Financing Form Ucc

What is the Financing Form Ucc

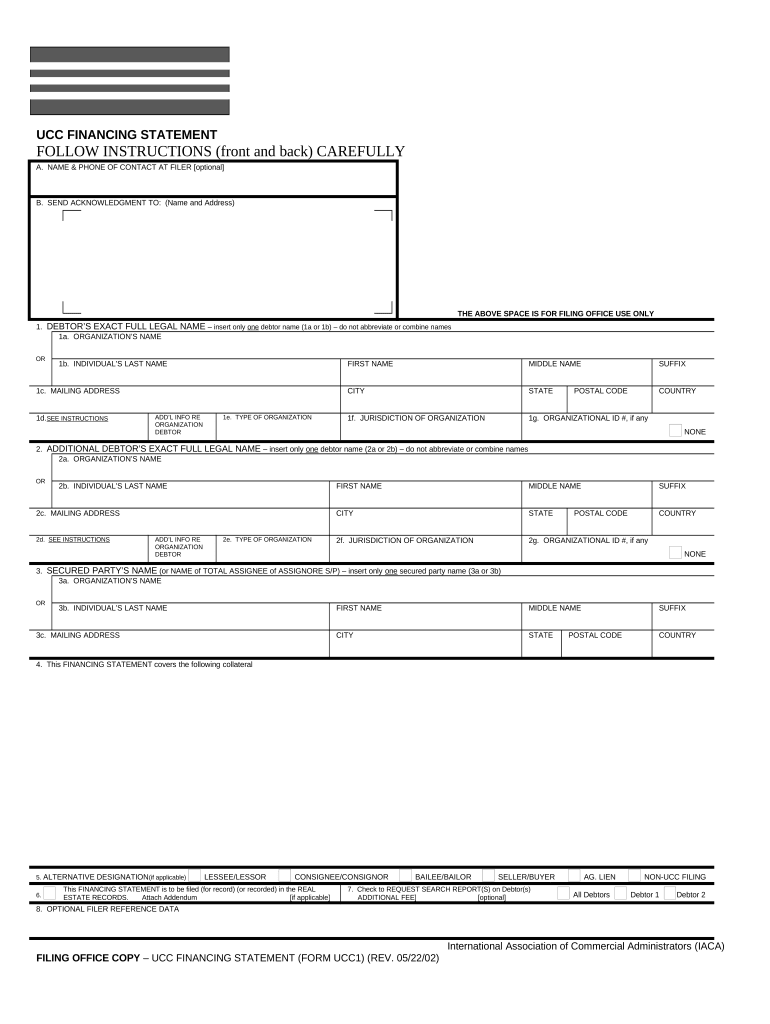

The financing form UCC, also known as the UCC-1 Financing Statement, is a legal document used to secure a creditor's interest in a debtor's personal property. This form is essential in the context of secured transactions, allowing lenders to establish a legal claim on collateral that a borrower offers to secure a loan. The UCC-1 form is filed with the appropriate state authority, typically the Secretary of State, and serves to publicly notify other creditors of the secured interest. This ensures that, in the event of default, the creditor has a priority claim over the specified collateral.

How to Use the Financing Form Ucc

Using the financing form UCC involves several key steps to ensure proper completion and filing. First, gather all necessary information about the debtor and the collateral. This includes the debtor's legal name, address, and a description of the collateral being secured. Next, accurately fill out the UCC-1 form, ensuring that all details are correct to avoid potential legal issues. Once completed, the form must be filed with the appropriate state office, along with any required filing fees. It is advisable to keep a copy of the filed form for your records, as this serves as proof of the secured interest.

Steps to Complete the Financing Form Ucc

Completing the financing form UCC requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary information, including the debtor's name and address, and a detailed description of the collateral.

- Obtain the UCC-1 form from the state Secretary of State's website or office.

- Fill out the form, ensuring all information is complete and accurate.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate state office, along with any required fees.

- Retain a copy of the filed form for your records.

Legal Use of the Financing Form Ucc

The legal use of the financing form UCC is governed by the Uniform Commercial Code (UCC), which provides a framework for secured transactions in the United States. To be legally binding, the UCC-1 form must be properly completed and filed. This document creates a public record of the secured interest, which is crucial for protecting the creditor's rights. If a debtor defaults on a loan, the creditor can use the UCC-1 filing to assert their claim over the collateral in a court of law. Compliance with state-specific regulations is essential to ensure the form's legal validity.

Key Elements of the Financing Form Ucc

Several key elements must be included in the financing form UCC to ensure its effectiveness:

- Debtor Information: The legal name and address of the debtor must be accurately provided.

- Secured Party Information: The name and address of the creditor or secured party should be clearly stated.

- Description of Collateral: A detailed description of the collateral must be included to identify what is being secured.

- Signature: The form must be signed by the debtor or an authorized representative.

- Filing Details: The form should be filed with the appropriate state office to create a public record.

Examples of Using the Financing Form Ucc

The financing form UCC is commonly used in various scenarios, including:

- Securing a loan for purchasing equipment, where the equipment serves as collateral.

- Establishing a security interest in inventory for a retail business.

- Protecting a lender's interest in accounts receivable when financing a business.

These examples illustrate the versatility of the UCC-1 form in securing various types of loans and interests, providing creditors with a legal framework to protect their investments.

Quick guide on how to complete financing form ucc

Effortlessly Prepare Financing Form Ucc on Any Device

The management of documents online has gained popularity among both businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents quickly and without complications. Manage Financing Form Ucc across any platform with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Financing Form Ucc Effortlessly

- Locate Financing Form Ucc and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize critical parts of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tiring searches for forms, or errors that require printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Financing Form Ucc while ensuring excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a financing form UCC?

A financing form UCC is a legal document used to record a security interest in personal property under Uniform Commercial Code regulations. This form allows lenders to secure loans by claiming a legal interest in collateral. Understanding how to properly complete a financing form UCC is critical for protecting both borrowers and lenders.

-

How can airSlate SignNow help with financing form UCC?

airSlate SignNow streamlines the process of completing and eSigning financing form UCC documents. Our intuitive platform ensures that you can easily fill out, send, and manage these forms without paperwork hassles. Furthermore, our solution is user-friendly, allowing fast and efficient completion of your financing form UCC.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans designed to accommodate businesses of all sizes. Each plan includes features that facilitate the creation and management of financing form UCC documents. You can choose a plan that suits your budget while enjoying access to our easy-to-use eSigning capabilities.

-

Is airSlate SignNow secure for handling financing form UCC?

Yes, airSlate SignNow provides robust security measures to protect your financing form UCC and any other documents. We employ encryption, secure cloud storage, and compliance with international security standards to ensure that your information remains confidential and safe. Trust our platform for your sensitive document transactions.

-

Can I integrate airSlate SignNow with other software for financing form UCC management?

Absolutely! airSlate SignNow offers integrations with a wide range of applications to enhance your workflow when managing financing form UCC. Whether you’re using CRMs, accounting software, or document management systems, our solution can seamlessly integrate to provide a comprehensive document signing experience.

-

What benefits does airSlate SignNow provide for financing form UCC?

With airSlate SignNow, you gain signNow benefits when dealing with financing form UCC, including time savings, reduced paperwork, and improved accuracy. Our electronic signature capabilities allow for faster processing, ensuring your financing agreements are executed promptly. Experience the convenience of managing your UCC forms digitally.

-

How do I eSign a financing form UCC using airSlate SignNow?

eSigning a financing form UCC with airSlate SignNow is quick and simple. After completing the document, you simply invite signers via email, who can then review and sign the form electronically. This process removes the need for printing and scanning, making it easier to get your financing agreements finalized.

Get more for Financing Form Ucc

- Form 122

- Parker leverett candace may form

- Learning agreement examples form

- Electrical permit application state of rhode island ribcc ri form

- Form medi cal point of service pos networkinternet agreement dhcs ca

- Form it 203 nonresident and part year resident it203 tax ny

- Temporary use permit tup application application for temporary use permit in austin texas form

- Sliding scale agreement template form

Find out other Financing Form Ucc

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms