New Hampshire Lien Form

What is the New Hampshire Lien

The New Hampshire lien is a legal claim against property that ensures the payment of a debt or obligation. This document serves as a formal notice to the public that a creditor has a right to the specified property until the debt is satisfied. In New Hampshire, liens can be placed on various types of property, including real estate and personal property, depending on the nature of the debt. Understanding the implications of a lien is crucial for both creditors and debtors, as it affects ownership rights and the ability to sell or transfer property.

How to use the New Hampshire Lien

Using the New Hampshire lien involves several steps to ensure it is legally binding and enforceable. First, the creditor must determine the appropriate type of lien based on the debt and the property involved. Next, the lien must be properly filed with the appropriate state or local authority, which may vary depending on the type of property. It is essential to include all necessary details, such as the debtor's information and the amount owed, to avoid any disputes later. Once filed, the lien serves as a public record, alerting potential buyers or lenders about the existing claim on the property.

Steps to complete the New Hampshire Lien

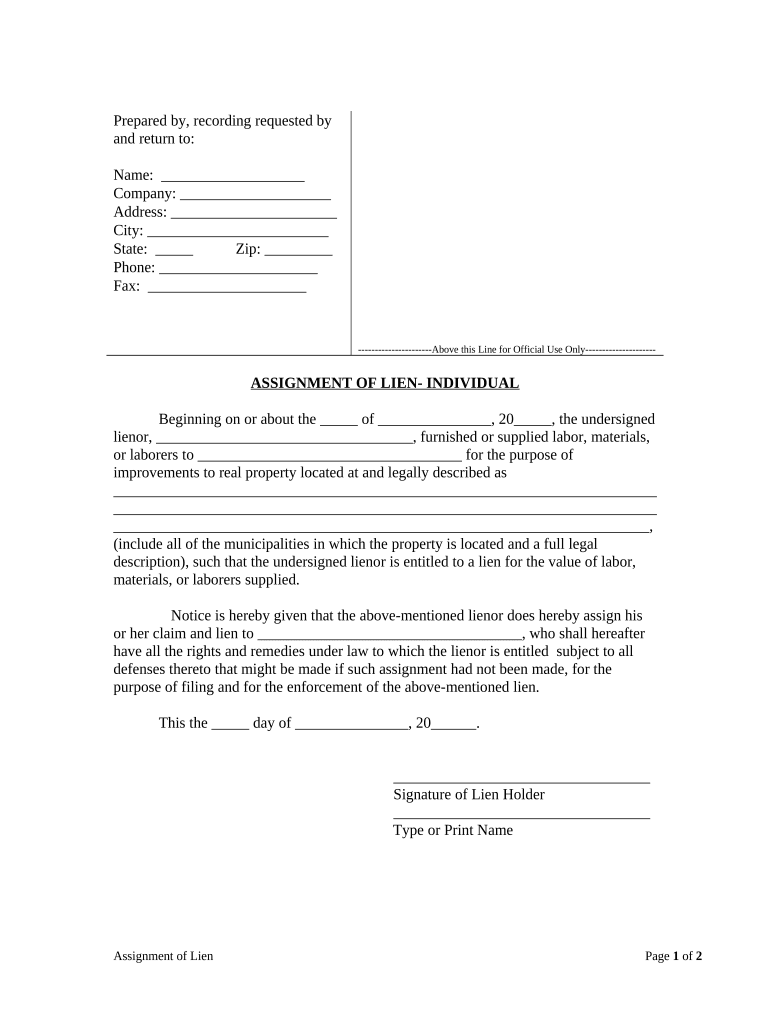

Completing the New Hampshire lien requires careful attention to detail. Follow these steps to ensure proper execution:

- Identify the type of lien needed based on the debt.

- Gather all relevant information about the debtor and the property.

- Fill out the lien form accurately, including the amount owed and any pertinent dates.

- File the completed form with the appropriate authority, such as the county clerk's office.

- Pay any required filing fees associated with the lien.

- Keep a copy of the filed lien for your records.

Legal use of the New Hampshire Lien

The legal use of the New Hampshire lien is governed by state laws that outline the rights and responsibilities of both creditors and debtors. A lien must be filed in accordance with these laws to be enforceable. It is important for creditors to understand the legal implications of placing a lien, including the potential for foreclosure on the property if the debt remains unpaid. Debtors should be aware of their rights, including the ability to dispute the lien if they believe it was filed improperly or if the debt is not valid.

Key elements of the New Hampshire Lien

Several key elements must be present for a New Hampshire lien to be valid:

- The lien must clearly identify the debtor and the property subject to the lien.

- The amount of the debt must be specified.

- The lien must be filed with the appropriate authority to establish public notice.

- Compliance with any specific state laws regarding the type of lien being filed is necessary.

- Timely filing is crucial to ensure the lien's enforceability.

Form Submission Methods for the New Hampshire Lien

Submitting the New Hampshire lien can be done through various methods, depending on the requirements of the filing authority. Common submission methods include:

- Online submission through the state’s official website, where applicable.

- Mailing the completed form to the appropriate county office.

- In-person submission at the local clerk's office for immediate processing.

Each method may have different processing times and fees, so it is advisable to check with the local authority for specific instructions.

Quick guide on how to complete new hampshire lien 497318620

Complete New Hampshire Lien effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the correct template and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents rapidly without delays. Handle New Hampshire Lien on any device using airSlate SignNow’s Android or iOS applications and streamline any document-centered process today.

The simplest way to modify and electronically sign New Hampshire Lien with ease

- Locate New Hampshire Lien and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically designed for that by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal authority as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your selected device. Modify and electronically sign New Hampshire Lien to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is nh lien and how does it relate to airSlate SignNow?

NH lien refers to a Notice of Lien, which is a legal document used to establish a creditor's right to a property. airSlate SignNow provides an easy-to-use platform for businesses to send and eSign nh lien documents efficiently, ensuring compliance and secure transactions.

-

How much does airSlate SignNow cost for handling nh lien documents?

Pricing for airSlate SignNow varies based on the plan you choose, starting with a free trial. For handling nh lien documents, our pricing remains competitive, allowing businesses to manage such important documents cost-effectively without sacrificing features or ease of use.

-

What features does airSlate SignNow offer for creating nh lien documents?

airSlate SignNow offers robust features for creating nh lien documents, including customizable templates, secure eSignature options, and automated workflows. These tools allow for quick document generation and efficient signature collection, which is essential for managing liens.

-

How can airSlate SignNow benefit my business in dealing with nh lien documents?

Utilizing airSlate SignNow for nh lien documents improves turnaround time and enhances professionalism in your documentation processes. The platform's user-friendly interface and reliable security make it easier for businesses to send, sign, and store their liens safely.

-

Is there an integration for nh lien document management with other software?

Yes, airSlate SignNow integrates seamlessly with numerous business applications, enhancing your ability to manage nh lien documents alongside your existing tools. This integration streamlines processes, making it easier to handle lien-related tasks within one ecosystem.

-

How does airSlate SignNow ensure the security of my nh lien documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and authentication measures to ensure that your nh lien documents are protected against unauthorized access and data bsignNowes, giving you peace of mind.

-

Can I customize nh lien templates in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize nh lien templates according to their specific requirements. This capability enables you to create personalized documents quickly, ensuring they meet legal standards while reflecting your brand's identity.

Get more for New Hampshire Lien

Find out other New Hampshire Lien

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors