Company Tax ID Form

What is the Company Tax ID?

The Company Tax ID, also known as the Employer Identification Number (EIN), is a unique identifier assigned by the Internal Revenue Service (IRS) to businesses operating in the United States. This number is essential for tax purposes, enabling the IRS to track a company's tax obligations and payments. It is required for various business activities, including filing tax returns, opening a business bank account, and hiring employees.

How to Obtain the Company Tax ID

Obtaining a Company Tax ID is a straightforward process. Businesses can apply for an EIN directly through the IRS website, by mail, or by fax. The online application is the quickest method, typically providing an EIN immediately upon completion. When applying, businesses must provide information such as the legal name of the entity, the type of entity, and the reason for applying. It is important to ensure that all information is accurate to avoid delays in processing.

Key Elements of the Company Tax ID

The Company Tax ID consists of nine digits, formatted as XX-XXXXXXX. This format helps distinguish it from other identification numbers. Key elements associated with the Company Tax ID include:

- Legal Entity Name: The official name of the business entity.

- Business Structure: The type of entity, such as LLC, corporation, or partnership.

- Address: The physical location of the business.

- Responsible Party: The individual or entity responsible for the business's tax obligations.

Legal Use of the Company Tax ID

The Company Tax ID is legally required for various business activities, including filing federal and state tax returns, applying for business licenses, and conducting payroll. It serves as a means for the IRS to identify and track businesses, ensuring compliance with tax regulations. Using the EIN correctly is crucial, as failure to do so can result in penalties or complications with tax filings.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Company Tax ID. Businesses must ensure that they use the correct EIN for all tax-related documents. It is also important to keep the EIN confidential to prevent identity theft. If a business changes its structure or ownership, it may be necessary to apply for a new EIN. The IRS outlines these scenarios in their guidelines, emphasizing the importance of maintaining accurate records.

Filing Deadlines / Important Dates

Filing deadlines related to the Company Tax ID vary depending on the type of business entity and the tax year. Generally, businesses must file their federal tax returns by the fifteenth day of the fourth month following the end of their tax year. It is essential to be aware of these deadlines to avoid late fees and penalties. Additionally, certain forms may have specific due dates that businesses should monitor throughout the year.

Quick guide on how to complete company tax id

Complete Company Tax Id effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without hindrances. Handle Company Tax Id on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Company Tax Id with ease

- Obtain Company Tax Id and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or hide sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only moments and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Company Tax Id and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the company tax id

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

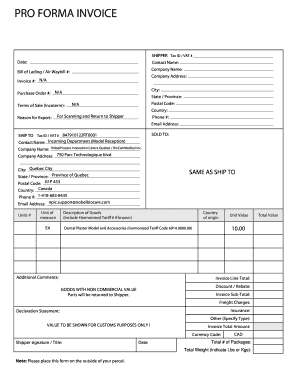

What is a Quebec invoice template?

A Quebec invoice template is a pre-designed document that complies with the invoicing requirements of Quebec's laws and regulations. It typically includes mandatory elements such as the seller's and buyer's information, description of goods or services, and applicable taxes. This template helps businesses streamline their billing process while ensuring compliance.

-

How can airSlate SignNow help me create a Quebec invoice template?

With airSlate SignNow, you can easily customize a Quebec invoice template using our intuitive online platform. You can drag and drop the necessary fields, add your company branding, and save your template for future use. This makes the invoicing process faster and more efficient for your business.

-

Is the Quebec invoice template customizable?

Yes, the Quebec invoice template in airSlate SignNow is fully customizable. You can modify fields, adjust layouts, and include your business logo to create an invoice that best represents your brand. This flexibility ensures you maintain a professional appearance while meeting local requirements.

-

What are the benefits of using a Quebec invoice template?

Using a Quebec invoice template offers several benefits, including time savings and accuracy in invoicing. It minimizes errors by providing a structured format that complies with Quebec regulations. Additionally, it can enhance cash flow management by speeding up the billing cycle.

-

What features does airSlate SignNow offer for invoicing?

airSlate SignNow provides a range of features for invoicing, including customizable Quebec invoice templates, automated reminders for payments, and electronic signature capabilities. These features simplify the process of sending invoices and getting them signed, allowing for quicker transactions.

-

Can I integrate airSlate SignNow with other software for invoicing?

Yes, airSlate SignNow can be easily integrated with various accounting and project management software. This allows you to streamline your invoicing process by syncing data and automating workflows. Integrating with popular tools enhances efficiency and helps keep your financial records organized.

-

Is there a cost associated with using the Quebec invoice template in airSlate SignNow?

airSlate SignNow offers various pricing plans, which include access to customizable Quebec invoice templates. Depending on your business needs, you can choose a plan that suits your budget and provides the necessary features for efficient invoicing. A free trial is available to explore the platform.

Get more for Company Tax Id

Find out other Company Tax Id

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast