Quitclaim Deed from Corporation to Corporation Nebraska Form

What is the Quitclaim Deed From Corporation To Corporation Nebraska

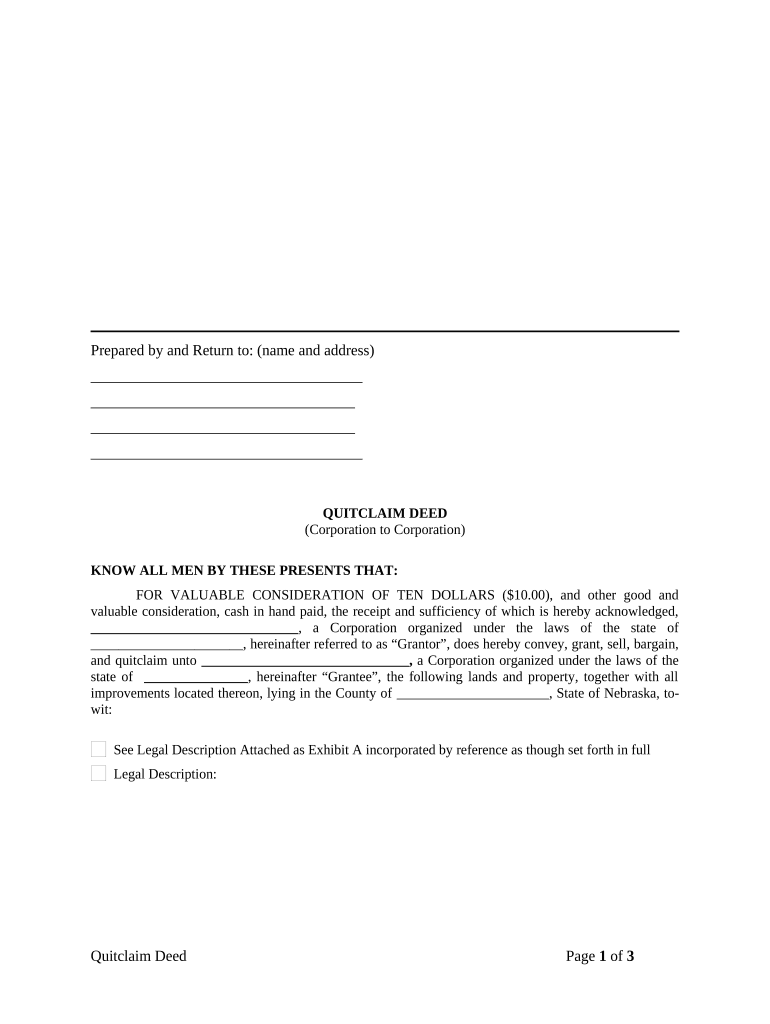

A quitclaim deed from corporation to corporation in Nebraska is a legal document that transfers ownership of property from one corporation to another without any warranties regarding the title. This means that the transferring corporation relinquishes any claim to the property, and the receiving corporation accepts it as-is. This type of deed is commonly used in business transactions where corporations need to transfer property quickly and without the complications of a warranty deed.

Key Elements of the Quitclaim Deed From Corporation To Corporation Nebraska

Several key elements must be included in a quitclaim deed for it to be valid in Nebraska. These elements include:

- Names of the Parties: The full legal names of both corporations involved in the transaction.

- Property Description: A detailed description of the property being transferred, including its legal description.

- Consideration: The amount paid for the property, if applicable, or a statement indicating that the transfer is a gift.

- Signature: The authorized representative of the transferring corporation must sign the deed.

- Notarization: The deed must be notarized to verify the authenticity of the signatures.

Steps to Complete the Quitclaim Deed From Corporation To Corporation Nebraska

Completing a quitclaim deed from corporation to corporation in Nebraska involves several steps:

- Gather necessary information about both corporations and the property.

- Draft the quitclaim deed, ensuring all required elements are included.

- Have the deed signed by an authorized representative of the transferring corporation.

- Obtain notarization of the signatures to validate the document.

- File the completed deed with the appropriate county recorder’s office to make the transfer official.

Legal Use of the Quitclaim Deed From Corporation To Corporation Nebraska

In Nebraska, a quitclaim deed is legally used for transferring property ownership between corporations. It is particularly beneficial in situations where the parties have a level of trust, as it does not guarantee that the title is free of defects. This type of deed is often used in mergers, acquisitions, or when one corporation is divesting its assets. It is essential to ensure that the deed complies with Nebraska state laws to avoid future disputes.

State-Specific Rules for the Quitclaim Deed From Corporation To Corporation Nebraska

Nebraska has specific rules governing the use of quitclaim deeds. These include:

- The deed must be executed by an authorized officer of the corporation.

- It must be notarized to be valid.

- Filing the deed with the county recorder is necessary for it to take effect against third parties.

- Any outstanding liens or encumbrances on the property should be disclosed to avoid legal complications.

How to Use the Quitclaim Deed From Corporation To Corporation Nebraska

Using a quitclaim deed from corporation to corporation involves preparing the document correctly and ensuring it meets all legal requirements. After drafting the deed, the transferring corporation must sign it, and a notary public must witness the signature. Once notarized, the deed should be filed with the county recorder’s office where the property is located. This process ensures that the transfer is legally recognized and protects the interests of both parties involved.

Quick guide on how to complete quitclaim deed from corporation to corporation nebraska

Complete Quitclaim Deed From Corporation To Corporation Nebraska effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling users to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Quitclaim Deed From Corporation To Corporation Nebraska on any platform using airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

How to modify and electronically sign Quitclaim Deed From Corporation To Corporation Nebraska with ease

- Obtain Quitclaim Deed From Corporation To Corporation Nebraska and click Get Form to begin.

- Make use of the tools available to fill out your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your revisions.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your choice. Modify and electronically sign Quitclaim Deed From Corporation To Corporation Nebraska and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Corporation in Nebraska?

A Quitclaim Deed From Corporation To Corporation in Nebraska is a legal document allowing one corporation to transfer its interest in a property to another corporation without guaranteeing the title. This process is often quicker and less formal than other types of property transfer. Using airSlate SignNow, you can create and sign this document electronically, making it a simple and efficient solution.

-

How does airSlate SignNow simplify the process of creating a Quitclaim Deed From Corporation To Corporation in Nebraska?

airSlate SignNow offers user-friendly templates that allow you to easily generate a Quitclaim Deed From Corporation To Corporation in Nebraska. The platform’s intuitive interface guides you through each step, ensuring that all necessary information is included. This streamlines the signing process for both corporations, saving time and reducing errors.

-

What are the key benefits of using airSlate SignNow for Quitclaim Deeds?

Using airSlate SignNow for Quitclaim Deeds provides several benefits including reduced paperwork, faster transactions, and the ability to eSign from anywhere. The platform's cost-effective solution allows businesses to manage their documentation efficiently. Additionally, it helps maintain compliance with Nebraska’s legal requirements for real estate transactions.

-

Is there a cost associated with using airSlate SignNow for Quitclaim Deeds?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that facilitate the creation and management of Quitclaim Deeds From Corporation To Corporation in Nebraska. By choosing airSlate SignNow, you can save signNowly compared to traditional paper-based methods.

-

What features does airSlate SignNow offer for managing Quitclaim Deeds?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance the management of Quitclaim Deeds From Corporation To Corporation in Nebraska, allowing corporations to efficiently track their transactions. Furthermore, the secure eSignature process ensures that your documents are legally binding.

-

Can airSlate SignNow integrate with other business applications?

Absolutely! airSlate SignNow easily integrates with various business applications, enhancing your ability to manage Quitclaim Deeds From Corporation To Corporation in Nebraska. This means you can connect the platform with tools that your organization already uses, streamlining your workflow and improving overall productivity.

-

Is it legal to use airSlate SignNow for Quitclaim Deeds in Nebraska?

Yes, it is legal to use airSlate SignNow for Quitclaim Deeds in Nebraska as long as the document is properly executed and meets state requirements. The platform ensures that all eSignatures and documents comply with the laws governing real estate transactions in Nebraska. This gives corporations confidence in the validity of their transactions.

Get more for Quitclaim Deed From Corporation To Corporation Nebraska

- Corrective deed georgia form

- Printablecreditcardcancellation form

- Eyelash extensions agreement and consent form name dob telephone cell would you like to receive text reminders of your

- Da 3161 1 fillable form

- Optional form petition for sentencing or reduction to misdemeanor kings courts ca

- Advocare progress tracker form

- Da form 1251

- Governor alabama gov assets 03 03 2225th supplemental soe covid 19 office of the governor of form

Find out other Quitclaim Deed From Corporation To Corporation Nebraska

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself