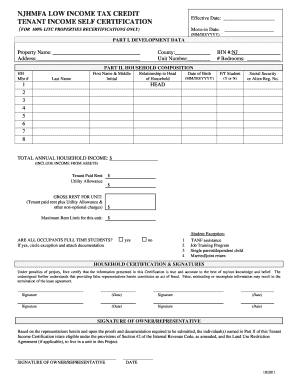

Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing 2011

What is the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing

The Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing is a form used by tenants to certify their income for the purpose of qualifying for low-income housing tax credits. This certification is essential for landlords and property managers to verify that tenants meet the income eligibility requirements set forth by the New Jersey Housing and Mortgage Finance Agency (NJHMFA). By completing this form, tenants provide a declaration of their income, which helps ensure they receive the appropriate tax credits and benefits associated with low-income housing.

Steps to complete the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing

Completing the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing involves several key steps:

- Gather necessary documentation, including proof of income, such as pay stubs, tax returns, or Social Security statements.

- Fill out the form accurately, providing details about your household income and any additional sources of income.

- Review the completed form to ensure all information is correct and complete.

- Sign and date the form to certify that the information provided is true and accurate.

- Submit the form to your landlord or property manager as instructed.

Eligibility Criteria

To qualify for the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing, tenants must meet specific income limits based on household size and the area median income (AMI). The criteria may vary depending on the location and the specific housing program. Generally, households must demonstrate that their income does not exceed the established limits to be eligible for low-income housing benefits. It is crucial for tenants to check the current income limits and requirements for their specific situation.

Required Documents

When completing the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing, tenants must provide various documents to support their income claims. Commonly required documents include:

- Recent pay stubs or wage statements.

- Tax returns from the previous year.

- Social Security or disability income statements.

- Unemployment benefit statements, if applicable.

- Any additional documentation that verifies other sources of income.

How to obtain the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing

The Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing form can typically be obtained from your landlord, property management office, or directly from the New Jersey Housing and Mortgage Finance Agency's website. It is important to ensure that you are using the most current version of the form, as requirements and formats may change over time. If you have difficulty accessing the form, contacting your local housing authority can also provide assistance.

Legal use of the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing

The Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing is a legally binding document. By signing this form, tenants affirm that the information provided is accurate and truthful. Misrepresentation or failure to disclose complete income information can result in penalties, including loss of housing benefits or legal action. It is essential for tenants to understand the legal implications of submitting this certification and to ensure that all information is reported honestly.

Quick guide on how to complete njhmfa low income tax credit tenant income self certification njhousing

Complete Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing effortlessly on any device

Web-based document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

How to modify and eSign Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing with ease

- Find Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing and ensure superior communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct njhmfa low income tax credit tenant income self certification njhousing

Create this form in 5 minutes!

How to create an eSignature for the njhmfa low income tax credit tenant income self certification njhousing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing?

The Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing is a program designed to assist low-income tenants in signNowing their income for tax credit purposes. This self-certification process simplifies the documentation required for tenants, making it easier for them to access financial assistance and housing benefits.

-

How can airSlate SignNow help with the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing?

airSlate SignNow provides an efficient platform for tenants to complete and eSign their Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing documents. Our user-friendly interface ensures that the process is quick and straightforward, allowing tenants to focus on their housing needs rather than paperwork.

-

What are the pricing options for using airSlate SignNow for Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing?

airSlate SignNow offers competitive pricing plans that cater to various needs, including individual users and businesses. Our plans are designed to be cost-effective, ensuring that tenants and property managers can easily access the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing services without breaking the bank.

-

What features does airSlate SignNow offer for the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all tailored to streamline the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing process. These features enhance efficiency and ensure that all necessary documentation is completed accurately and promptly.

-

Are there any benefits to using airSlate SignNow for the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing?

Using airSlate SignNow for the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing offers numerous benefits, including reduced processing time and improved accuracy. Tenants can complete their certifications from anywhere, making it a convenient solution for busy individuals seeking financial assistance.

-

Can airSlate SignNow integrate with other tools for managing Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing?

Yes, airSlate SignNow can integrate with various tools and platforms to enhance the management of the Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing process. This integration capability allows users to streamline workflows and improve overall efficiency in handling tenant documentation.

-

Is airSlate SignNow secure for handling Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing documents are protected. Our platform uses advanced encryption and security protocols to safeguard sensitive information throughout the signing process.

Get more for Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing

Find out other Njhmfa Low Income Tax Credit Tenant Income Self Certification Njhousing

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy