G 1003 2018

What is the G 1003

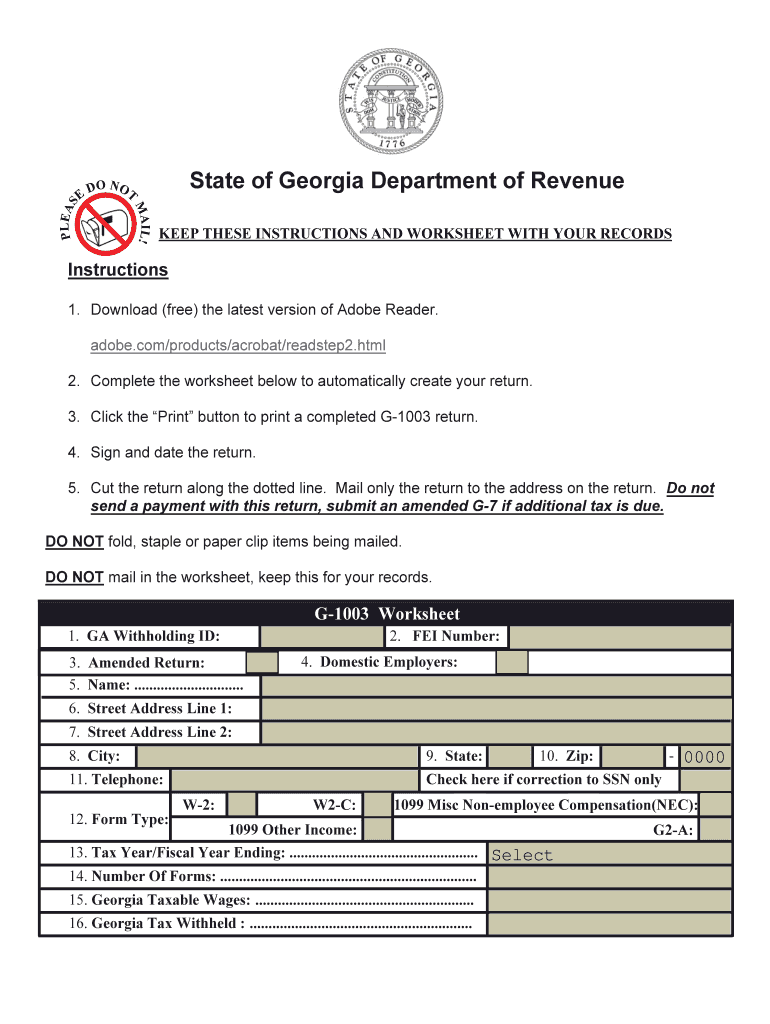

The G 1003 form, also known as the GA Form G , is a document used primarily for tax reporting in the state of Georgia. This form is specifically designed to collect information necessary for taxpayers to accurately report their income and deductions. It is essential for individuals and businesses to ensure compliance with state tax regulations. The G 1003 form includes various sections where taxpayers can provide detailed information about their financial activities, ensuring that their tax returns reflect their true financial status.

How to use the G 1003

Using the G 1003 form involves a few straightforward steps. First, download the form from an official source or access it through a digital platform that supports eSignature. Next, fill in the required fields, ensuring that all information is accurate and up-to-date. After completing the form, review it for any errors or omissions. Once verified, you can sign the form electronically using a trusted eSignature solution, which enhances the security and validity of your submission. Finally, submit the form electronically or by mail, depending on your preference and the specific submission guidelines provided by the Georgia Department of Revenue.

Steps to complete the G 1003

Completing the G 1003 form involves several key steps:

- Access the G 1003 form from a reliable source.

- Gather all necessary documents, including income statements and deduction records.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy, checking for any potential errors.

- Sign the form electronically to ensure it meets legal requirements.

- Submit the completed form according to the guidelines provided by the Georgia Department of Revenue.

Legal use of the G 1003

The legal use of the G 1003 form is governed by state tax laws in Georgia. It is crucial for taxpayers to understand that submitting this form accurately is not only a requirement but also a legal obligation. The form must be completed with truthful information, as any discrepancies or fraudulent claims can lead to penalties or legal repercussions. Additionally, utilizing a secure method to sign and submit the form, such as an eSignature platform, ensures that the submission is legally binding and compliant with the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Key elements of the G 1003

The G 1003 form contains several key elements that are essential for proper tax reporting. These include:

- Personal Information: Taxpayer's name, address, and identification number.

- Income Details: Sections to report various sources of income, including wages, interest, and dividends.

- Deductions: Areas to detail allowable deductions that can reduce taxable income.

- Signature Section: A designated area for the taxpayer's signature, confirming the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The G 1003 form can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online Submission: Taxpayers can submit the form electronically using a secure eSignature platform, ensuring a quick and efficient process.

- Mail Submission: The completed form can be printed and mailed to the appropriate address as specified by the Georgia Department of Revenue.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at designated state revenue offices, where assistance may be available.

Quick guide on how to complete georgia g 1003 2018 2019 form

Your assistance manual on how to prepare your G 1003

If you’re seeking to understand how to complete and submit your G 1003, here are a few concise instructions on simplifying the tax submission process.

To begin, you simply need to register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to modify, create, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revisit to amend information as needed. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your G 1003 in just a few minutes:

- Establish your account and start working on PDFs within a few moments.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to open your G 1003 in our editor.

- Fill in the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any discrepancies.

- Save modifications, print your version, send it to your intended recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can lead to increased errors and delays in reimbursements. Before e-filing your taxes, make sure to review the IRS website for filing protocols in your state.

Create this form in 5 minutes or less

Find and fill out the correct georgia g 1003 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the georgia g 1003 2018 2019 form

How to make an electronic signature for your Georgia G 1003 2018 2019 Form in the online mode

How to create an electronic signature for your Georgia G 1003 2018 2019 Form in Chrome

How to generate an electronic signature for putting it on the Georgia G 1003 2018 2019 Form in Gmail

How to create an eSignature for the Georgia G 1003 2018 2019 Form straight from your smartphone

How to create an electronic signature for the Georgia G 1003 2018 2019 Form on iOS devices

How to generate an eSignature for the Georgia G 1003 2018 2019 Form on Android

People also ask

-

What is the GA Form G 1003 2018?

The GA Form G 1003 2018 is a specific application form used primarily for loan requests in Georgia. This form collects essential borrower information, helping lenders to evaluate creditworthiness efficiently. Completing the GA Form G 1003 2018 accurately ensures swift processing of your loan application.

-

How can airSlate SignNow assist with GA Form G 1003 2018?

airSlate SignNow simplifies the eSigning process for the GA Form G 1003 2018 by allowing users to prepare, send, and sign the document electronically. This minimizes turnaround time and ensures that all parties can sign the form securely from anywhere, saving valuable time in the loan approval process.

-

Is there a cost associated with using airSlate SignNow for the GA Form G 1003 2018?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides cost-effective access to features that can streamline the signing process for documents like the GA Form G 1003 2018. You can choose a plan that fits your budget and requirement.

-

What features does airSlate SignNow offer for the GA Form G 1003 2018?

airSlate SignNow provides features such as document templates, automated workflows, and real-time tracking for documents like the GA Form G 1003 2018. These tools help ensure that the signing process is efficient and organized, allowing for better management of your documentation needs.

-

Can I integrate airSlate SignNow with other applications when handling the GA Form G 1003 2018?

Absolutely! airSlate SignNow integrates seamlessly with various CRM systems, cloud storage services, and productivity tools. This ensures that you can manage your GA Form G 1003 2018 and other documents efficiently within your existing workflows without any disruption.

-

What are the benefits of using airSlate SignNow for GA Form G 1003 2018?

Using airSlate SignNow for the GA Form G 1003 2018 enhances efficiency by reducing the time spent on document management. It provides a secure platform for eSigning and document storage, which can improve compliance and enhance the user experience for both lenders and borrowers.

-

Is airSlate SignNow easy to use for the GA Form G 1003 2018?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the GA Form G 1003 2018. With a straightforward interface, you can quickly navigate through the platform and manage your documents without extensive training or technical skills.

Get more for G 1003

- Miaa volleyball score sheet form

- Petition for expungement form minnesota judicial branch mncourts

- Alarm monitoring agreement form

- Wetland inhabitant word search pdf water epa form

- Bellarine model aircraft club inc shepherds road mannerimvic roads map 94b5 membership application 20142015 please complete and form

- Food truck agreement template form

- Food vendor agreement template form

- Forbearance agreement template 787742365 form

Find out other G 1003

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free