Do You Sen W2 with G 1003 Form 2012

What is the Do You Sen W2 With G 1003 Form

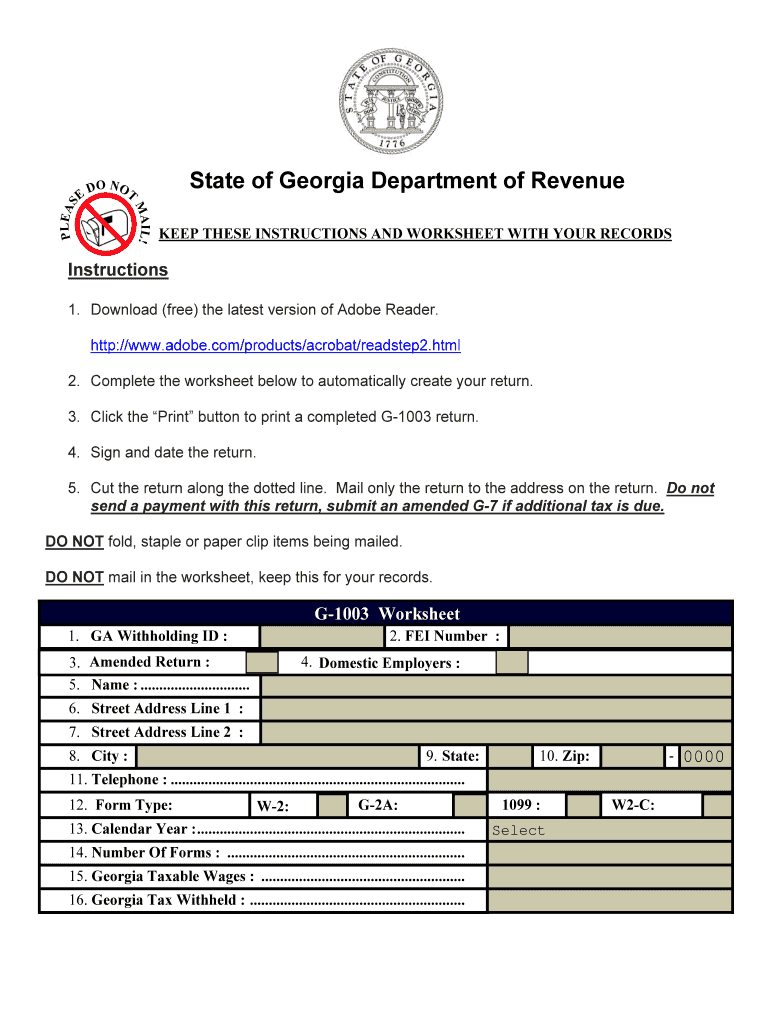

The Do You Sen W2 With G 1003 Form is a specific tax document used in the United States. It combines information from the W-2 form, which reports wages and taxes withheld from an employee's paycheck, with the G-1003 form, which is utilized for various tax reporting purposes. This form is essential for individuals and businesses to accurately report income and ensure compliance with federal tax regulations. Understanding its components and purpose is crucial for effective tax filing.

Steps to complete the Do You Sen W2 With G 1003 Form

Completing the Do You Sen W2 With G 1003 Form involves several key steps:

- Gather necessary information, including personal details, income data, and tax withholding amounts.

- Access the form through a trusted digital platform that supports eSignatures.

- Fill in the required fields accurately, ensuring all information matches your financial records.

- Review the completed form for any errors or omissions.

- Sign the form electronically using a compliant eSignature solution.

- Submit the form through the designated method, whether online or via mail.

Legal use of the Do You Sen W2 With G 1003 Form

The legal use of the Do You Sen W2 With G 1003 Form is governed by IRS regulations. This form must be filled out accurately and submitted on time to avoid penalties. It is essential for reporting income and ensuring that tax obligations are met. The IRS allows eSignatures for this form, enhancing its legal validity while facilitating a more efficient filing process. Users should always verify their compliance with current tax laws and regulations.

Form Submission Methods (Online / Mail / In-Person)

The Do You Sen W2 With G 1003 Form can be submitted through various methods, each with its own benefits:

- Online Submission: This method allows for quick processing and immediate confirmation. Using a secure eSignature platform streamlines the process.

- Mail Submission: Users can print the completed form and send it to the appropriate IRS address. Ensure to use certified mail for tracking purposes.

- In-Person Submission: Some individuals may choose to submit the form directly at local IRS offices. This option may provide immediate assistance if needed.

IRS Guidelines

IRS guidelines for the Do You Sen W2 With G 1003 Form outline the requirements for accurate completion and submission. Taxpayers must ensure that all information is correct and that the form is filed by the designated deadlines. The IRS provides resources and instructions to assist users in understanding how to fill out the form properly. Staying informed about any changes to IRS regulations is crucial for compliance.

Required Documents

To complete the Do You Sen W2 With G 1003 Form, several documents are typically required:

- W-2 Form: This document reports your wages and the taxes withheld by your employer.

- Previous Tax Returns: These can provide context for your current income and deductions.

- Identification Documents: Such as a Social Security number or taxpayer identification number.

Having these documents ready can simplify the process and help ensure accuracy when filling out the form.

Quick guide on how to complete do you sen w2 with g 1003 2012 form

Your assistance manual on how to prepare your Do You Sen W2 With G 1003 Form

If you’re wondering how to generate and submit your Do You Sen W2 With G 1003 Form, here are some brief directions on making tax filing considerably simpler.

To begin, you simply need to set up your airSlate SignNow profile to alter how you handle documentation online. airSlate SignNow is an exceptionally intuitive and powerful document management tool that enables you to modify, draft, and finalize your tax documents effortlessly. With its editing feature, you can toggle between text, check boxes, and eSignatures and revisit to modify details as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and easy sharing options.

Follow the steps below to complete your Do You Sen W2 With G 1003 Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax document; browse through variants and schedules.

- Click Get form to access your Do You Sen W2 With G 1003 Form in our editor.

- Populate the mandatory fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to incorporate your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Employ this manual to file your taxes digitally with airSlate SignNow. Please be aware that filing on paper can increase errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct do you sen w2 with g 1003 2012 form

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

How many of you fill out a Restaurant Feedback form? What problem do you have with it?

I'll fill one out if it is there and there is a pen handy. For much the same reason as Christine Leigh Langtree, except I used to work in first line customer service as opposed to marketing.A tip is a direct gesture of thanks to your server but hopefully the comment card makes it up the hierarchy also and gets recognition of the person at those levels also.Equally, if I've not been happy with my visit I'll say so but only when it is not related to the server, who I normally just have a conversation with person to person on the rare occasions this is so. Criticise in private, praise in public etc.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do you fill out music copyright forms for works with two writers?

U.S. perspectiveAs concerns copyright registration, a work that is created by multiple authors or composers is referred to as a “joint work” - please see 17 USC Section 201(a).Put simply, one lists both composers of a joint musical work as the authors.You probably will register the copyright online. However, it is easier to show how multiple authors are entered by referring to the form used for hard-copy registration.Form PA is used to register works of the performing arts. The composers are identified in Space 2 - the first composer in part a, the second in part b.

-

How do you fill out music copyright forms for works with two producers?

U.S. perspectiveAlthough this question is similar to How do you fill out music copyright forms for works with two writers?, the answer to this question is not quite so straightforward because the role of the producers, as concerns copyright registration, has not been explicitly stated.If the registration pertains to a sound recording, rather than the underlying composition, then Form SR (or the online equivalent) is used.If the two producers are the copyright claimants, then they are so identified in Space 4a, and how they became the claimants (e.g., by transfer of rights by the authors) is explained in Space 4b.

-

How do you fill out a customs form when visiting a country with no permanent address or phone?

No country will let a visitor in if they believe that person intends to be homeless. The ability to look after yourself and not be a burden on the state is one of the reasons visitors are screened in the first place.No, you can't leave it blank when you are trying to enter a country as a visitor. If you are returning home however, you're not a visitor and in my experience no country seeks address information for citizens returning home.

-

What's the best way to deal with Skype support when they continually fail to do anything other than provide you with a form to fill out?

1 (800) 642-7676 is Microsoft Support's hotline.

Create this form in 5 minutes!

How to create an eSignature for the do you sen w2 with g 1003 2012 form

How to generate an electronic signature for your Do You Sen W2 With G 1003 2012 Form online

How to make an eSignature for your Do You Sen W2 With G 1003 2012 Form in Google Chrome

How to create an eSignature for signing the Do You Sen W2 With G 1003 2012 Form in Gmail

How to create an electronic signature for the Do You Sen W2 With G 1003 2012 Form right from your smart phone

How to make an eSignature for the Do You Sen W2 With G 1003 2012 Form on iOS devices

How to generate an electronic signature for the Do You Sen W2 With G 1003 2012 Form on Android OS

People also ask

-

What is the process to send a W2 with the G 1003 Form using airSlate SignNow?

To send a W2 with the G 1003 Form using airSlate SignNow, simply upload your document, select the recipients, and add any necessary fields for e-signatures. This user-friendly platform streamlines the process, ensuring that you can quickly manage your documents while maintaining compliance. By leveraging this feature, you can efficiently handle your W2 submissions alongside the G 1003 Form.

-

How much does it cost to use airSlate SignNow for sending W2s with the G 1003 Form?

airSlate SignNow offers various pricing plans tailored to suit different business sizes and needs. Pricing starts at an affordable monthly rate, allowing you to conveniently send W2s with the G 1003 Form without breaking the bank. Check our pricing page for specific plans and features included.

-

What features does airSlate SignNow offer for sending W2s with the G 1003 Form?

airSlate SignNow includes a robust set of features to enhance your document management, such as customizable templates, real-time tracking, and reminders. These features ensure you can efficiently send W2s with the G 1003 Form and receive signed documents promptly. The platform's intuitive interface simplifies the entire process for users.

-

Is it secure to send W2s with the G 1003 Form through airSlate SignNow?

Yes, airSlate SignNow prioritizes your privacy and document security. With end-to-end encryption and secure cloud storage, you can confidently send W2s with the G 1003 Form. Additionally, we comply with relevant regulations to keep your sensitive information safe.

-

Can I integrate airSlate SignNow with other software for sending W2s with the G 1003 Form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Salesforce, Google Drive, and Dropbox. By integrating these services, you can streamline your workflow when sending W2s with the G 1003 Form, enhancing productivity and efficiency.

-

What benefits can I expect when using airSlate SignNow for W2 submissions with the G 1003 Form?

Using airSlate SignNow for W2 submissions with the G 1003 Form offers several benefits, including time savings, enhanced accuracy, and improved compliance. Automating the sending and signing processes reduces manual errors and accelerates your document turnaround time, making your operations more efficient.

-

How does the eSignature process work for W2s with the G 1003 Form in airSlate SignNow?

The eSignature process in airSlate SignNow is straightforward. After uploading your W2 with the G 1003 Form and assigning signers, recipients receive a notification to sign the document electronically. This eliminates paper trails and ensures a fast and streamlined signing experience.

Get more for Do You Sen W2 With G 1003 Form

- Landlord tenant sublease package arizona form

- Buy sell agreement package arizona form

- Arizona option 497297819 form

- Amendment of lease package arizona form

- Annual financial checkup package arizona form

- Az bill sale 497297822 form

- Living wills and health care package arizona form

- Arizona testament form

Find out other Do You Sen W2 With G 1003 Form

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form