Nc Guaranty Form

What is the Nc Guaranty

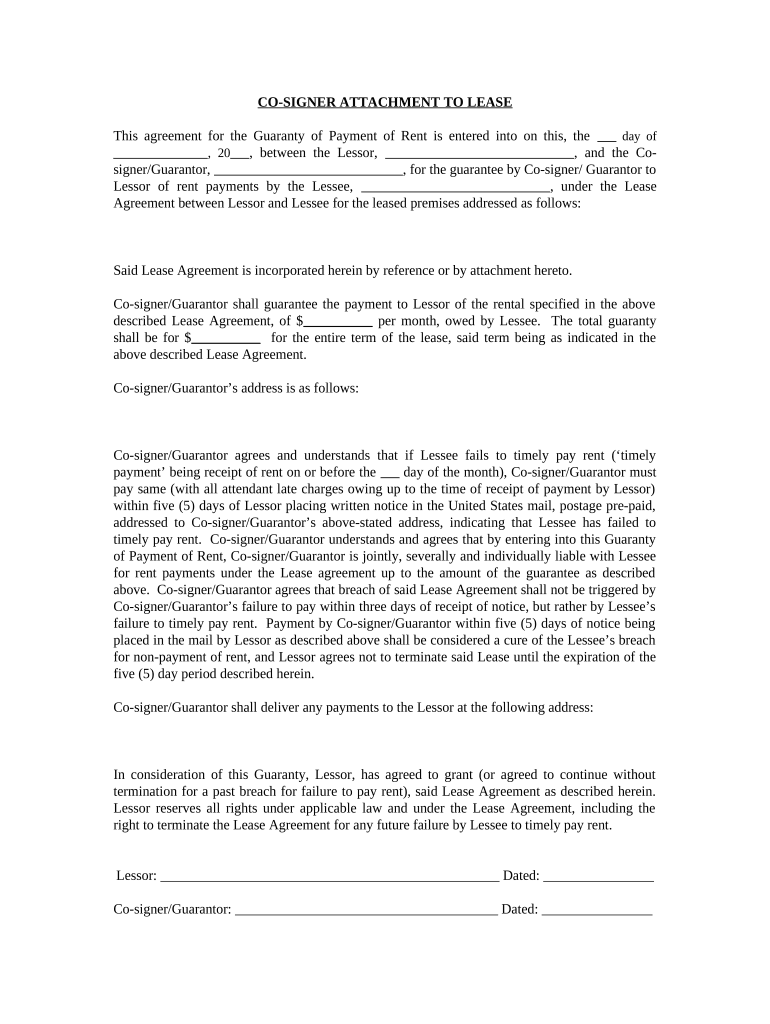

The Nc Guaranty is a legal document used in various financial and real estate transactions. It serves as a promise by one party to assume responsibility for another party's obligations, typically in the context of loans or leases. This form is essential for ensuring that lenders or landlords have a reliable assurance that their financial interests will be protected. Understanding the specifics of the Nc Guaranty is crucial for all parties involved in a transaction, as it outlines the terms and conditions under which the guaranty is valid.

How to use the Nc Guaranty

Using the Nc Guaranty involves several key steps to ensure its effectiveness and legal validity. First, both the guarantor and the party requiring the guaranty must clearly understand the obligations being guaranteed. Next, the form should be completed accurately, including all necessary details such as names, dates, and specific obligations. Once the document is filled out, it should be signed by the guarantor in the presence of a witness or notary, depending on state requirements. This process helps to establish the legal binding nature of the Nc Guaranty.

Steps to complete the Nc Guaranty

Completing the Nc Guaranty requires careful attention to detail. Here are the essential steps:

- Gather all necessary information, including the names of the parties involved and the specific obligations being guaranteed.

- Fill out the form accurately, ensuring all fields are completed to avoid any potential disputes.

- Review the document for clarity and accuracy, checking that all terms are understood by both parties.

- Sign the form in the presence of a witness or notary, as required by state law.

- Keep a copy of the signed document for your records, as it serves as proof of the agreement.

Legal use of the Nc Guaranty

The Nc Guaranty must comply with specific legal standards to be enforceable. This includes adherence to state laws governing guarantees and ensuring that the document is properly executed. The guarantor must have the legal capacity to enter into the agreement, and the terms must be clear and unambiguous. By following these legal guidelines, the Nc Guaranty can serve as a robust tool for protecting the interests of all parties involved in a transaction.

Key elements of the Nc Guaranty

Several key elements are essential for the Nc Guaranty to be effective:

- Identification of Parties: Clearly identify the guarantor and the party whose obligations are being guaranteed.

- Obligations: Specify the exact obligations that the guarantor is agreeing to assume.

- Terms and Conditions: Outline any conditions under which the guaranty may be invoked.

- Signatures: Ensure that all parties sign the document, as this is crucial for its enforceability.

Who Issues the Form

The Nc Guaranty form is typically issued by financial institutions, landlords, or legal entities involved in the transaction. Depending on the context, it may be provided directly by the lender or landlord, or it may be available through legal resources or online platforms specializing in legal documents. It is important to use the correct version of the form that complies with state regulations to ensure its validity.

Quick guide on how to complete nc guaranty

Effortlessly Prepare Nc Guaranty on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Nc Guaranty on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Nc Guaranty without hassle

- Locate Nc Guaranty and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using features that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal status as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Modify and eSign Nc Guaranty while ensuring exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the nc guaranty provided by airSlate SignNow?

The nc guaranty from airSlate SignNow ensures that your electronic signatures are legally binding and secure, giving you peace of mind. This guarantee covers the authenticity and integrity of the documents signed, complying with national and state regulations. With airSlate SignNow's nc guaranty, you can confidently manage your document transactions.

-

How does airSlate SignNow's pricing model work with the nc guaranty?

airSlate SignNow offers flexible pricing plans that integrate the nc guaranty benefits across all tiers. This means you can choose a plan that fits your business needs, knowing that the nc guaranty is included. Our cost-effective solution ensures you don’t have to sacrifice compliance or security for affordability.

-

What features are included with the nc guaranty on airSlate SignNow?

With the nc guaranty, airSlate SignNow provides features like document tracking, reminders for signers, and secure storage. These functionalities enhance the signing process, ensuring all documents are handled efficiently and securely. Our robust platform supports your business transactions while fully abiding by the nc guaranty standards.

-

What are the benefits of using airSlate SignNow with the nc guaranty?

Using airSlate SignNow with the nc guaranty ensures that your eSigning processes are secure, reliable, and compliant. It streamlines document workflows and reduces the time spent on manual signatures, allowing you to focus on core business activities. Furthermore, the nc guaranty enhances trust with clients and partners, boosting your professional reputation.

-

Can I integrate airSlate SignNow's nc guaranty with other applications?

Yes, airSlate SignNow allows integrations with various applications while including the nc guaranty features. You can seamlessly connect tools like CRM and project management software to enhance your workflow efficiency. This flexibility ensures that you can retain compliance and document security across all platforms.

-

Is the nc guaranty valid for international transactions?

The nc guaranty is primarily designed to meet U.S. standards, but it can also enhance the acceptance of your documents in international dealings. Many countries recognize the validity of eSignatures, especially when compliant with U.S. regulations. By using airSlate SignNow, you are likely to strengthen your global document management efforts.

-

How does airSlate SignNow ensure compliance with the nc guaranty?

airSlate SignNow implements strict security protocols and follows all federal and state laws regarding electronic signatures to uphold the nc guaranty. We utilize encryption, secure servers, and identity verification processes to maintain compliance. This commitment to security helps protect your documents and ensures their legality.

Get more for Nc Guaranty

- Rewriting and editing short passages at the farm form

- Sa100 form

- Medicaid application state of north dakota coverageforall form

- Haccp plan template forms checklists ampamp reportscompleting your haccp plan template a step by step guide hazard analysis

- Division of food and lodging nd department of health form

- Office space lease agreement template form

- Office sublease agreement template form

- Official lease agreement template form

Find out other Nc Guaranty

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors