Release of Mortgage Individual Nebraska Form

What is the Release of Mortgage Individual Nebraska?

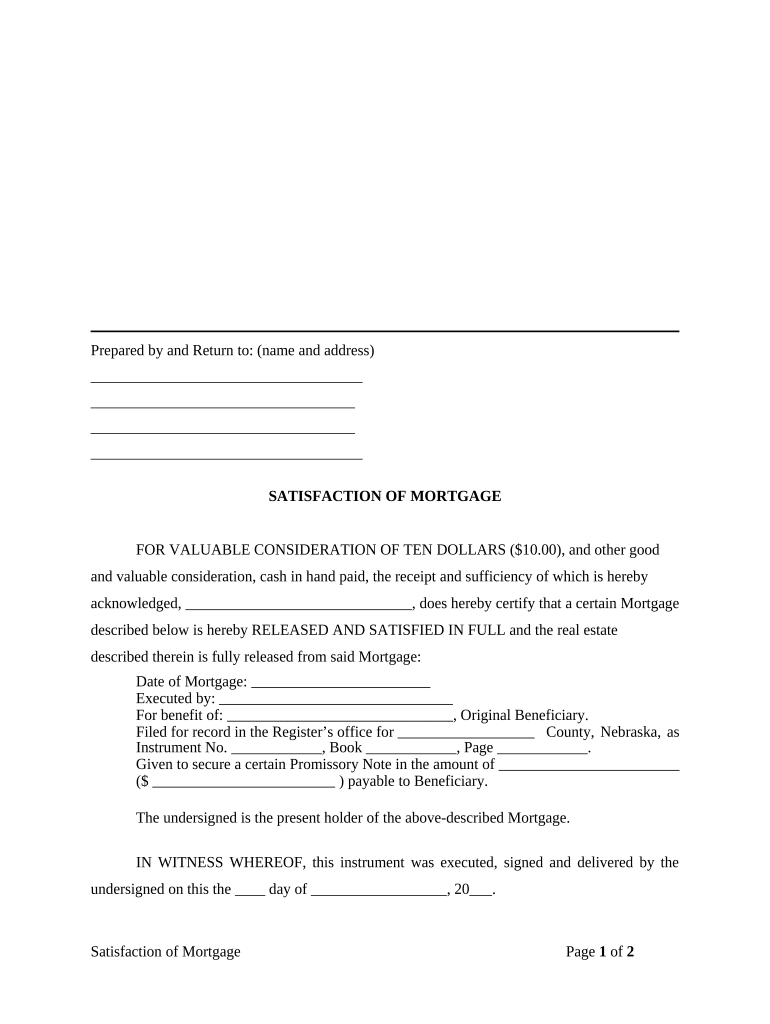

The Release of Mortgage Individual Nebraska is a legal document that signifies the discharge of a mortgage obligation. Once a borrower has satisfied their mortgage payments, this document is filed to remove the lien on the property, confirming that the lender no longer has a claim against it. This release is essential for homeowners to clear their title and is often required when selling or refinancing the property.

Steps to Complete the Release of Mortgage Individual Nebraska

Completing the Release of Mortgage Individual Nebraska involves several important steps:

- Gather necessary information, including the mortgage account number and property details.

- Obtain the correct form from a reliable source or legal professional.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign the document in the presence of a notary public, if required.

- Submit the completed form to the appropriate county office for recording.

Legal Use of the Release of Mortgage Individual Nebraska

The Release of Mortgage Individual Nebraska serves a crucial legal function. It formally acknowledges that the borrower has fulfilled their mortgage obligations and that the lender relinquishes any rights to the property. This document must be executed correctly to avoid any future disputes regarding property ownership. Legal validity is ensured by following state-specific regulations and obtaining necessary signatures.

Key Elements of the Release of Mortgage Individual Nebraska

Several key elements must be included in the Release of Mortgage Individual Nebraska to ensure its validity:

- The names of the borrower and lender.

- The property description, including the address and legal description.

- The mortgage account number.

- A statement confirming the satisfaction of the mortgage.

- The date of execution and signatures of the involved parties.

How to Use the Release of Mortgage Individual Nebraska

To use the Release of Mortgage Individual Nebraska, homeowners should first ensure that they have paid off their mortgage in full. Once confirmed, they can complete the form and submit it to the appropriate county office. This process officially releases the mortgage lien, allowing the homeowner to clear their title. Keeping a copy of the recorded release is advisable for personal records and future transactions.

State-Specific Rules for the Release of Mortgage Individual Nebraska

In Nebraska, specific rules govern the execution and filing of the Release of Mortgage. These include requirements for notarization, the necessity of filing within a certain timeframe after mortgage satisfaction, and adherence to local county regulations. It is important for homeowners to familiarize themselves with these rules to ensure compliance and avoid potential legal issues.

Quick guide on how to complete release of mortgage individual nebraska

Effortlessly Prepare Release Of Mortgage Individual Nebraska on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Release Of Mortgage Individual Nebraska on any device with airSlate SignNow's Android or iOS applications and enhance your document-based workflows today.

How to Edit and Electronically Sign Release Of Mortgage Individual Nebraska with Ease

- Locate Release Of Mortgage Individual Nebraska and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive data using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Release Of Mortgage Individual Nebraska and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a release mortgage sample?

A release mortgage sample is a template used to document the satisfaction and release of a mortgage on a property. It serves as proof that a borrower has repaid their mortgage in full, thus freeing the property from the mortgage lien. Utilizing a release mortgage sample can simplify the process for both borrowers and lenders.

-

How can I create a release mortgage sample using airSlate SignNow?

With airSlate SignNow, you can easily create a release mortgage sample by customizing our available templates. Our user-friendly platform allows you to fill in the required information, add signatures, and send the document for eSigning with just a few clicks. This streamlines the process and reduces paperwork.

-

What features does airSlate SignNow offer for managing release mortgage samples?

airSlate SignNow offers features such as document templates, eSigning, and tracking capabilities that are essential for managing release mortgage samples. You can also integrate with other tools and automate workflows to enhance efficiency. This ensures that your documentation processes are seamless and organized.

-

Is there a cost associated with using airSlate SignNow for a release mortgage sample?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can create and manage release mortgage samples at a competitive price, and the cost typically includes unlimited eSignatures and access to customizable templates. Consider trying our free trial to explore all features before committing.

-

Can I store my release mortgage samples securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including release mortgage samples. Our platform ensures that your sensitive information is protected with industry-standard security measures, including encryption and secure access controls.

-

What integrations does airSlate SignNow offer for managing release mortgage samples?

airSlate SignNow integrates seamlessly with various third-party applications, including CRM systems, cloud storage services, and productivity tools. This allows you to manage release mortgage samples and other documents within your existing workflows, making the document management process more efficient.

-

How does eSigning a release mortgage sample work with airSlate SignNow?

ESigning a release mortgage sample with airSlate SignNow is simple and quick. Once the document is ready, you can send it to the necessary parties for signatures via email. Recipients can sign electronically from any device, and you will receive notifications once the document is fully signed and completed.

Get more for Release Of Mortgage Individual Nebraska

- Fcma application example form

- Interruttori orari e dispositivi di temporizzazione catalogo bticino form

- Did you hear about the two punsters who told a lot of jokes about cats form

- Emergency ambulance cleaning schedule form

- Marseilles training center form

- Westmed mammogram form

- Notary education fund form

- Interior design contract template form

Find out other Release Of Mortgage Individual Nebraska

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document