Chapter 13 Plan Mississippi Form

What is the Chapter 13 Plan Mississippi

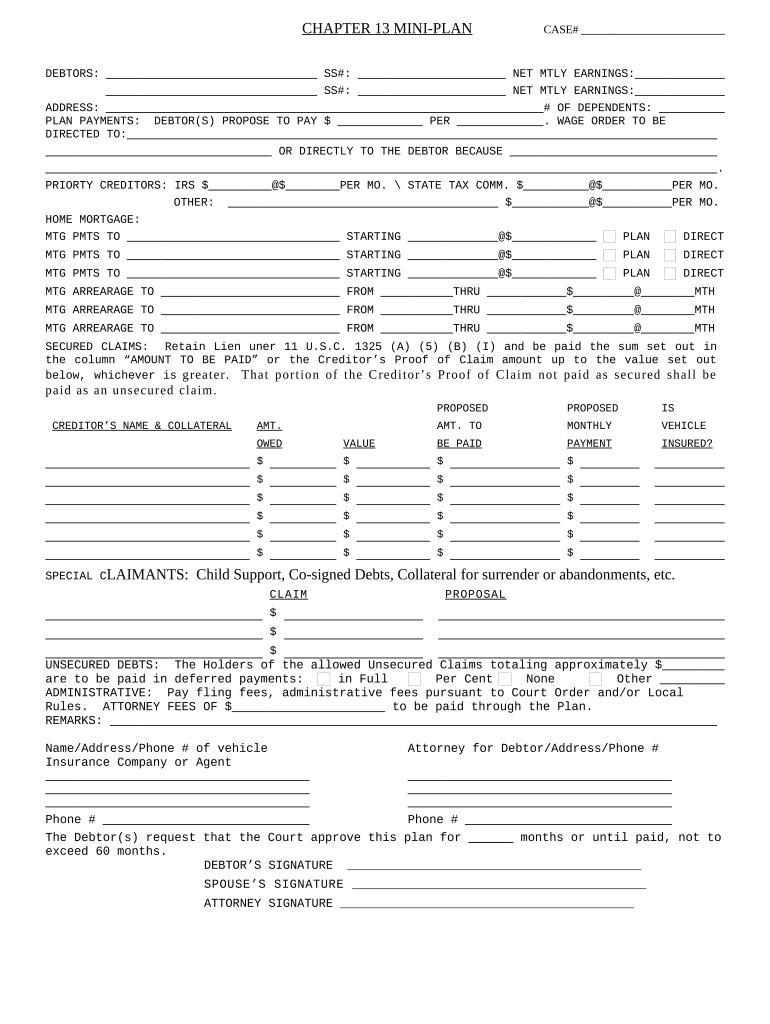

The Chapter 13 Plan in Mississippi is a legal framework designed for individuals who are struggling with debt but wish to retain their assets while repaying creditors over a specified period. This plan allows debtors to propose a repayment schedule that lasts three to five years, depending on their income and financial situation. It is particularly beneficial for those who have a regular income and want to avoid foreclosure on their homes or repossession of their vehicles.

How to use the Chapter 13 Plan Mississippi

To effectively use the Chapter 13 Plan in Mississippi, individuals must first file a petition with the bankruptcy court. This petition includes detailed information about their income, expenses, debts, and assets. After filing, the court will schedule a meeting of creditors, where the debtor must present their repayment plan. It is crucial to adhere to the terms of the plan and make regular payments to the bankruptcy trustee, who will distribute the funds to creditors according to the plan's stipulations.

Steps to complete the Chapter 13 Plan Mississippi

Completing the Chapter 13 Plan involves several key steps:

- Gather financial documents, including income statements, tax returns, and a list of debts and assets.

- Consult with a qualified bankruptcy attorney to draft a repayment plan that meets legal requirements and addresses your financial situation.

- File the Chapter 13 petition with the appropriate bankruptcy court in Mississippi.

- Attend the meeting of creditors and present your repayment plan for approval.

- Make regular payments to the bankruptcy trustee as outlined in the approved plan.

Legal use of the Chapter 13 Plan Mississippi

The legal use of the Chapter 13 Plan in Mississippi is governed by federal bankruptcy laws, which provide a structured process for individuals to reorganize their debts. To ensure compliance, debtors must follow specific procedures, including timely filing of documents and adherence to the repayment schedule. Failure to comply with the plan's terms can result in dismissal of the bankruptcy case or conversion to Chapter 7 bankruptcy, which may lead to liquidation of assets.

Key elements of the Chapter 13 Plan Mississippi

Key elements of the Chapter 13 Plan include:

- The proposed repayment amount and duration, typically spanning three to five years.

- Classification of debts into secured and unsecured categories, determining how each type will be treated.

- Provisions for maintaining secured assets, such as homes and vehicles, while repaying creditors.

- Requirements for regular payments to the bankruptcy trustee, who oversees the distribution of funds to creditors.

Eligibility Criteria

To qualify for the Chapter 13 Plan in Mississippi, individuals must meet specific eligibility criteria, including:

- Having a regular income that enables them to make monthly payments to the bankruptcy trustee.

- Debt limits, which must not exceed certain thresholds for unsecured and secured debts.

- Filing the necessary documentation and forms accurately and on time.

Quick guide on how to complete chapter 13 plan mississippi

Effortlessly Prepare Chapter 13 Plan Mississippi on Any Device

Digital document management has become increasingly popular with businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Chapter 13 Plan Mississippi on any device using the airSlate SignNow applications for Android or iOS and simplify any document-centric process today.

Edit and eSign Chapter 13 Plan Mississippi with Ease

- Find Chapter 13 Plan Mississippi and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Chapter 13 Plan Mississippi to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Chapter 13 Plan Mississippi?

A Chapter 13 Plan Mississippi is a legal framework that allows individuals with a regular income to restructure their debts and repay them over a period of time, usually three to five years. This plan is designed for those who want to avoid foreclosure and reclaim their financial stability. By opting for a Chapter 13 Plan, residents can manage their debt while still maintaining their assets.

-

How does airSlate SignNow support the Chapter 13 Plan Mississippi process?

airSlate SignNow simplifies the Chapter 13 Plan Mississippi process by allowing users to easily prepare, send, and eSign the necessary documents online. The platform creates a seamless workflow that ensures all stakeholders can collaborate effectively. By using airSlate SignNow, individuals can manage their documentation with confidence and efficiency.

-

What are the costs associated with a Chapter 13 Plan Mississippi?

The costs for a Chapter 13 Plan Mississippi can vary based on a variety of factors including income, the total amount of debt, and attorney fees. Typically, individuals will have a repayment plan that allows them to pay off their debts over three to five years. Investing in services like airSlate SignNow can further reduce administrative costs by streamlining document management.

-

Does airSlate SignNow offer any features specifically for Chapter 13 Plan Mississippi users?

Yes, airSlate SignNow provides features tailored for those handling Chapter 13 Plan Mississippi documents, including customizable templates and secure eSigning. This allows users to ensure their legal documents are compliant and easily accessible. These features support efficiency and accuracy during the filing and repayment process.

-

What are the benefits of using airSlate SignNow for my Chapter 13 Plan Mississippi?

Using airSlate SignNow for your Chapter 13 Plan Mississippi can save you time and reduce stress during a complicated process. The platform offers an easy-to-use interface and reliable security to ensure your documents remain confidential. Additionally, by allowing for electronic signatures, you can expedite the timeline for submitting your plan.

-

Can I integrate airSlate SignNow with other tools for managing my Chapter 13 Plan Mississippi?

Absolutely, airSlate SignNow offers various integrations that can enhance the management of your Chapter 13 Plan Mississippi. Whether it's connecting to your financial software or a CRM system, airSlate SignNow ensures that your documents are easily shared and collaborated on. This flexibility supports a more comprehensive approach to handling your financial plans.

-

How secure is airSlate SignNow when handling my Chapter 13 Plan Mississippi documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents related to your Chapter 13 Plan Mississippi. The platform utilizes advanced encryption and security protocols to protect your documents from unauthorized access. You can trust that your information is safe while using airSlate SignNow for your legal documentation needs.

Get more for Chapter 13 Plan Mississippi

Find out other Chapter 13 Plan Mississippi

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document