Nebraska Limited Liability Company Form

What is the Nebraska Limited Liability Company

The Nebraska Limited Liability Company (LLC) is a popular business structure that combines the flexibility of a partnership with the liability protection of a corporation. This type of entity allows owners, known as members, to limit their personal liability for business debts and obligations. An LLC can be owned by one or more individuals or entities, making it a versatile option for various business ventures.

In Nebraska, the formation of an LLC is governed by state law, which outlines the necessary steps for registration and compliance. The LLC structure is particularly appealing for small business owners due to its straightforward management and tax benefits, including pass-through taxation, where profits are taxed only at the member level.

Steps to complete the Nebraska Limited Liability Company

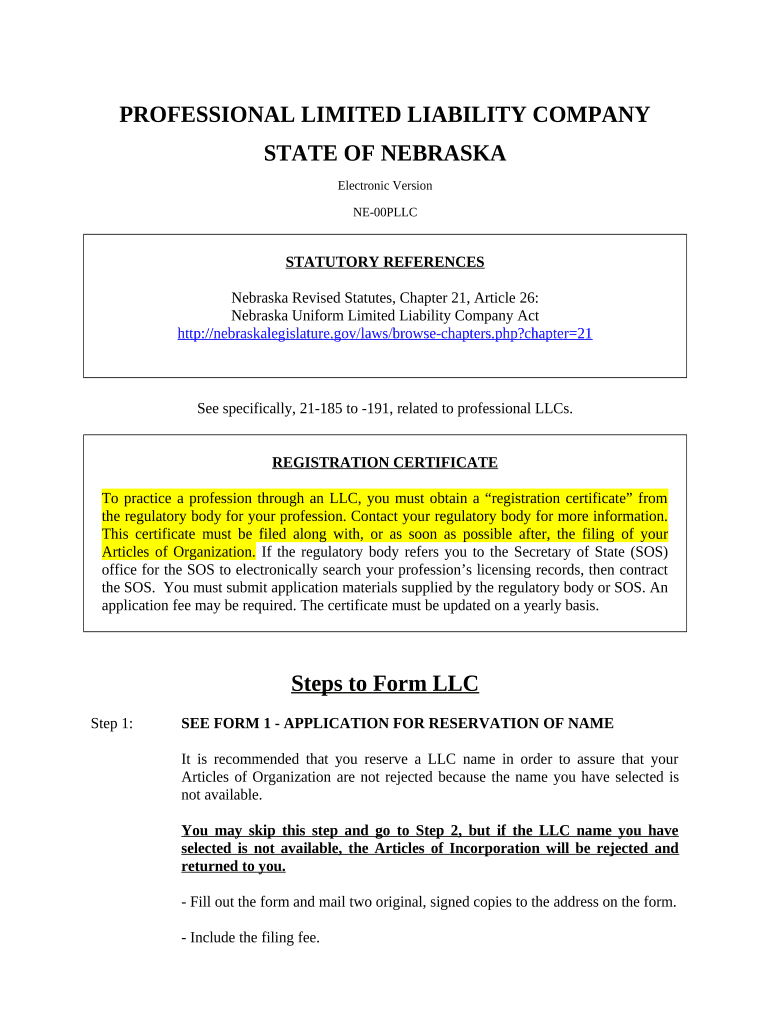

Completing the process to establish a Nebraska Limited Liability Company involves several key steps:

- Choose a name: The name must be unique and include "Limited Liability Company" or abbreviations like "LLC" or "L.L.C."

- Designate a registered agent: This individual or business entity must have a physical address in Nebraska and be available during business hours to receive legal documents.

- File Articles of Organization: Submit this document to the Nebraska Secretary of State, providing essential details about the LLC, including its name, purpose, and registered agent information.

- Draft an Operating Agreement: Although not required by law, this document outlines the management structure and operating procedures of the LLC, helping to prevent future disputes among members.

- Obtain necessary licenses and permits: Depending on the nature of the business, additional licenses may be required at the local, state, or federal level.

- Apply for an Employer Identification Number (EIN): This number is necessary for tax purposes and is required if the LLC has employees or multiple members.

Legal use of the Nebraska Limited Liability Company

The legal use of a Nebraska Limited Liability Company encompasses various activities that comply with state and federal regulations. An LLC can engage in any lawful business activity, including retail, services, and professional practices, as long as it adheres to the specific licensing requirements for its industry.

Additionally, the LLC structure provides personal liability protection for its members, meaning that personal assets are generally safeguarded from business debts and lawsuits. However, to maintain this protection, it is crucial for members to operate the LLC as a separate entity, keeping personal and business finances distinct.

Eligibility Criteria

To form a Nebraska Limited Liability Company, certain eligibility criteria must be met:

- At least one member is required, who can be an individual or another business entity.

- The chosen name for the LLC must comply with state naming conventions and be distinguishable from existing entities.

- Members must be of legal age, typically eighteen years or older.

- All members should agree to the terms outlined in the Operating Agreement, even if it is not filed with the state.

Required Documents

Establishing a Nebraska Limited Liability Company requires specific documents to be submitted to the state:

- Articles of Organization: This foundational document includes the LLC's name, address, registered agent, and purpose.

- Operating Agreement: While not mandatory, this internal document details the management structure and operational guidelines.

- Employer Identification Number (EIN) application: This form is needed for tax purposes if the LLC has employees or multiple members.

Form Submission Methods

Submitting the necessary forms to establish a Nebraska Limited Liability Company can be done through various methods:

- Online: The Nebraska Secretary of State's website allows for electronic filing of the Articles of Organization.

- By Mail: Completed forms can be mailed to the Secretary of State's office, along with any required fees.

- In-Person: Documents may also be submitted directly at the Secretary of State's office during business hours.

Quick guide on how to complete nebraska limited liability company

Prepare Nebraska Limited Liability Company effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage Nebraska Limited Liability Company on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Nebraska Limited Liability Company without any hassle

- Find Nebraska Limited Liability Company and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form—via email, SMS, or shareable link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign Nebraska Limited Liability Company and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nebraska limited liability company (LLC)?

A Nebraska limited liability company (LLC) is a business structure that combines the flexibility of a partnership with the limited liability of a corporation. This means that the owners, known as members, are generally protected from personal liability for the debts and obligations of the business. Forming an LLC in Nebraska allows business owners to benefit from pass-through taxation while enjoying the protections that come with corporate status.

-

How do I form a Nebraska limited liability company?

To form a Nebraska limited liability company, you must file the Articles of Organization with the Secretary of State and pay the required filing fee. Additionally, it's essential to create an operating agreement to outline the management structure and operational procedures of the LLC. This document is not required by law but is highly recommended for clarity and legal protection.

-

What are the benefits of a Nebraska limited liability company?

The primary benefits of a Nebraska limited liability company include personal liability protection and pass-through taxation. Members are shielded from personal liability for business debts, ensuring their personal assets remain secure. Additionally, profits and losses can be reported directly on the members' personal tax returns, simplifying tax obligations.

-

What is the cost to establish a Nebraska limited liability company?

Establishing a Nebraska limited liability company involves a filing fee for the Articles of Organization, typically around $100. While this is the primary cost, additional expenses may arise from drafting an operating agreement or other legal documents. It's advisable to budget for potential costs associated with compliance and ongoing maintenance of the LLC.

-

Can airSlate SignNow help with managing a Nebraska limited liability company?

Yes, airSlate SignNow provides an effective platform for managing documents related to your Nebraska limited liability company. The solution enables you to easily send, sign, and store important documents securely. With its user-friendly interface, airSlate SignNow simplifies paperwork, making it ideal for busy business owners.

-

What integrations does airSlate SignNow offer for Nebraska limited liability companies?

airSlate SignNow offers a range of integrations that can benefit Nebraska limited liability companies. You can connect with popular applications like Google Workspace, Salesforce, and Microsoft Teams, enhancing your team's workflow and productivity. These integrations streamline document management processes, allowing for seamless collaboration.

-

Is airSlate SignNow secure for my Nebraska limited liability company documents?

Absolutely! airSlate SignNow ensures that your documents are secure with industry-leading encryption and compliance with regulations like GDPR and CCPA. This level of security is vital for a Nebraska limited liability company that needs to protect sensitive information. Your business documents will be safely managed, allowing you to focus on growth.

Get more for Nebraska Limited Liability Company

Find out other Nebraska Limited Liability Company

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online