage. Understanding its contents is crucial for both parties involved, as it ensures clarity and legal compliance in the mortgage process.

Key elements of the affidavit of mortgage

When completing an affidavit of mortgage, several key elements must be included to ensure its validity:

- Borrower Information: Full name, address, and contact details of the borrower.

- Lender Information: Full name and address of the lending institution.

- Property Description: Detailed description of the property, including its address and legal description.

- Loan Amount: The total amount of the mortgage loan.

- Terms of the Mortgage: Specific terms, including interest rate, payment schedule, and duration of the loan.

- Signatures: Signatures of the borrower and a notary public to validate the document.

Steps to complete the affidavit of mortgage

Completing the affidavit of mortgage involves several straightforward steps:

- Gather necessary information, including personal details and property specifics.

- Fill out the affidavit form, ensuring all sections are completed accurately.

- Review the document for any errors or omissions.

- Sign the affidavit in the presence of a notary public to ensure its legal standing.

- Submit the completed affidavit to the appropriate authorities or retain it for personal records.

Legal use of the affidavit of mortgage

The affidavit of mortgage is legally binding once it has been properly executed. It is crucial for establishing the rights of the lender and borrower regarding the mortgage. This document can be used in court to prove the existence of a mortgage and the obligations of the borrower. Additionally, it may be required during the sale of the property or when refinancing the mortgage. Ensuring compliance with local laws and regulations is essential for its enforceability.

Digital vs. paper version of the affidavit of mortgage

Both digital and paper versions of the affidavit of mortgage are legally acceptable, provided they meet the necessary requirements. The digital version offers convenience and efficiency, allowing for quick completion and submission. It is essential, however, to use a secure platform that complies with eSignature laws to ensure the document's legality. The paper version, while traditional, may involve longer processing times and additional steps for notarization. Choosing between the two often depends on personal preference and the specific requirements of the lending institution.

Who issues the affidavit of mortgage

The affidavit of mortgage is typically issued by the borrower or their legal representative. However, it may also be prepared by the lender's legal team or a title company involved in the mortgage process. It is important for the document to be completed accurately and submitted to the appropriate parties, including the lender and any relevant government offices, to ensure it is properly recorded and recognized.

Quick guide on how to complete affidavit of occupancy and financial status missouri

Complete Affidavit Of Occupancy And Financial Status Missouri effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Affidavit Of Occupancy And Financial Status Missouri on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Affidavit Of Occupancy And Financial Status Missouri with ease

- Obtain Affidavit Of Occupancy And Financial Status Missouri and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Affidavit Of Occupancy And Financial Status Missouri and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an affidavit of mortgage?

An affidavit of mortgage is a legal document that states the details of a mortgage agreement. This document serves as proof of the mortgage and outlines the responsibilities of both the borrower and the lender. Using airSlate SignNow, you can easily create and eSign your affidavit of mortgage securely and efficiently.

-

How does airSlate SignNow simplify the affidavit of mortgage process?

airSlate SignNow streamlines the process of signing an affidavit of mortgage by allowing users to send, sign, and manage documents online. The platform eliminates the need for physical paperwork, thereby saving time and enhancing accessibility. With its intuitive interface, creating and handling your affidavit of mortgage becomes quick and straightforward.

-

What are the benefits of using airSlate SignNow for creating an affidavit of mortgage?

Using airSlate SignNow for your affidavit of mortgage offers numerous benefits, including enhanced security, time efficiency, and ease of use. The platform includes features like templates for quick document generation and secure eSigning capabilities. This way, you can ensure that your affidavit of mortgage is both valid and professionally executed.

-

Are there any integrations available for managing an affidavit of mortgage?

Yes, airSlate SignNow offers a variety of integrations that make managing your affidavit of mortgage even easier. You can integrate it with popular business applications such as Google Drive, Dropbox, and more for seamless document management. These integrations enhance your workflow and help keep all your documents organized.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow provides flexible pricing plans to cater to different business needs when it comes to managing documents like an affidavit of mortgage. Whether you're a small business or a large enterprise, you can choose a plan that fits your requirements and budget. You can also opt for a free trial to explore its features before committing to a subscription.

-

Is the affidavit of mortgage legally binding when signed through airSlate SignNow?

Absolutely! An affidavit of mortgage signed through airSlate SignNow is legally binding and compliant with eSignature laws. This means you can confidently execute your mortgage agreement electronically. Additionally, airSlate SignNow provides a detailed audit trail for each signature, further ensuring its legality.

-

Can I edit my affidavit of mortgage after sending it for signatures?

Yes, airSlate SignNow allows you to edit your affidavit of mortgage even after it has been sent for signatures, provided it hasn’t been fully signed yet. This feature enables you to make necessary adjustments quickly without starting from scratch. Simply modify the document and resend it for signatures.

Get more for Affidavit Of Occupancy And Financial Status Missouri

- Sri venkateswara university application for the award of the degree of b svudde form

- Vehicle motor form

- Nomination for family pension form 4

- Clay county fl small claims court law suites form

- Employee election form 441227537

- Njhmfa low income tax credit tenant income self certification njhousing form

- Home health patient tracking sheet home health patient tracking sheet form

- Purchase and sale agreement template form

Find out other Affidavit Of Occupancy And Financial Status Missouri

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form