Living Trust Individual Form

What is the Living Trust Individual

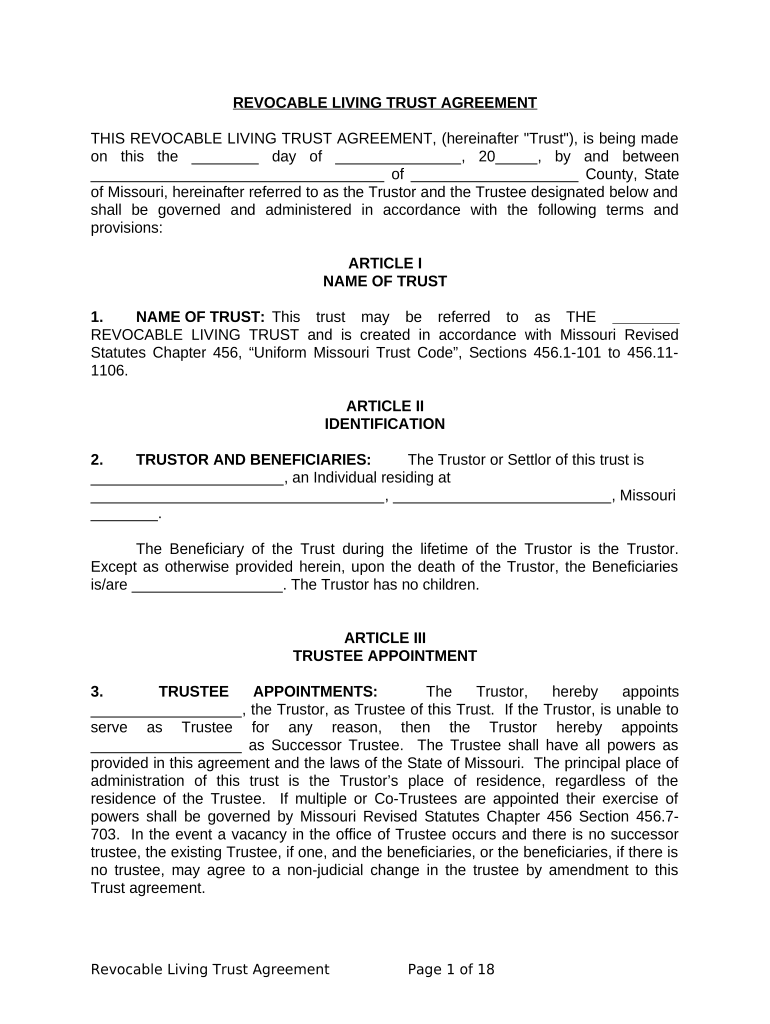

A living trust individual is a legal document that allows a person to manage their assets during their lifetime and specify how those assets will be distributed after their death. This form is particularly useful for individuals who want to avoid probate, maintain privacy regarding their estate, and ensure a smooth transition of their assets to beneficiaries. The trust is revocable, meaning the individual can modify or revoke it at any time while they are alive.

How to use the Living Trust Individual

Using a living trust individual involves several steps. First, the individual must gather information about their assets, including real estate, bank accounts, and investments. Next, they will need to decide who will serve as the trustee, responsible for managing the trust. The individual then completes the living trust document, outlining how assets will be managed and distributed. Once the document is signed and notarized, assets should be transferred into the trust to ensure they are covered by its terms.

Steps to complete the Living Trust Individual

Completing the living trust individual form involves a series of clear steps:

- Identify and list all assets to be included in the trust.

- Select a trustee, who can be the individual themselves or another trusted person.

- Draft the living trust document, specifying all terms and conditions.

- Sign the document in the presence of a notary public to ensure its legal validity.

- Transfer ownership of assets into the trust, which may require additional paperwork for real estate or financial accounts.

Legal use of the Living Trust Individual

The legal use of a living trust individual is governed by state laws, which can vary significantly. Generally, the trust must be created in writing and signed by the individual in the presence of a notary. It is crucial to ensure that the trust complies with state-specific regulations to be legally recognized. Additionally, the trust should be properly funded by transferring assets into it, as unfunded trusts may not serve their intended purpose.

Key elements of the Living Trust Individual

Key elements of a living trust individual include:

- Grantor: The person who creates the trust and transfers assets into it.

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or organizations designated to receive the trust assets upon the grantor's death.

- Terms of the trust: Specific instructions on how assets are to be managed and distributed.

State-specific rules for the Living Trust Individual

Each state has its own regulations governing living trusts. It is essential to understand these rules, as they can affect the validity and execution of the trust. Some states may require specific language in the trust document or have particular procedures for funding the trust. Consulting with a legal professional familiar with state laws can help ensure compliance and proper setup.

Quick guide on how to complete living trust individual

Effortlessly Prepare Living Trust Individual on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage Living Trust Individual on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Easiest Way to Modify and eSign Living Trust Individual Effortlessly

- Find Living Trust Individual and click on Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize important sections of your documents or obscure confidential information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just a few seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form efforts, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs within just a few clicks from any device you choose. Modify and eSign Living Trust Individual and guarantee effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust individual?

A living trust individual is a legal document that allows you to manage your assets during your lifetime and outline how they will be distributed after your death. This type of trust can help avoid probate, making the transfer of your assets simpler and faster for your beneficiaries.

-

How can an individual create a living trust?

Creating a living trust individual involves drafting the trust document and designating a trustee. You can do this through legal assistance or by using online tools like airSlate SignNow, which provides customizable templates to streamline the process.

-

What are the benefits of using a living trust individual?

A living trust individual helps you maintain control of your assets while providing guidance on their distribution after your passing. It also helps avoid the lengthy probate process, offering privacy and ensuring that your wishes are followed without court intervention.

-

How much does it cost to set up a living trust individual?

The cost to set up a living trust individual can vary widely based on whether you use an attorney or an online service. With airSlate SignNow, you can access cost-effective solutions that simplify the document preparation process, providing great value for your investment.

-

Can a living trust individual be changed after it's created?

Yes, a living trust individual can be modified or revoked at any time while you are alive and mentally competent. This flexibility allows you to adjust the trust to reflect your changing circumstances, such as the addition of new assets or changes in beneficiaries.

-

Does a living trust individual require ongoing management?

Yes, managing a living trust individual involves keeping the assets accurately documented and ensuring that any changes in ownership are appropriately recorded. Using airSlate SignNow enables easy access to your documents, making management more straightforward and efficient.

-

How does a living trust individual differ from a will?

A living trust individual differs from a will in that it takes effect during your lifetime, allowing for immediate management of your assets, whereas a will only goes into effect after your death. Additionally, a living trust avoids probate, which can save time and costs for your beneficiaries.

Get more for Living Trust Individual

- Standard release form for video

- Convert to word form

- Reynolds oven bag cooking chart form

- Tripartite agreement for axis bank builder a form

- Report list of unserviced preneed funeal contracts georgia form

- Dc rental application form

- Maintenance service agreement template form

- Managed service agreement template form

Find out other Living Trust Individual

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template