Affidavit in Support of Default Regarding Tax Sale Mississippi Form

What is the Affidavit In Support Of Default Regarding Tax Sale Mississippi

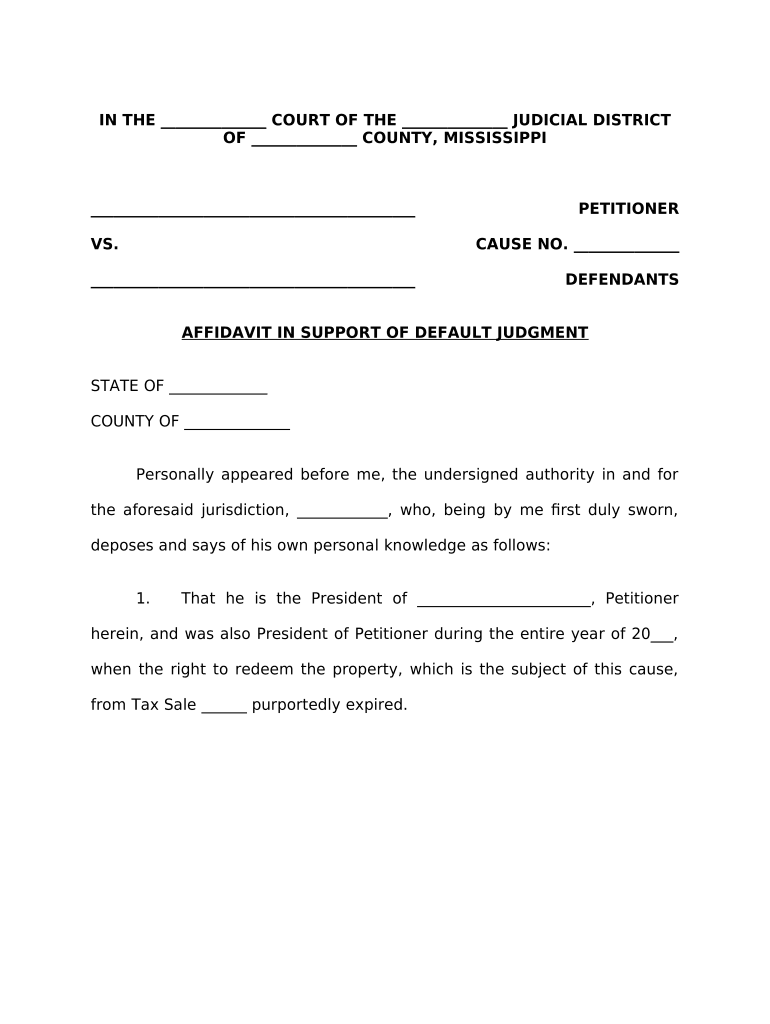

The Affidavit In Support Of Default Regarding Tax Sale Mississippi is a legal document used in the context of property tax sales in the state of Mississippi. This affidavit serves to affirm that a property owner has defaulted on their tax obligations, leading to the potential sale of their property. It is a crucial step in the legal process, as it provides the necessary evidence for the court or relevant authorities to proceed with the tax sale. This document must be completed accurately to ensure compliance with state laws and regulations.

Steps to Complete the Affidavit In Support Of Default Regarding Tax Sale Mississippi

Completing the Affidavit In Support Of Default Regarding Tax Sale Mississippi involves several important steps:

- Gather necessary information about the property, including the address and tax identification number.

- Clearly state the reasons for the default, including any relevant dates and amounts owed.

- Provide your personal information, including your name, address, and relationship to the property.

- Sign the affidavit in the presence of a notary public to ensure its legal validity.

- Submit the completed affidavit to the appropriate local government office or court.

Legal Use of the Affidavit In Support Of Default Regarding Tax Sale Mississippi

The legal use of the Affidavit In Support Of Default Regarding Tax Sale Mississippi is essential for ensuring that the tax sale process adheres to state laws. This affidavit must be filed in accordance with Mississippi statutes regarding property tax sales. It serves as a formal declaration that the property owner has failed to meet their tax obligations, which is necessary for the initiation of the tax sale proceedings. Proper legal use also includes ensuring that the affidavit is notarized and submitted within the required timeframes.

Key Elements of the Affidavit In Support Of Default Regarding Tax Sale Mississippi

Several key elements must be included in the Affidavit In Support Of Default Regarding Tax Sale Mississippi to ensure its effectiveness:

- Property Information: Accurate details about the property, including its legal description.

- Tax Information: Specifics about the tax default, including the amount owed and due dates.

- Affiant Information: The name and contact information of the individual completing the affidavit.

- Notary Acknowledgment: A section for a notary public to verify the identity of the affiant and witness the signing.

State-Specific Rules for the Affidavit In Support Of Default Regarding Tax Sale Mississippi

Mississippi has specific rules governing the use of the Affidavit In Support Of Default Regarding Tax Sale. These rules dictate how the affidavit should be structured, the information required, and the timeline for submission. It is important to adhere to these regulations to avoid potential legal issues. For instance, the affidavit must be filed within a certain period following the tax default, and failure to comply with these rules may result in delays or dismissal of the tax sale process.

Form Submission Methods for the Affidavit In Support Of Default Regarding Tax Sale Mississippi

The Affidavit In Support Of Default Regarding Tax Sale Mississippi can be submitted through various methods, depending on local regulations:

- In-Person: Many individuals choose to submit the affidavit directly to the local tax collector's office or court.

- By Mail: The affidavit can often be mailed to the appropriate office, but it is important to check for specific mailing addresses and requirements.

- Online: Some jurisdictions may offer online submission options, allowing for a more convenient and faster process.

Quick guide on how to complete affidavit in support of default regarding tax sale mississippi

Complete Affidavit In Support Of Default Regarding Tax Sale Mississippi seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a great environmentally friendly substitute for conventional physical and signed paperwork, allowing you to locate the necessary template and securely preserve it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and electronically sign your documents quickly without delays. Handle Affidavit In Support Of Default Regarding Tax Sale Mississippi on any gadget using the airSlate SignNow apps for Android or iOS and streamline your document-related workflow today.

How to modify and eSign Affidavit In Support Of Default Regarding Tax Sale Mississippi with ease

- Locate Affidavit In Support Of Default Regarding Tax Sale Mississippi and click Get Form to commence.

- Utilize the tools available to complete your document.

- Mark pertinent sections of your documents or redact sensitive information with the tools airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes a few moments and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Affidavit In Support Of Default Regarding Tax Sale Mississippi and ensure effective communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Affidavit In Support Of Default Regarding Tax Sale Mississippi?

An Affidavit In Support Of Default Regarding Tax Sale Mississippi is a legal document used to assert the default status of a property owner in relation to tax sales. It serves to formalize the claims and can be vital in legal proceedings. Understanding its purpose can help you navigate tax-related issues more effectively.

-

How can airSlate SignNow assist with the Affidavit In Support Of Default Regarding Tax Sale Mississippi?

airSlate SignNow simplifies the process of creating and signing an Affidavit In Support Of Default Regarding Tax Sale Mississippi. Our platform allows users to easily customize the affidavit, collect electronic signatures, and store documents securely. This efficient workflow saves time and enhances compliance with legal requirements.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a user-friendly interface, customizable templates, and secure eSigning capabilities specifically for documents like the Affidavit In Support Of Default Regarding Tax Sale Mississippi. Additional features include real-time tracking, collaboration tools, and integrations with various business applications. These tools ensure seamless document management.

-

Is airSlate SignNow cost-effective for small businesses needing an Affidavit In Support Of Default Regarding Tax Sale Mississippi?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage affidavits and other documents. Our pricing plans are designed to accommodate businesses of all sizes, providing value without compromising on features. You can access affordable plans to efficiently handle your Affidavit In Support Of Default Regarding Tax Sale Mississippi needs.

-

What benefits does using airSlate SignNow provide for legal documents?

Using airSlate SignNow for legal documents like the Affidavit In Support Of Default Regarding Tax Sale Mississippi enhances efficiency and accuracy. Our platform reduces the turnaround time for document processing and ensures that all signatures are secure and compliant. This allows you to focus on other important legal matters with peace of mind.

-

Can I integrate airSlate SignNow with other software for managing affidavits?

Absolutely! airSlate SignNow offers integrations with various business software, making it easy to manage your Affidavit In Support Of Default Regarding Tax Sale Mississippi alongside other tools you may already use. This flexibility streamlines processes and improves productivity across your workflow.

-

How secure is airSlate SignNow for handling sensitive legal documents?

Security is a top priority for airSlate SignNow. We implement robust security measures, including data encryption and secure cloud storage, to protect your Affidavit In Support Of Default Regarding Tax Sale Mississippi. You can trust that your documents and sensitive information are safe with us.

Get more for Affidavit In Support Of Default Regarding Tax Sale Mississippi

- Affidavit bc form

- Printable calpers self recipricial form

- Application for financial assistance mountain states health alliance form

- Signia earmold order form 405049044

- Kindergarten student information form

- Ghana passport application forms apply inghana

- Replacement ssc returning error ampquotthe drivers license or form

- Vehicle accident reporting proceduresrisk management form

Find out other Affidavit In Support Of Default Regarding Tax Sale Mississippi

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document