Non Foreign Affidavit under IRC 1445 Mississippi Form

What is the Non Foreign Affidavit Under IRC 1445 Mississippi

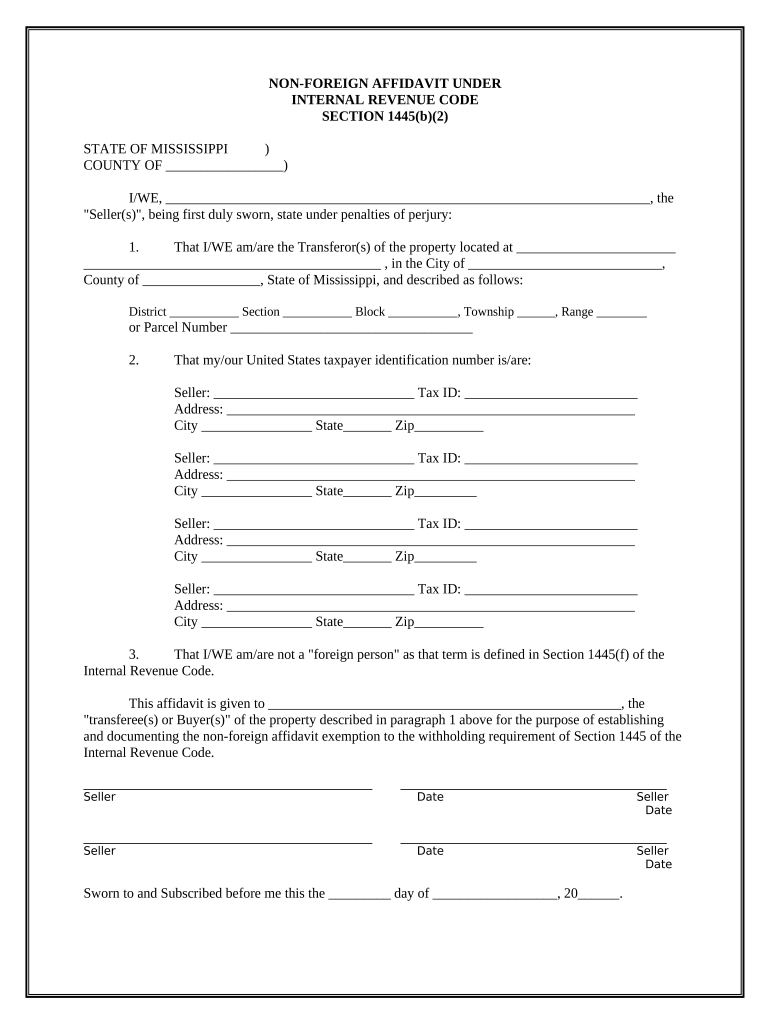

The Non Foreign Affidavit Under IRC 1445 is a legal document required in Mississippi for transactions involving the sale of real property by foreign persons. This affidavit serves to certify that the seller is not a foreign person, which is essential for compliance with U.S. tax laws. The Internal Revenue Code (IRC) Section 1445 mandates that buyers withhold a portion of the sales price when purchasing property from foreign sellers to ensure tax obligations are met. This affidavit helps clarify the seller's status and can prevent unnecessary withholding.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Mississippi

Completing the Non Foreign Affidavit involves several key steps:

- Gather Information: Collect necessary details such as the seller's name, address, and Taxpayer Identification Number (TIN).

- Fill Out the Form: Accurately complete the affidavit, ensuring all information is correct and up to date.

- Sign the Document: The seller must sign the affidavit, affirming the truthfulness of the information provided.

- Notarization: Although not always required, having the document notarized can add an extra layer of authenticity.

- Submit the Affidavit: Provide the completed affidavit to the buyer or their representative as part of the transaction process.

Legal use of the Non Foreign Affidavit Under IRC 1445 Mississippi

The Non Foreign Affidavit Under IRC 1445 is legally binding when properly executed. It is used primarily to ensure compliance with tax regulations during real estate transactions. By providing this affidavit, sellers affirm their non-foreign status, which protects buyers from potential tax liabilities associated with foreign sellers. Failure to use this affidavit correctly can lead to significant withholding tax penalties for buyers, emphasizing the importance of accurate completion and submission.

Key elements of the Non Foreign Affidavit Under IRC 1445 Mississippi

Several key elements must be included in the Non Foreign Affidavit to ensure its validity:

- Seller's Identification: Full name and address of the seller.

- Taxpayer Identification Number: The seller's TIN or Social Security Number.

- Certification Statement: A statement confirming the seller is not a foreign person.

- Signature: The seller's signature, affirming the accuracy of the information provided.

State-specific rules for the Non Foreign Affidavit Under IRC 1445 Mississippi

In Mississippi, the Non Foreign Affidavit must adhere to specific state regulations in addition to federal requirements. These may include guidelines on notarization, submission methods, and any additional documentation required by local authorities. It is essential for sellers and buyers to be aware of these state-specific rules to ensure compliance and avoid any legal issues during the property transaction.

Examples of using the Non Foreign Affidavit Under IRC 1445 Mississippi

Common scenarios where the Non Foreign Affidavit is utilized include:

- A U.S. citizen selling their property to a buyer who needs to confirm the seller's status.

- A resident alien selling real estate and needing to provide proof of their non-foreign status.

- Real estate transactions involving partnerships or corporations that may have foreign partners, requiring clarification of the seller's status.

Quick guide on how to complete non foreign affidavit under irc 1445 mississippi

Effortlessly Prepare Non Foreign Affidavit Under IRC 1445 Mississippi on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the right format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without complications. Manage Non Foreign Affidavit Under IRC 1445 Mississippi on any platform using airSlate SignNow's Android or iOS applications and streamline any documentation process today.

How to Edit and eSign Non Foreign Affidavit Under IRC 1445 Mississippi with Ease

- Locate Non Foreign Affidavit Under IRC 1445 Mississippi and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow effectively meets all your document management needs in just a few clicks from a device of your preference. Edit and eSign Non Foreign Affidavit Under IRC 1445 Mississippi and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 in Mississippi?

A Non Foreign Affidavit Under IRC 1445 Mississippi is a document that certifies a seller is not a foreign person, which is important for tax purposes. This affidavit helps buyers in confirming that they are not required to withhold tax on the sale of real estate. Understanding this affidavit is crucial for smooth transactions in Mississippi's real estate market.

-

Why do I need a Non Foreign Affidavit Under IRC 1445 in my real estate transaction?

You're required to provide a Non Foreign Affidavit Under IRC 1445 in Mississippi to avoid potential tax withholding issues during property transactions. This affidavit protects both the buyer and seller from IRS penalties related to withholding tax on foreign sellers. It's a straightforward yet essential part of compliant real estate dealings.

-

How much does it cost to prepare a Non Foreign Affidavit Under IRC 1445 in Mississippi?

The cost of preparing a Non Foreign Affidavit Under IRC 1445 in Mississippi can vary depending on the service provider. However, with airSlate SignNow's cost-effective solution, you can create, sign, and manage this affidavit at a competitive price, ensuring compliance without breaking the bank. Check out our pricing plans to find an option that fits your needs.

-

What features does airSlate SignNow offer for managing Non Foreign Affidavits Under IRC 1445?

airSlate SignNow provides a user-friendly interface to create, send, and eSign Non Foreign Affidavits Under IRC 1445 in Mississippi easily. Our platform allows for secure document storage, tracking of changes, and reminders for signing, simplifying the management of your real estate documents. Discover how our features enhance your workflow and provide peace of mind.

-

Can I integrate airSlate SignNow with other tools for handling Non Foreign Affidavits Under IRC 1445?

Yes, airSlate SignNow integrates seamlessly with various applications to streamline your document management process, including CRMs and cloud storage solutions. This means you can easily manage your Non Foreign Affidavit Under IRC 1445 along with your other business documents. Explore our integration options to enhance your productivity.

-

What are the benefits of using airSlate SignNow for Non Foreign Affidavits Under IRC 1445 in Mississippi?

Using airSlate SignNow for your Non Foreign Affidavit Under IRC 1445 in Mississippi offers numerous benefits, such as improved efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your documents electronically, making the process faster and more reliable. Enjoy the peace of mind that comes with our legally compliant eSignature solution.

-

Is airSlate SignNow legal for eSigning Non Foreign Affidavits Under IRC 1445 in Mississippi?

Absolutely, airSlate SignNow is fully compliant with U.S. electronic signature laws, making it legal and valid for eSigning Non Foreign Affidavits Under IRC 1445 in Mississippi. Our platform meets all regulatory requirements, ensuring that your signed documents hold up in court if needed. Leverage our legal assurance to boost your confidence in the signing process.

Get more for Non Foreign Affidavit Under IRC 1445 Mississippi

- Disposal of security with insignificant value form

- Idaho form 850 fillable

- Arcon housing application form

- Cattle movement form

- Skintestor omni testing sheet 276813364 form

- Department of labour and employment proskills malaysia maid bb form

- Meritain vision claim form

- Homeowners tax relief assessor ada county form

Find out other Non Foreign Affidavit Under IRC 1445 Mississippi

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online