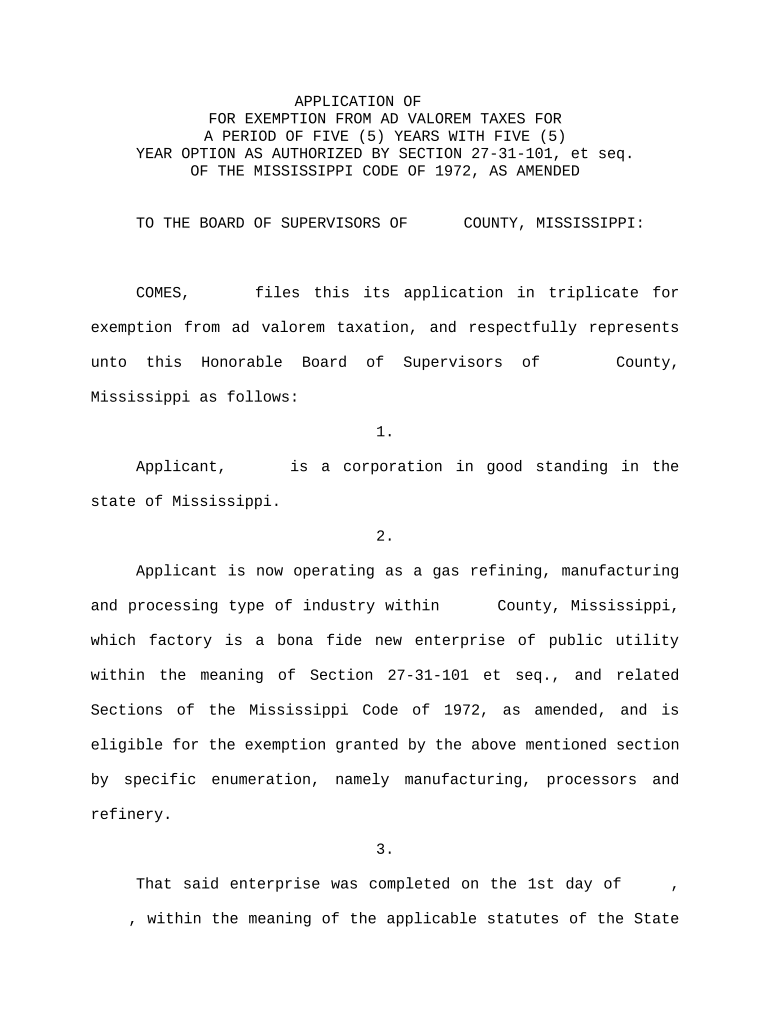

Ad Valorem Form

What is the Ad Valorem?

The term "Ad Valorem" refers to a type of tax based on the assessed value of an item, typically real estate or personal property. This tax is calculated as a percentage of the value of the property, making it a significant source of revenue for local governments. In the context of the Mississippi exemption file, understanding ad valorem taxes is crucial for property owners seeking to benefit from exemptions that can reduce their tax burden.

Steps to complete the Ad Valorem

Completing the ad valorem application requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including proof of ownership and any prior tax assessments.

- Fill out the Mississippi exemption application form accurately, ensuring all fields are completed.

- Attach supporting documentation that verifies eligibility for the exemption.

- Review the completed application for accuracy and completeness.

- Submit the application through the preferred method, which may include online submission, mailing, or in-person delivery.

Legal use of the Ad Valorem

The legal framework surrounding ad valorem taxes is established by state law, which dictates how these taxes are assessed and collected. In Mississippi, property owners must comply with specific regulations to qualify for exemptions. Utilizing the ms exemption file correctly ensures that the application is legally binding and meets all necessary requirements. Failure to adhere to these regulations may result in penalties or denial of the exemption.

Eligibility Criteria

To qualify for the Mississippi exemption, applicants must meet certain eligibility criteria. Typically, these criteria include:

- Ownership of the property for which the exemption is being sought.

- Use of the property as a primary residence.

- Meeting any income limitations set forth by state regulations.

- Filing the application within the designated timeframe.

Required Documents

When applying for the ms exemption file, several documents are typically required to support the application. These may include:

- Proof of property ownership, such as a deed or title.

- Previous tax bills or assessments.

- Identification documents to verify the applicant's identity.

- Any additional documentation that demonstrates eligibility for the exemption.

Form Submission Methods

Submitting the ms exemption file can be done through various methods, allowing flexibility for applicants. The available submission methods typically include:

- Online submission through the state’s tax website.

- Mailing the completed application to the appropriate local tax office.

- In-person submission at designated tax offices, ensuring direct communication with officials.

Who Issues the Form

The ms exemption file is issued by the local tax assessor's office in Mississippi. Each county may have its own procedures and requirements for processing exemption applications. It is essential for applicants to contact their local office for specific instructions and to ensure compliance with county regulations regarding ad valorem taxes.

Quick guide on how to complete ad valorem

Effortlessly Prepare Ad Valorem on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents promptly without delays. Manage Ad Valorem on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to Amend and eSign Ad Valorem Effortlessly

- Find Ad Valorem and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finish button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, annoying form searches, or mistakes that require creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ad Valorem to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an ms exemption file and how does it work?

An ms exemption file is a specific document that businesses can use to claim exemption from certain taxes or regulations. With airSlate SignNow, you can easily create, send, and eSign your ms exemption file, ensuring that all necessary parties have acknowledged and approved it securely and efficiently.

-

How can airSlate SignNow help with managing ms exemption files?

AirSlate SignNow simplifies the process of managing ms exemption files by allowing you to create templates, track document status, and store files securely in the cloud. Our platform ensures that you can access and share your ms exemption file anytime, enhancing your workflow and reducing administrative burdens.

-

What features are included for ms exemption file management?

When using airSlate SignNow for your ms exemption file, you benefit from customizable templates, seamless eSigning capabilities, automated workflows, and advanced security features. These tools provide a comprehensive solution for handling your ms exemption file with ease and confidence.

-

Is there a free trial available for using the ms exemption file features?

Yes, airSlate SignNow offers a free trial that allows you to test all the features related to ms exemption files without any commitment. During the trial, you can explore eSigning, template creation, and document management features to see how they can benefit your business.

-

Can I integrate airSlate SignNow with other applications for ms exemption file processing?

Absolutely! airSlate SignNow provides integrations with various applications such as Google Drive, Salesforce, and Microsoft Office to streamline the processing of your ms exemption files. This integration capability allows you to enhance your existing workflows and ensures data consistency across platforms.

-

What security measures does airSlate SignNow have for ms exemption files?

AirSlate SignNow employs industry-leading security measures for your ms exemption files, including data encryption, secure cloud storage, and compliance with regulatory standards. We prioritize the safety of your sensitive documents by ensuring secure eSigning and sharing processes.

-

What are the pricing plans for using airSlate SignNow for ms exemption files?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes looking to manage ms exemption files efficiently. You can choose a plan that fits your organization's needs, and we often provide discounts for annual subscriptions.

Get more for Ad Valorem

- Timberhills hoa form

- Form 807 5494289

- Vehicle insurance making a claim if you re in an accident citizens form

- Monthly probe thermometer check fill out ampamp sign online form

- Insure and go claim form

- Bradford leisure card application form

- Ybs 0778logo indd yorkshire building society ybs co form

- Consultation feedback form

Find out other Ad Valorem

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure