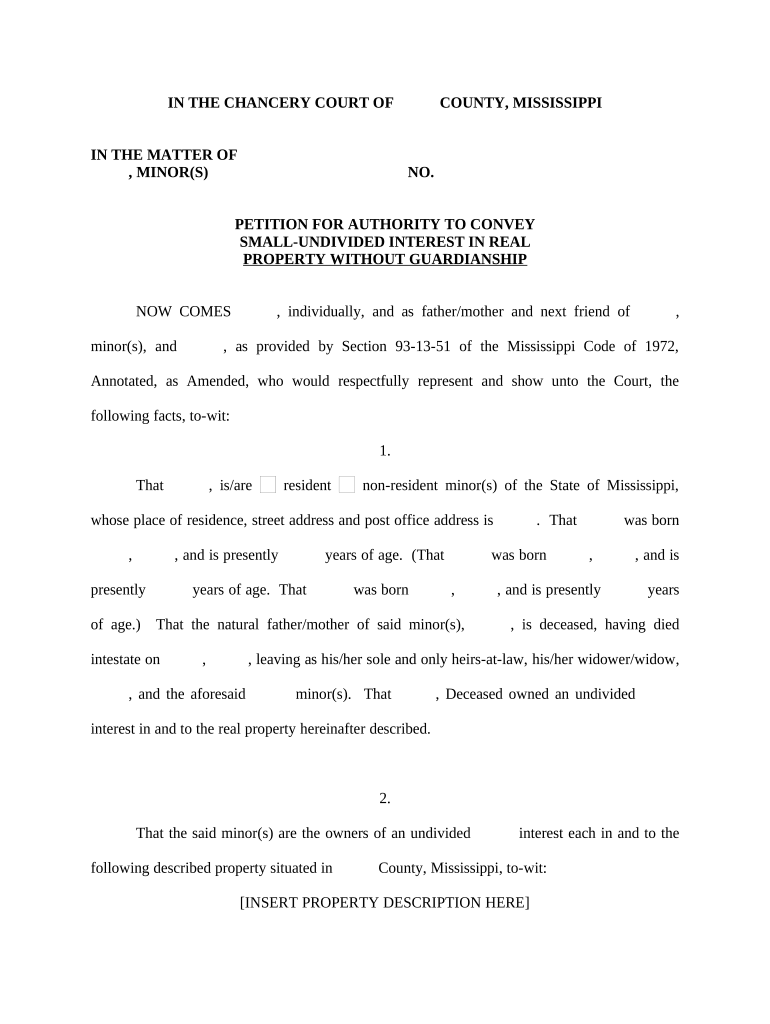

Undivided Interest Property Form

What is the Undivided Interest Property

The undivided interest property refers to a shared ownership arrangement where multiple parties hold a collective interest in a single property. Each owner has the right to use and enjoy the property, but no single owner can claim exclusive rights to any specific portion. This type of ownership is common in real estate, particularly in situations like family inheritances or partnerships. Understanding the implications of undivided interest is crucial for all parties involved, especially regarding rights, responsibilities, and potential disputes.

How to use the Undivided Interest Property

Utilizing undivided interest property involves several key considerations. Owners must communicate effectively to manage the property and make decisions regarding its use. This can include maintenance, rental agreements, or selling the property. It is essential to establish clear agreements among co-owners to avoid conflicts. Documenting decisions and maintaining transparent communication can help ensure a harmonious co-ownership experience.

Key elements of the Undivided Interest Property

Several critical elements define undivided interest property. These include:

- Shared Ownership: All owners possess an equal right to the entire property, not just a specific portion.

- Usage Rights: Each owner can use the property, but usage should be coordinated to respect the rights of others.

- Decision-Making: Major decisions regarding the property typically require consensus among all owners.

- Financial Responsibilities: Owners must share costs related to maintenance, taxes, and other expenses associated with the property.

Steps to complete the Undivided Interest Property

Completing the necessary documentation for undivided interest property involves several steps:

- Gather all relevant information about the property and the owners.

- Draft a co-ownership agreement that outlines the rights and responsibilities of each owner.

- Ensure all owners review and agree to the terms of the agreement.

- Sign the agreement in the presence of a notary public to enhance its legal standing.

- File any necessary documents with local authorities, if required, to formalize the ownership structure.

Legal use of the Undivided Interest Property

The legal use of undivided interest property is governed by state laws, which can vary significantly. It is essential to understand the legal framework surrounding shared ownership in your state. This includes knowledge of property rights, transferability of interest, and dispute resolution mechanisms. Consulting with a legal professional can provide clarity on the specific laws applicable to undivided interest property in your jurisdiction.

State-specific rules for the Undivided Interest Property

Each state in the U.S. has unique regulations governing undivided interest property. These rules can affect how property is managed, how disputes are resolved, and the rights of co-owners. For example, some states may require specific documentation to be filed when establishing co-ownership, while others may have different laws regarding the sale or transfer of interest. Understanding these state-specific rules is vital for ensuring compliance and protecting the interests of all parties involved.

Quick guide on how to complete undivided interest property

Prepare Undivided Interest Property effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Undivided Interest Property on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Undivided Interest Property without hassle

- Locate Undivided Interest Property and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from your preferred device. Modify and eSign Undivided Interest Property and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow for managing Mississippi interest?

airSlate SignNow offers a range of features tailored to manage Mississippi interest, including document templates, real-time collaboration, and secure eSignature options. These features ensure that businesses can efficiently handle agreements related to interest calculations without any hassle.

-

How does airSlate SignNow ensure compliance with Mississippi interest regulations?

airSlate SignNow is designed with compliance in mind, helping businesses adhere to Mississippi interest regulations. Our platform incorporates legally binding eSignatures and maintains an audit trail, ensuring that all signed documents meet the legal standards set forth by Mississippi law.

-

What pricing plans are available for businesses wanting to manage Mississippi interest documents?

We offer a variety of pricing plans to suit different business needs for managing Mississippi interest documents. Our cost-effective solutions allow businesses of all sizes to choose a plan that best fits their requirements while providing access to all essential features.

-

Can airSlate SignNow integrate with my existing tools for processing Mississippi interest?

Yes, airSlate SignNow seamlessly integrates with various applications that businesses already use for processing Mississippi interest. This interoperability allows you to connect your existing workflow tools, enhancing productivity and saving time in document management processes.

-

What benefits does airSlate SignNow provide for managing Mississippi interest agreements?

By using airSlate SignNow, businesses can streamline their operations related to Mississippi interest agreements. The platform enhances efficiency through easy document creation, automated workflows, and timely notifications, allowing for faster completion of agreements.

-

Is there customer support available for inquiries related to Mississippi interest?

Absolutely! Our dedicated customer support team is available to assist with any questions or concerns regarding Mississippi interest. Whether you need help with features or pricing, we are here to ensure you have a smooth experience with airSlate SignNow.

-

How secure is airSlate SignNow for handling documents with Mississippi interest?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like those related to Mississippi interest. Our platform employs advanced encryption methods and complies with industry standards to safeguard all your data and transactions.

Get more for Undivided Interest Property

Find out other Undivided Interest Property

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe