Contract for Deed Seller's Annual Accounting Statement Nebraska Form

What is the Contract For Deed Seller's Annual Accounting Statement Nebraska

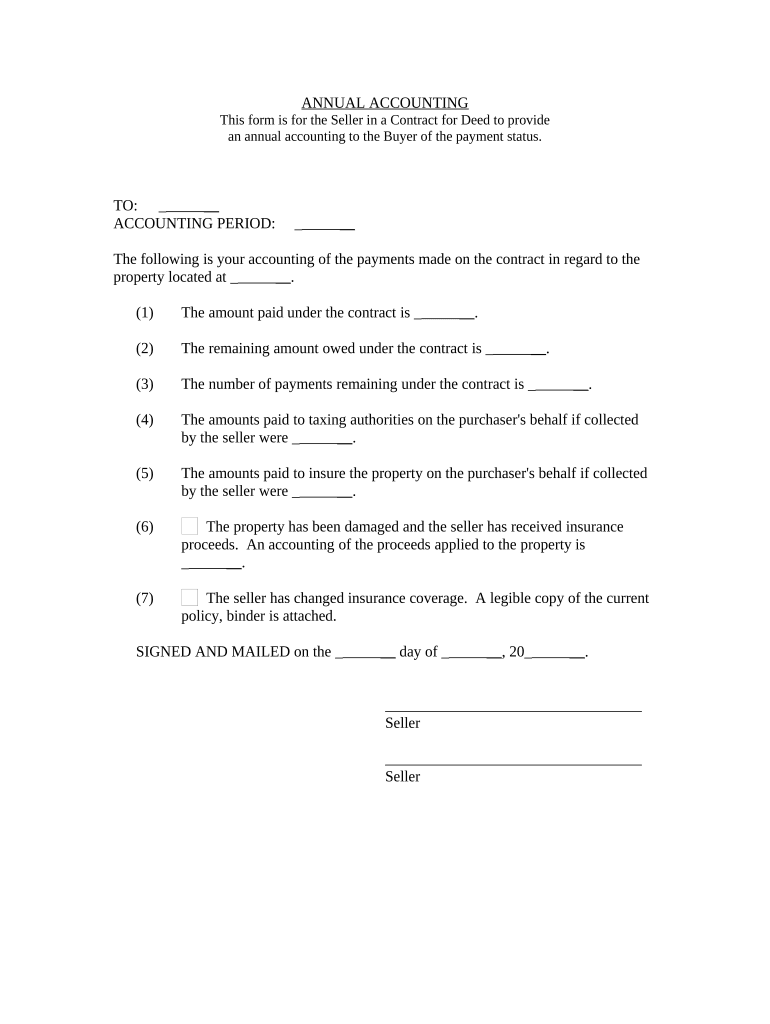

The Contract For Deed Seller's Annual Accounting Statement in Nebraska is a vital document used by sellers in a contract for deed arrangement. This form serves to provide a detailed account of the financial transactions and obligations between the seller and the buyer over the course of the year. It includes information such as payments received, outstanding balances, and any other relevant financial details. This statement helps ensure transparency and accountability in the seller-buyer relationship, making it essential for both parties to maintain accurate records.

How to use the Contract For Deed Seller's Annual Accounting Statement Nebraska

Using the Contract For Deed Seller's Annual Accounting Statement in Nebraska involves several straightforward steps. First, the seller should gather all relevant financial records related to the contract for deed. This includes payment history, interest calculations, and any additional fees. Next, the seller completes the statement by accurately detailing all transactions for the year. Once the form is filled out, it should be reviewed for accuracy before being provided to the buyer. This ensures that both parties have a clear understanding of the financial status of the contract.

Steps to complete the Contract For Deed Seller's Annual Accounting Statement Nebraska

Completing the Contract For Deed Seller's Annual Accounting Statement requires careful attention to detail. Here are the steps involved:

- Gather all financial documents related to the contract for deed.

- List all payments received from the buyer throughout the year.

- Calculate any interest accrued on the outstanding balance.

- Include any additional fees or charges that may apply.

- Review the completed statement for accuracy and completeness.

- Provide the statement to the buyer, ensuring they understand the details.

Key elements of the Contract For Deed Seller's Annual Accounting Statement Nebraska

Several key elements must be included in the Contract For Deed Seller's Annual Accounting Statement to ensure it is comprehensive and useful. These elements include:

- Payment History: A detailed record of all payments made by the buyer.

- Outstanding Balance: The remaining amount owed by the buyer at the end of the year.

- Interest Calculations: Any interest that has accrued on the outstanding balance.

- Fees and Charges: A breakdown of any additional fees incurred during the year.

- Signatures: Signatures from both the seller and the buyer to acknowledge receipt and agreement with the statement.

Legal use of the Contract For Deed Seller's Annual Accounting Statement Nebraska

The legal use of the Contract For Deed Seller's Annual Accounting Statement in Nebraska is crucial for maintaining compliance with state laws governing real estate transactions. This document serves as a formal record of the financial dealings between the seller and buyer, which can be essential in case of disputes. It is important for both parties to retain copies of this statement for their records, as it may be required for tax purposes or legal proceedings. Ensuring that the statement is completed accurately and in accordance with Nebraska law helps protect the interests of both the seller and the buyer.

State-specific rules for the Contract For Deed Seller's Annual Accounting Statement Nebraska

Nebraska has specific regulations that govern the use of the Contract For Deed Seller's Annual Accounting Statement. Sellers must adhere to these rules to ensure compliance. Key state-specific rules include:

- All financial transactions must be documented accurately and in a timely manner.

- The statement must be provided to the buyer within a specified timeframe, typically at the end of each fiscal year.

- Both parties should retain copies of the statement for a minimum of three years for record-keeping purposes.

- Any changes to the terms of the contract must be documented and communicated to the buyer.

Quick guide on how to complete contract for deed sellers annual accounting statement nebraska

Effortlessly prepare Contract For Deed Seller's Annual Accounting Statement Nebraska on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Contract For Deed Seller's Annual Accounting Statement Nebraska on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The simplest method to alter and eSign Contract For Deed Seller's Annual Accounting Statement Nebraska with ease

- Obtain Contract For Deed Seller's Annual Accounting Statement Nebraska and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive data using tools that airSlate SignNow provides specifically for this task.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Contract For Deed Seller's Annual Accounting Statement Nebraska and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Contract For Deed Seller's Annual Accounting Statement in Nebraska?

A Contract For Deed Seller's Annual Accounting Statement in Nebraska is a financial document that provides a detailed account of all transactions related to a Contract For Deed agreement. This statement summarizes payments made and remaining balances, ensuring clarity for both the buyer and seller. It helps maintain accurate records throughout the duration of the agreement.

-

How can I create a Contract For Deed Seller's Annual Accounting Statement in Nebraska using airSlate SignNow?

You can easily create a Contract For Deed Seller's Annual Accounting Statement in Nebraska by utilizing airSlate SignNow’s user-friendly templates. Simply select a pre-built template, fill in the necessary details, and our platform will generate a professional document ready for eSigning. This streamlines the process and ensures compliance with state requirements.

-

What features does airSlate SignNow offer for managing contracts in Nebraska?

airSlate SignNow offers a variety of features for managing contracts, including easy document creation, electronic signatures, and secure storage. The platform also provides tracking capabilities, allowing you to monitor the status of your Contract For Deed Seller's Annual Accounting Statement in Nebraska. These features enhance productivity and ensure your documents are legally compliant.

-

Is airSlate SignNow cost-effective for small businesses needing a Contract For Deed Seller's Annual Accounting Statement in Nebraska?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses requiring a Contract For Deed Seller's Annual Accounting Statement in Nebraska. With flexible pricing plans and no hidden fees, businesses can easily budget for their document management needs. Our affordable solutions make professional document processing accessible to everyone.

-

Can airSlate SignNow integrate with other tools for managing real estate transactions?

Absolutely! airSlate SignNow integrates seamlessly with various tools used in real estate transactions, enhancing the management of your Contract For Deed Seller's Annual Accounting Statement in Nebraska. You can connect with popular CRM systems, payment platforms, and cloud storage solutions to create a streamlined workflow that fits your needs perfectly.

-

What are the benefits of electronic signatures for a Contract For Deed Seller's Annual Accounting Statement in Nebraska?

Electronic signatures provide numerous benefits for a Contract For Deed Seller's Annual Accounting Statement in Nebraska, such as increased efficiency and security. They eliminate the need for physical paperwork, making it easy to sign documents from anywhere. Additionally, electronic signatures are legally binding and reduce the risk of document tampering.

-

How does airSlate SignNow ensure the security of my Contract For Deed Seller's Annual Accounting Statement in Nebraska?

airSlate SignNow prioritizes security with advanced encryption protocols that protect your Contract For Deed Seller's Annual Accounting Statement in Nebraska. Our platform complies with industry standards for data security, ensuring that your sensitive information remains confidential. You can trust us to keep your documents safe and secure at all times.

Get more for Contract For Deed Seller's Annual Accounting Statement Nebraska

- Land tax clearance certificate form

- Randwick city council rates form

- Visiting application and information form inmate word version 2 pages demande et information relatives aux visites dtenus

- Patient health questionnaire 2 phq 2 over the past 2 form

- Bariatricpatient packet 4 7 09 pdf bariatricky com form

- Employer designation and authorization form 3 08 br 002a doc

- Ac17 provider credentialing application 3 docx form

- Community service verification form 07 01 11 doc

Find out other Contract For Deed Seller's Annual Accounting Statement Nebraska

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online