Living Trust for Husband and Wife with No Children New Hampshire Form

What is the Living Trust for Husband and Wife with No Children in New Hampshire

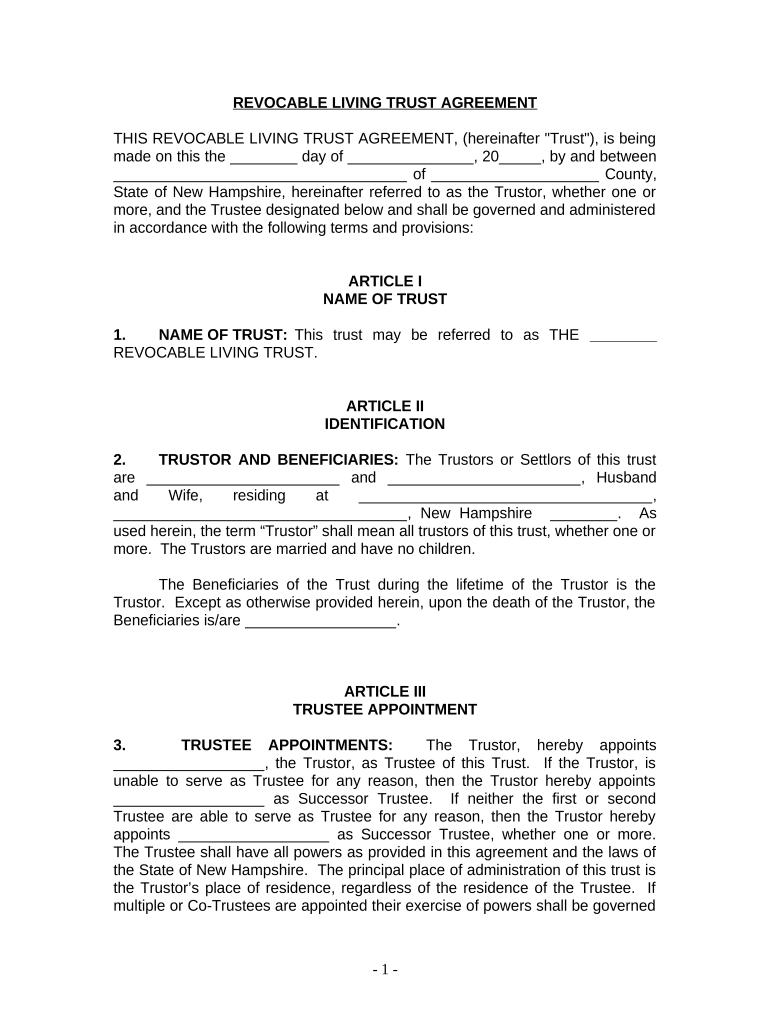

A living trust for husband and wife with no children in New Hampshire is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed upon their passing. This type of trust can help avoid probate, ensuring a smoother transition of assets without the need for court intervention. The trust is revocable, meaning that the couple can modify or dissolve it as needed while they are alive. It is particularly beneficial for couples without children, as it allows them to designate beneficiaries, such as relatives, friends, or charitable organizations.

Key Elements of the Living Trust for Husband and Wife with No Children in New Hampshire

Several key elements define a living trust for husband and wife with no children in New Hampshire:

- Trustees: The couple typically serves as co-trustees, managing the trust assets together.

- Beneficiaries: The couple can designate beneficiaries who will receive the trust assets upon their death, allowing for flexibility in asset distribution.

- Revocability: The trust can be changed or revoked at any time during the couple's lifetime, providing control over their assets.

- Asset Protection: Assets placed in the trust may be protected from creditors and legal claims, depending on state laws.

Steps to Complete the Living Trust for Husband and Wife with No Children in New Hampshire

Completing a living trust for husband and wife with no children involves several important steps:

- Gather Information: Collect details about assets, including bank accounts, real estate, and investments.

- Choose a Trustee: Decide whether to serve as co-trustees or appoint a third party.

- Draft the Trust Document: Create a legal document outlining the terms of the trust, including asset distribution and trustee powers.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its validity.

- Fund the Trust: Transfer ownership of assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Living Trust for Husband and Wife with No Children in New Hampshire

The legal use of a living trust for husband and wife with no children in New Hampshire is recognized under state law. It serves as a valid estate planning tool that allows couples to control their assets during their lifetime and dictate the terms of distribution after death. By establishing this trust, couples can avoid the lengthy and often costly probate process. Additionally, the trust can be structured to provide specific instructions regarding asset management and distribution, ensuring that the couple's wishes are honored.

State-Specific Rules for the Living Trust for Husband and Wife with No Children in New Hampshire

New Hampshire has specific rules governing living trusts that couples should be aware of:

- Trust Creation: The trust must be created in writing and signed by both spouses in front of a notary.

- Asset Transfer: To be effective, assets must be formally transferred into the trust, which may require retitling property and accounts.

- Tax Considerations: Couples should consult with a tax professional to understand any implications related to income and estate taxes.

How to Use the Living Trust for Husband and Wife with No Children in New Hampshire

Using a living trust for husband and wife with no children in New Hampshire involves managing the assets placed within the trust during the couple's lifetime. The couple can continue to use and control these assets as they see fit. Upon the death of one spouse, the surviving spouse typically retains control of the trust. After both spouses have passed, the designated beneficiaries will receive the trust assets according to the terms outlined in the trust document. Regularly reviewing and updating the trust is essential to reflect any changes in circumstances or wishes.

Quick guide on how to complete living trust for husband and wife with no children new hampshire

Effortlessly Manage Living Trust For Husband And Wife With No Children New Hampshire on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Living Trust For Husband And Wife With No Children New Hampshire on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The easiest way to edit and electronically sign Living Trust For Husband And Wife With No Children New Hampshire with minimal effort

- Find Living Trust For Husband And Wife With No Children New Hampshire and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow efficiently addresses your document management needs in just a few clicks from any chosen device. Modify and electronically sign Living Trust For Husband And Wife With No Children New Hampshire to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in New Hampshire?

A Living Trust For Husband And Wife With No Children in New Hampshire is a legal arrangement that allows couples to manage and distribute their assets without the need for probate. This type of trust can simplify the estate planning process and ensure that your wishes are honored. It's particularly useful for couples who want to preserve their assets and avoid complications after death.

-

How much does a Living Trust For Husband And Wife With No Children cost in New Hampshire?

The cost for creating a Living Trust For Husband And Wife With No Children in New Hampshire can vary depending on several factors, including legal fees and the complexity of your estate. Generally, prices may range from a few hundred to several thousand dollars. However, considering the long-term benefits, such as avoiding probate costs, it's often a worthwhile investment.

-

What are the benefits of a Living Trust For Husband And Wife With No Children in New Hampshire?

The primary benefits of a Living Trust For Husband And Wife With No Children in New Hampshire include avoiding probate, maintaining privacy, and ensuring a smooth transfer of assets. This trust allows you to dictate how your assets are managed and distributed, providing peace of mind and protecting your loved ones from potential legal challenges.

-

Can we make changes to our Living Trust For Husband And Wife With No Children in New Hampshire?

Yes, a Living Trust For Husband And Wife With No Children in New Hampshire is revocable, which means you can make changes or revoke it entirely at any time while you are alive. This flexibility allows you to adapt to changes in your financial situation or family dynamics. It's advisable to consult with a legal professional when making signNow modifications.

-

Is it necessary to have a lawyer for a Living Trust For Husband And Wife With No Children in New Hampshire?

While it is possible to create a Living Trust For Husband And Wife With No Children in New Hampshire without a lawyer, it's highly recommended to seek legal assistance. An experienced attorney can ensure that your trust is properly set up, compliant with state laws, and accurately reflects your wishes. This helps to avoid potential legal issues down the road.

-

What assets can be included in a Living Trust For Husband And Wife With No Children?

You can include a variety of assets in a Living Trust For Husband And Wife With No Children, such as real estate, bank accounts, investments, and personal property. By funding your trust with these assets, you can ensure they are managed and distributed according to your wishes. It's essential to properly title these assets to the trust to avoid complications later.

-

How does a Living Trust For Husband And Wife With No Children in New Hampshire integrate with other estate planning tools?

A Living Trust For Husband And Wife With No Children in New Hampshire can work seamlessly with other estate planning tools, such as wills, powers of attorney, and healthcare directives. Combining these tools provides a comprehensive plan that addresses various aspects of your estate and financial security. This integrated approach ensures that all your wishes are respected and followed.

Get more for Living Trust For Husband And Wife With No Children New Hampshire

- Cosmetic surgery form

- College lesson plan template form

- Equipment disposaltransfer request form

- Bumber to bumber insurance aditya birla brokers sample form

- Hbuhsd work permit form

- Eflex fsa enrollment form

- Title cwpcudip0115 urine dipstick emergency dept form b1 normal quality control record sheet

- Exposure control plan ecp template oil based drilling fluids form

Find out other Living Trust For Husband And Wife With No Children New Hampshire

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA