Nebraska Deed Reconveyance Form

What is the Nebraska Deed Reconveyance

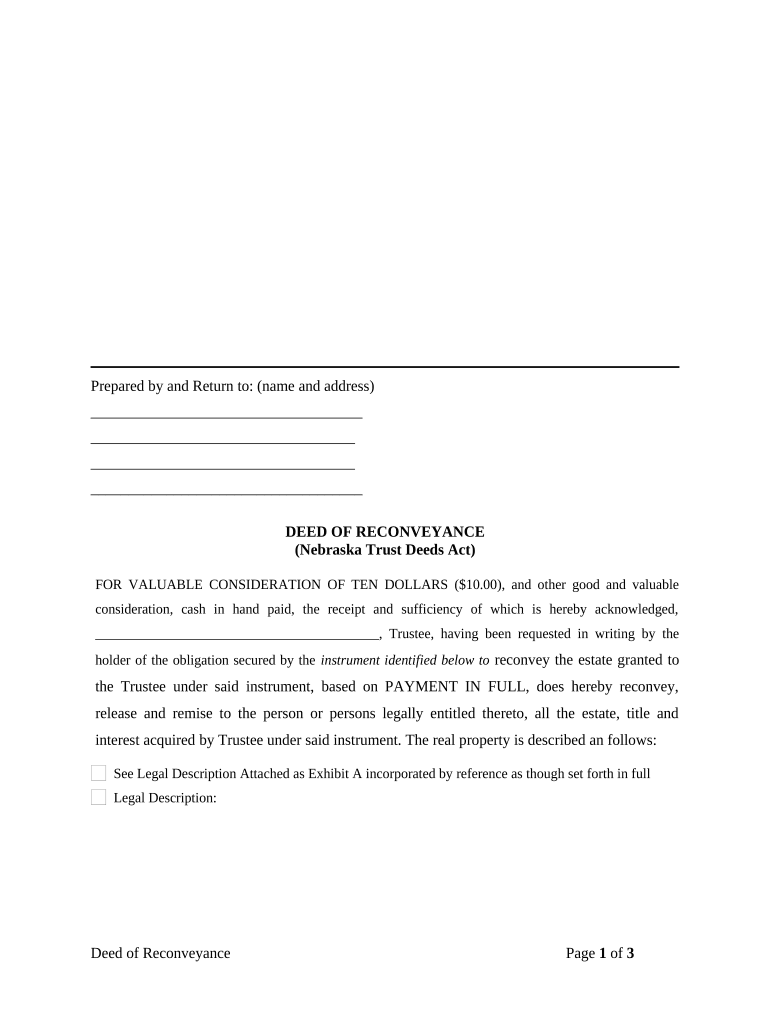

The Nebraska deed reconveyance is a legal document used to transfer the title of a property back to the borrower once a mortgage or deed of trust has been fully paid off. This process signifies the completion of the borrower’s obligations under the loan agreement. The reconveyance serves as proof that the lender no longer has a claim on the property, allowing the borrower to regain full ownership rights. It is crucial for homeowners to understand this document, as it plays a key role in clearing any liens or encumbrances associated with the property.

How to use the Nebraska Deed Reconveyance

To utilize the Nebraska deed reconveyance, the borrower must first ensure that all loan payments have been made in full. Once the loan is satisfied, the lender prepares the reconveyance document. The borrower should review this document for accuracy before signing. After signing, the document must be recorded with the appropriate county clerk or register of deeds to make the reconveyance official. This process not only protects the borrower’s rights but also provides a public record of the property’s clear title.

Steps to complete the Nebraska Deed Reconveyance

Completing the Nebraska deed reconveyance involves several key steps:

- Confirm that the mortgage or deed of trust has been fully paid.

- Request the lender to prepare the deed reconveyance document.

- Review the document for accuracy and completeness.

- Sign the document in the presence of a notary public.

- File the signed reconveyance with the county clerk or register of deeds.

Following these steps ensures that the reconveyance is legally binding and effectively restores the title to the borrower.

Legal use of the Nebraska Deed Reconveyance

The Nebraska deed reconveyance is legally recognized as a means to restore property ownership once a mortgage has been satisfied. It is essential for the document to meet state-specific requirements to ensure its validity. This includes proper notarization and recording with the appropriate government office. By adhering to these legal stipulations, borrowers can protect their property rights and avoid potential disputes regarding ownership.

Key elements of the Nebraska Deed Reconveyance

Several key elements are essential in the Nebraska deed reconveyance, including:

- The names and addresses of the borrower and lender.

- A clear description of the property being reconveyed.

- A statement confirming that the mortgage or deed of trust has been paid in full.

- The signatures of both the lender and borrower, along with a notary acknowledgment.

These elements ensure that the reconveyance is complete and legally enforceable, providing clarity and protection for all parties involved.

State-specific rules for the Nebraska Deed Reconveyance

Nebraska has specific rules governing the deed reconveyance process. It is important to comply with state laws regarding the format and content of the document. Additionally, the reconveyance must be recorded within a certain timeframe after the loan is paid off to be considered valid. Understanding these state-specific regulations helps borrowers navigate the reconveyance process effectively and ensures that their rights are protected.

Quick guide on how to complete nebraska deed reconveyance

Complete Nebraska Deed Reconveyance effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the resources necessary to generate, modify, and electronically sign your documents quickly without interruptions. Handle Nebraska Deed Reconveyance on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

How to modify and electronically sign Nebraska Deed Reconveyance with ease

- Locate Nebraska Deed Reconveyance and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Nebraska Deed Reconveyance to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nebraska deed reconveyance?

A Nebraska deed reconveyance is a legal document that signifies the return of property ownership to the borrower after the mortgage or deed of trust has been paid in full. This document is essential for clearing the borrower's title and ensures that the lender's claim on the property is removed.

-

How do I obtain a Nebraska deed reconveyance?

To obtain a Nebraska deed reconveyance, you need to request the document from your lender or title company once your mortgage is satisfied. The lender will typically prepare the reconveyance and record it with the county to finalize the process and update public records.

-

What are the benefits of using airSlate SignNow for Nebraska deed reconveyance?

Using airSlate SignNow for Nebraska deed reconveyance offers a streamlined and efficient process. You can easily eSign the reconveyance documents and quickly send them to relevant parties, reducing the time it takes to finalize property ownership transfers.

-

What features does airSlate SignNow provide for Nebraska deed reconveyance?

airSlate SignNow provides features such as eSigning, document templates, and tracking capabilities specifically designed to facilitate the Nebraska deed reconveyance process. These tools help ensure that all parties involved can efficiently manage and verify the transaction.

-

Is there a cost associated with using airSlate SignNow for Nebraska deed reconveyance?

Yes, there is a cost associated with using airSlate SignNow, but it is competitively priced to provide value for your business. The costs vary depending on the subscription plan, which can help you save on legal and administrative fees related to Nebraska deed reconveyance.

-

Can airSlate SignNow integrate with other systems for Nebraska deed reconveyance?

Yes, airSlate SignNow offers integrations with various business systems, ensuring a seamless workflow for Nebraska deed reconveyance and other document processes. You can connect it with CRM, document management, and storage solutions to optimize your operations.

-

How secure is airSlate SignNow for processing Nebraska deed reconveyance documents?

airSlate SignNow prioritizes security and employs advanced encryption methods to protect your Nebraska deed reconveyance documents. With features such as user authentication and secure cloud storage, your sensitive information is well-guarded throughout the signing process.

Get more for Nebraska Deed Reconveyance

- As is residential contract for sale and purchase form

- Gozo channel frequent travel card form

- Forms eft form

- Nz arrival card 473621175 form

- Legacy health system childrens emergency consent form

- H 323 overview cisco form

- Roommate release agreement template form

- Roommate sublease agreement template form

Find out other Nebraska Deed Reconveyance

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document