Living Trust for Husband and Wife with One Child Nebraska Form

What is the Living Trust For Husband And Wife With One Child Nebraska

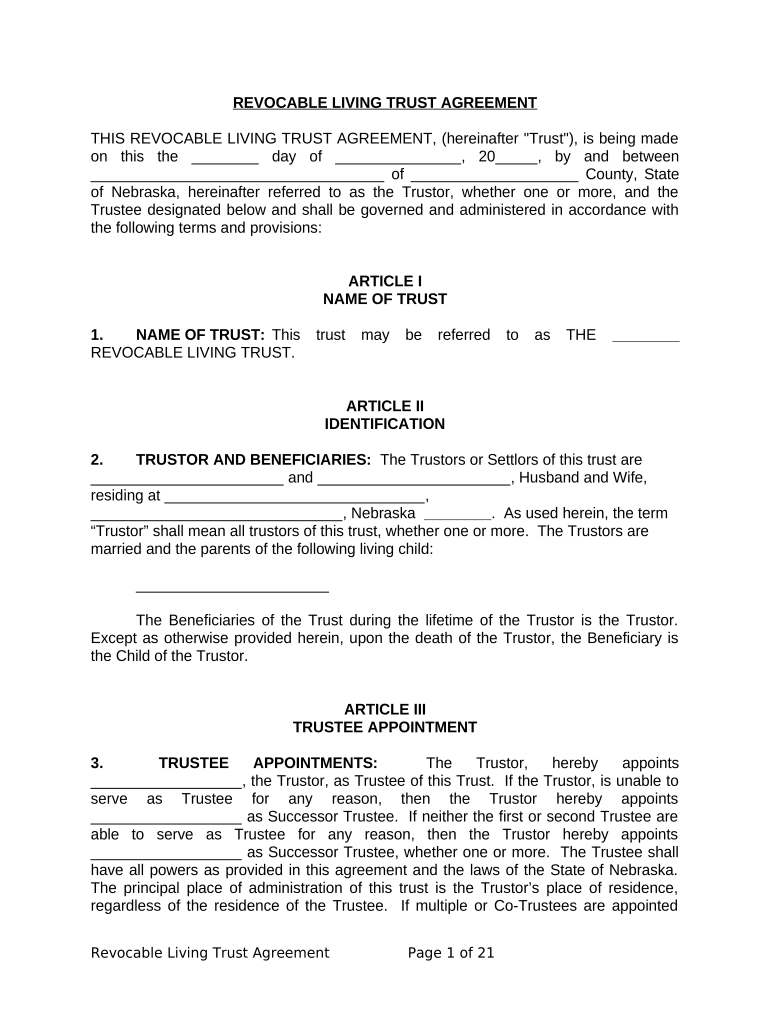

A living trust for husband and wife with one child in Nebraska is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets should be distributed upon their death. This type of trust can help avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It typically includes provisions for both spouses, allowing them to act as co-trustees, and may outline specific instructions for asset management and distribution, tailored to the family's needs.

How to use the Living Trust For Husband And Wife With One Child Nebraska

To use a living trust for husband and wife with one child in Nebraska, couples must first create the trust document, which outlines the terms and conditions of the trust. This document should include details about the assets being placed into the trust, the responsibilities of the trustees, and instructions for distribution after the death of the surviving spouse. Once established, the couple can transfer ownership of their assets into the trust, ensuring that they are managed according to the trust's terms. Regular reviews and updates may be necessary to reflect changes in family circumstances or financial situations.

Steps to complete the Living Trust For Husband And Wife With One Child Nebraska

Completing a living trust for husband and wife with one child in Nebraska involves several key steps:

- Consult with an estate planning attorney to understand the legal requirements and implications.

- Draft the trust document, detailing the terms, trustees, and beneficiaries.

- Transfer assets into the trust, which may include real estate, bank accounts, and investments.

- Sign the trust document in accordance with Nebraska state laws, ensuring that witnesses or notarization is obtained if required.

- Review and update the trust periodically to ensure it meets the family's evolving needs.

Key elements of the Living Trust For Husband And Wife With One Child Nebraska

Key elements of a living trust for husband and wife with one child in Nebraska include:

- Trustees: Typically, both spouses act as co-trustees, allowing them to manage the trust together.

- Beneficiaries: The couple's child is usually named as the primary beneficiary, receiving assets upon the death of both parents.

- Asset Management: The trust document specifies how assets are to be managed during the couple's lifetime and distributed after their passing.

- Revocability: Most living trusts are revocable, allowing the couple to make changes as needed.

State-specific rules for the Living Trust For Husband And Wife With One Child Nebraska

In Nebraska, specific rules govern the creation and management of living trusts. These include requirements for the trust document to be in writing, the need for clear identification of the trust's assets, and provisions for the appointment of trustees. Nebraska law also allows for the revocation or amendment of a living trust at any time, provided both spouses agree. It's important to ensure that the trust complies with state laws to maintain its legal validity and effectiveness.

Legal use of the Living Trust For Husband And Wife With One Child Nebraska

The legal use of a living trust for husband and wife with one child in Nebraska is primarily to manage assets and facilitate their transfer upon death. This type of trust is recognized under Nebraska law and can be used to avoid probate, which can be a lengthy and costly process. By clearly outlining the terms of asset distribution and management, the trust provides legal protection for the family's wishes and helps ensure that the child receives their inheritance smoothly and efficiently.

Quick guide on how to complete living trust for husband and wife with one child nebraska

Effortlessly Prepare Living Trust For Husband And Wife With One Child Nebraska on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Living Trust For Husband And Wife With One Child Nebraska on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Living Trust For Husband And Wife With One Child Nebraska with Ease

- Locate Living Trust For Husband And Wife With One Child Nebraska and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Living Trust For Husband And Wife With One Child Nebraska and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in Nebraska?

A Living Trust For Husband And Wife With One Child in Nebraska is a legal document that allows couples to manage their assets and plan for the distribution of their estate well before they pass. This type of trust ensures that your child will receive the intended inheritance while minimizing the probate hassle.

-

How does a Living Trust benefit us as a couple with one child in Nebraska?

Creating a Living Trust For Husband And Wife With One Child in Nebraska offers several benefits, including avoiding probate, ensuring privacy regarding your assets, and providing a clear plan for your child's inheritance. It allows couples to retain control over their assets while also safeguarding their child's financial future.

-

What are the costs associated with setting up a Living Trust For Husband And Wife With One Child in Nebraska?

The costs for setting up a Living Trust For Husband And Wife With One Child in Nebraska can vary depending on the complexity of your estate and the services of a legal professional. Generally, you can expect to pay between $1,500 to $3,000 for comprehensive service, which could be a cost-effective solution compared to other estate planning methods.

-

Can we change our Living Trust For Husband And Wife With One Child in Nebraska in the future?

Yes, a Living Trust For Husband And Wife With One Child in Nebraska is flexible and can be amended or revoked as your circumstances change. Whether you have more children, acquire new assets, or decide to change beneficiaries, you can easily update your trust documentation to reflect your current wishes.

-

What documents are needed to create a Living Trust For Husband And Wife With One Child in Nebraska?

To create a Living Trust For Husband And Wife With One Child in Nebraska, you will typically need documents that detail your assets, such as bank statements, real estate deeds, and other financial documents. Additionally, personal identification and information about your child and any chosen trustees will also be required.

-

Do we need an attorney to set up a Living Trust For Husband And Wife With One Child in Nebraska?

While it's possible to set up a Living Trust For Husband And Wife With One Child in Nebraska without an attorney, consulting one is highly recommended. An attorney can ensure that the trust is valid, complies with Nebraska laws, and accurately reflects your wishes to protect your family.

-

What happens to our Living Trust if we move out of Nebraska?

If you move out of Nebraska, your Living Trust For Husband And Wife With One Child can still be valid, but it may need to be reviewed to ensure compliance with the laws of your new state. It's advisable to consult with an estate planning attorney in your new location to make any necessary adjustments and maintain its effectiveness.

Get more for Living Trust For Husband And Wife With One Child Nebraska

- Noaa osha respirator medical evaluation questionnaire corpscpc noaa form

- Positive flu test paperwork 387631652 form

- Inquiry access only 386752293 form

- Homeowner contractor agreement template form

- Work permit va form

- Request for personnel file documents grand prairie isd form

- Wales occupation contract template form

- Wardrobe stylist contract template form

Find out other Living Trust For Husband And Wife With One Child Nebraska

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template