Individual Credit Application North Dakota Form

What is the Individual Credit Application North Dakota

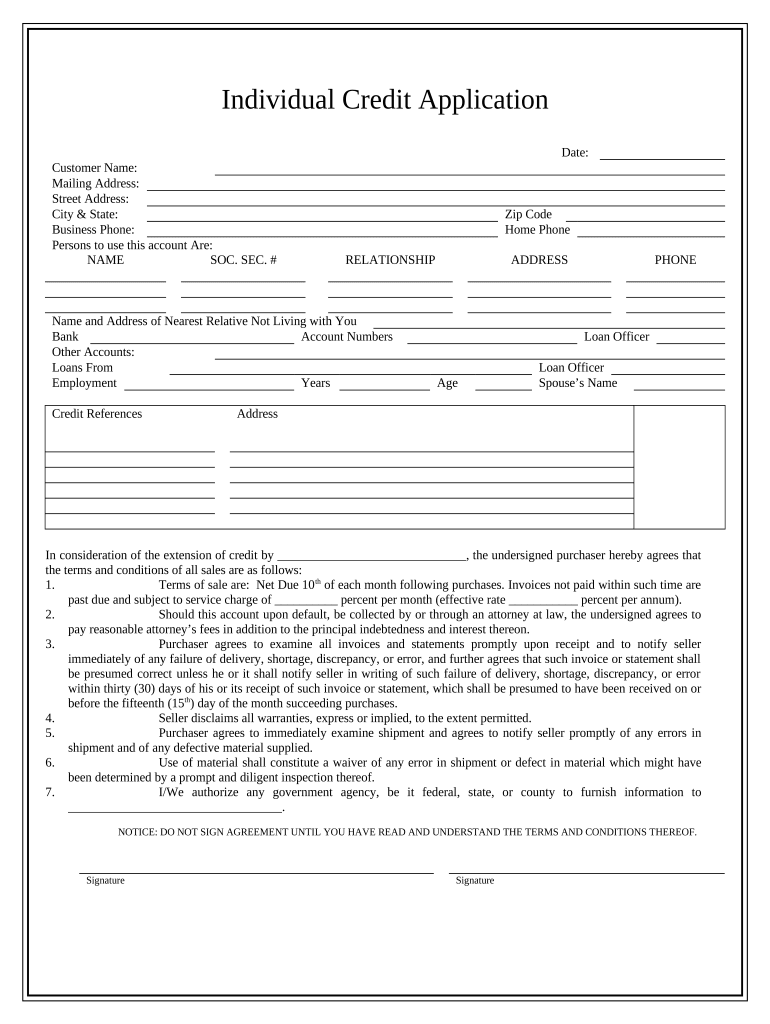

The Individual Credit Application North Dakota is a formal document used by individuals seeking credit from financial institutions. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically includes details such as income, employment history, existing debts, and personal identification. Financial institutions use this information to make informed lending decisions.

Steps to complete the Individual Credit Application North Dakota

Completing the Individual Credit Application North Dakota involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial documents, such as proof of income, identification, and any existing loan information. Next, fill out the application form accurately, providing all requested details. Review the application for any errors or omissions before submission. Finally, submit the application electronically or in person, depending on the institution's requirements.

Legal use of the Individual Credit Application North Dakota

The legal use of the Individual Credit Application North Dakota is governed by state and federal regulations. It is crucial that the information provided is truthful and complete, as inaccuracies can lead to legal repercussions or denial of credit. The application must also comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic signatures are legally binding. Financial institutions are required to protect the applicant's personal information in accordance with privacy laws.

Key elements of the Individual Credit Application North Dakota

Key elements of the Individual Credit Application North Dakota include personal identification information, employment details, income verification, and financial history. Applicants must provide their full name, address, Social Security number, and date of birth. Employment information should include the employer's name, address, and contact details, along with the applicant's job title and length of employment. Additionally, applicants must disclose any existing debts and financial obligations to give lenders a complete picture of their financial situation.

Eligibility Criteria

Eligibility criteria for the Individual Credit Application North Dakota vary by lender but generally include age, residency, and credit history requirements. Applicants must be at least eighteen years old and a resident of North Dakota. Lenders typically assess the applicant's credit score, income level, and debt-to-income ratio to determine eligibility. Meeting these criteria is essential for a successful application and to secure favorable lending terms.

Form Submission Methods

The Individual Credit Application North Dakota can be submitted through various methods, depending on the lender's preferences. Common submission methods include online applications via the lender's website, mailing a printed form to the institution, or delivering it in person at a local branch. Each method has its advantages, such as convenience for online submissions or personal interaction when submitting in person.

Quick guide on how to complete individual credit application north dakota

Complete Individual Credit Application North Dakota effortlessly on any gadget

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage Individual Credit Application North Dakota on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest method to modify and eSign Individual Credit Application North Dakota without any hassle

- Obtain Individual Credit Application North Dakota and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive content with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Individual Credit Application North Dakota and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Individual Credit Application North Dakota process?

The Individual Credit Application North Dakota process allows applicants to submit their financial information electronically, streamlining the approval process. With airSlate SignNow, users can easily fill out and sign the application from any device, ensuring a quick turnaround. This solution facilitates faster decision-making for lenders.

-

How does airSlate SignNow enhance the Individual Credit Application North Dakota experience?

airSlate SignNow enhances the Individual Credit Application North Dakota experience by providing an intuitive platform for document creation and electronic signatures. This eliminates the need for paper forms and manual signatures, making the process more efficient. Additionally, it ensures compliance with local regulations.

-

What are the costs associated with using airSlate SignNow for the Individual Credit Application North Dakota?

Pricing for using airSlate SignNow for the Individual Credit Application North Dakota is competitive and offers various plans to suit different business needs. Customers can choose from monthly or annual subscriptions, allowing them to manage their budgets effectively. Detailed pricing information is available on the airSlate website.

-

Are there any integrations available with airSlate SignNow for the Individual Credit Application North Dakota?

Yes, airSlate SignNow offers numerous integrations that enhance the functionality of the Individual Credit Application North Dakota process. You can seamlessly connect with popular CRM platforms, cloud storage solutions, and payment processors. This connectivity ensures a smooth workflow and improves efficiency.

-

What benefits does airSlate SignNow provide for the Individual Credit Application North Dakota?

Using airSlate SignNow for the Individual Credit Application North Dakota provides several benefits, including reduced paperwork, faster processing times, and improved accuracy. It allows for real-time updates throughout the application process, enabling better communication between lenders and borrowers. Moreover, it boosts overall customer satisfaction.

-

Is airSlate SignNow secure for handling the Individual Credit Application North Dakota?

Absolutely! airSlate SignNow prioritizes security for the Individual Credit Application North Dakota by providing advanced encryption and compliance with industry standards. This ensures that all applicant data remains confidential and protected during transmission and storage. Users can trust that their information is safe.

-

Can I customize the Individual Credit Application North Dakota forms in airSlate SignNow?

Yes, you can customize the Individual Credit Application North Dakota forms in airSlate SignNow to meet your specific requirements. The platform allows you to add branding elements, modify questions, and adjust the layout. This flexibility ensures that the application aligns with your business identity.

Get more for Individual Credit Application North Dakota

- Earthquake drill report template form

- Cms form 0938 0600

- Installation guide charge controller able solar form

- Capf 15 form

- Affidavit of correction notarial certificate affidavit of correction notarial certificate form

- Interim footwear invoice 435351003 form

- California form 592 f foreign partner or member annual withholding return

- Important changes to nsampampampi childrens bonus bonds form

Find out other Individual Credit Application North Dakota

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template