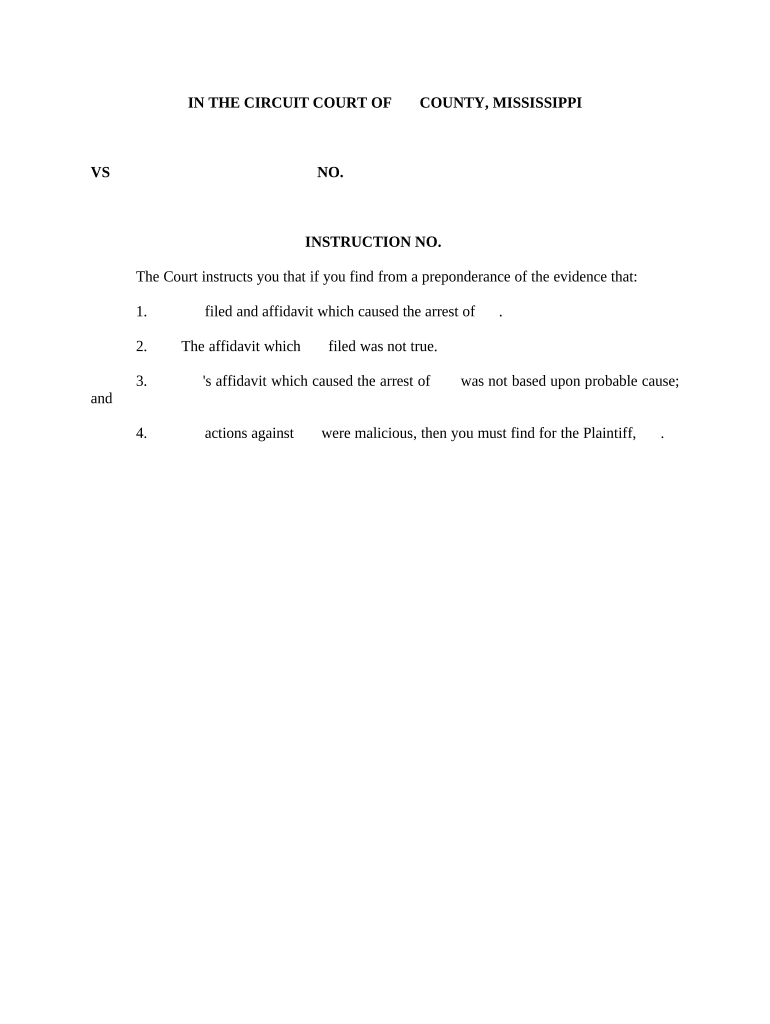

Instruction No Mississippi Form

What makes the instruction no mississippi form legally binding?

Because the society ditches office work, the execution of documents more and more occurs electronically. The instruction no mississippi form isn’t an exception. Working with it using electronic tools differs from doing so in the physical world.

An eDocument can be viewed as legally binding on condition that particular requirements are met. They are especially critical when it comes to stipulations and signatures associated with them. Typing in your initials or full name alone will not ensure that the organization requesting the sample or a court would consider it performed. You need a trustworthy solution, like airSlate SignNow that provides a signer with a electronic certificate. Furthermore, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your instruction no mississippi form when completing it online?

Compliance with eSignature laws is only a portion of what airSlate SignNow can offer to make form execution legal and secure. It also offers a lot of opportunities for smooth completion security smart. Let's quickly run through them so that you can be assured that your instruction no mississippi form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: major privacy regulations in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties identities through additional means, such as a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the information safely to the servers.

Filling out the instruction no mississippi form with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete instruction no mississippi

Effortlessly prepare instruction no mississippi form on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without any holdups. Manage instruction no mississippi form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign instruction no mississippi form effortlessly

- Locate instruction no mississippi form and then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize relevant portions of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs within just a few clicks from any chosen device. Modify and eSign instruction no mississippi form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Instruction No Mississippi Form

Instructions and help about Instruction No Mississippi

Related searches to Instruction No Mississippi

Create this form in 5 minutes!

People also ask

-

What is Instruction No Mississippi in the context of airSlate SignNow?

Instruction No Mississippi refers to the specific guidelines or templates for electronically signing documents within the state of Mississippi using airSlate SignNow. This feature ensures that all eSignatures comply with local laws and regulations, making it a reliable choice for businesses operating in the state.

-

How much does it cost to use airSlate SignNow for Instruction No Mississippi?

The pricing for airSlate SignNow varies depending on the subscription plan you choose. For businesses focused on Instruction No Mississippi, we offer competitive pricing that scales according to the number of users and features needed, ensuring an economical solution for document management.

-

What features does airSlate SignNow offer for users focusing on Instruction No Mississippi?

airSlate SignNow provides essential features tailored for Instruction No Mississippi, including customizable templates, bulk sending options, and detailed audit trails for enhanced compliance. These tools empower businesses to manage their document signing processes efficiently and securely.

-

What are the benefits of using airSlate SignNow for Instruction No Mississippi?

By choosing airSlate SignNow for Instruction No Mississippi, businesses gain a cost-effective solution that simplifies the eSigning process while ensuring legal compliance. The platform enhances workflow efficiency, reduces turnaround time, and minimizes the environmental impact of printing and mailing documents.

-

Can I integrate airSlate SignNow with other applications for Instruction No Mississippi?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems, document storage solutions, and more. This capability enables organizations to streamline their workflow while focusing on Instruction No Mississippi and improving overall productivity.

-

Is airSlate SignNow compliant with Mississippi state laws regarding electronic signatures?

Absolutely! airSlate SignNow fully complies with Mississippi's laws surrounding electronic signatures, including the requirements outlined under Instruction No Mississippi. You can trust that your documents will meet all necessary legal standards for eSigning in the state.

-

Does airSlate SignNow provide support for users dealing with Instruction No Mississippi?

Yes, airSlate SignNow provides dedicated customer support to assist users with any questions related to Instruction No Mississippi. Our support team is always ready to help you navigate the platform and ensure you utilize all the features effectively.

Get more for Instruction No Mississippi

- Pakistan deposit form

- Company declaration form propertymark co

- Efficiency discipline accountability act form

- Cz 50 declaration form

- Wwwcbpgovtradebasic import exportexporting a motor vehicleus customs and border protection form

- Social sciences quaid i azam university islamabad pakistan qau form

- Microsoft office excel kod klavuzu file extension types and form

- Web access form 2

Find out other Instruction No Mississippi

- Electronic signature Idaho Finance & Tax Accounting Job Offer Secure

- Electronic signature Idaho Finance & Tax Accounting Job Offer Fast

- Electronic signature Idaho Finance & Tax Accounting Job Offer Simple

- Electronic signature Idaho Finance & Tax Accounting Job Offer Easy

- How Do I Electronic signature Idaho Finance & Tax Accounting Bill Of Lading

- Electronic signature Idaho Finance & Tax Accounting Job Offer Safe

- Help Me With Electronic signature Idaho Finance & Tax Accounting Bill Of Lading

- How Can I Electronic signature Idaho Finance & Tax Accounting Bill Of Lading

- Electronic signature Government Word Kansas Online

- Electronic signature Government Word Kansas Computer

- Can I Electronic signature Idaho Finance & Tax Accounting Bill Of Lading

- How To Electronic signature Idaho Finance & Tax Accounting Job Offer

- Electronic signature Government Word Kansas Mobile

- Electronic signature Government Word Kansas Now

- Electronic signature Government Word Kansas Later

- Electronic signature Government Word Kansas Myself

- How Do I Electronic signature Idaho Finance & Tax Accounting Job Offer

- Electronic signature Government Word Kansas Free

- Electronic signature Government Word Kansas Secure

- Electronic signature Government Word Kansas Fast