New Jersey Lien Form

What is the New Jersey Lien

A New Jersey lien is a legal claim against property to secure the payment of an unpaid balance. This type of lien can arise from various situations, including unpaid taxes, loans, or other financial obligations. When a lien is placed on a property, it can affect the owner's ability to sell or refinance the property until the debt is resolved. Understanding the nature of a lien is crucial for property owners in New Jersey, as it can have significant implications for their financial and legal standing.

How to Obtain the New Jersey Lien

To obtain a New Jersey lien, individuals or entities must follow a specific process. This typically involves filing the appropriate documentation with the New Jersey Division of Taxation or the local county clerk's office, depending on the type of lien being pursued. It is essential to provide accurate information regarding the debtor, the amount owed, and the nature of the debt. Once the lien is filed, it becomes a matter of public record, allowing potential creditors to see the claim against the property.

Steps to Complete the New Jersey Lien

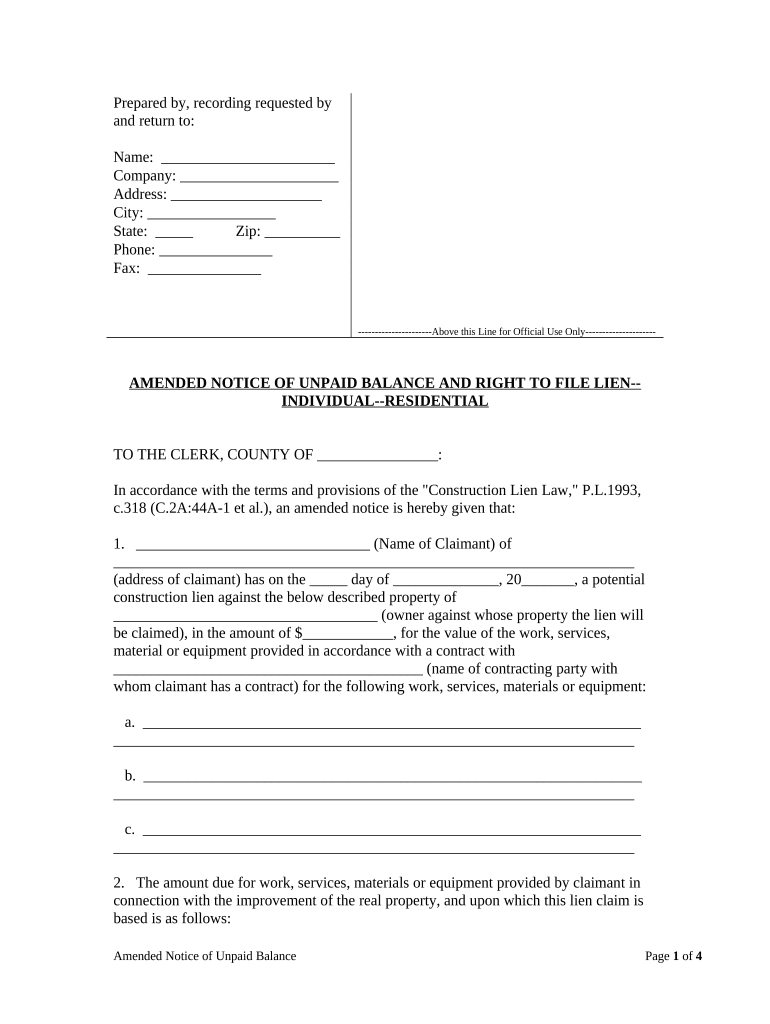

Completing a New Jersey lien involves several key steps:

- Gather necessary information, including the debtor's details and the amount owed.

- Complete the required lien form, ensuring all information is accurate and complete.

- Submit the form to the appropriate authority, such as the county clerk or tax office.

- Pay any associated fees for filing the lien.

- Keep a copy of the filed lien for your records.

Legal Use of the New Jersey Lien

The legal use of a New Jersey lien is governed by state laws and regulations. It is essential for lien holders to ensure that their claims are valid and enforceable. This includes adhering to all filing requirements and deadlines. A properly executed lien can serve as a powerful tool for creditors to secure payment. However, misuse of a lien can lead to legal disputes and potential penalties.

Key Elements of the New Jersey Lien

Key elements of a New Jersey lien include:

- Debtor Information: The name and address of the individual or entity responsible for the debt.

- Amount Owed: The total unpaid balance that the lien secures.

- Description of Property: Details about the property subject to the lien, including its location and type.

- Filing Date: The date the lien is officially recorded, which establishes priority over other claims.

Filing Deadlines / Important Dates

Filing deadlines for a New Jersey lien can vary based on the type of lien and the nature of the debt. It is crucial to be aware of these deadlines to ensure that the lien is filed timely and remains enforceable. For example, certain tax liens may have specific time frames for filing after the debt becomes due. Keeping track of these dates can help prevent complications and ensure that the lien serves its intended purpose.

Quick guide on how to complete new jersey lien 497319194

Complete New Jersey Lien effortlessly on any device

Digital document management has gained traction with companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle New Jersey Lien on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and eSign New Jersey Lien without hassle

- Obtain New Jersey Lien and then select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign New Jersey Lien and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Jersey lien, and how does it work?

A New Jersey lien is a legal claim against a property for unpaid debts or obligations. This means that if a property owner fails to pay certain debts, creditors can place a lien on the property, securing their interests. Understanding how New Jersey liens function can help you navigate your financial responsibilities effectively.

-

How can airSlate SignNow help with New Jersey lien documentation?

airSlate SignNow streamlines the process of creating and signing documents related to New Jersey liens. Our platform allows you to easily prepare, send, and eSign legal documents securely online. This not only minimizes paperwork but also speeds up transaction times, making it ideal for real estate professionals dealing with liens.

-

What are the pricing options for using airSlate SignNow for New Jersey lien documents?

airSlate SignNow offers competitive pricing plans tailored for businesses managing New Jersey lien documents. You can choose from several subscription tiers based on your frequency of use and required features. We ensure that our solutions are cost-effective, helping you save time and resources.

-

Are there any specific features in airSlate SignNow for tracking New Jersey liens?

Yes, airSlate SignNow includes features specifically designed for tracking documents related to New Jersey liens. With our advanced tracking capabilities, you can monitor the status of your lien documents in real-time and receive notifications once they are signed. This ensures that your transactions are always up to date.

-

How secure is airSlate SignNow when handling New Jersey lien data?

Security is our top priority at airSlate SignNow, especially when dealing with sensitive New Jersey lien data. Our platform employs advanced encryption protocols and secure access controls to protect your information. You can confidently manage your lien documents, knowing that your data is safe with us.

-

Can airSlate SignNow integrate with other tools for managing New Jersey liens?

Absolutely! airSlate SignNow seamlessly integrates with a variety of tools and platforms used for managing New Jersey liens. This allows you to consolidate your workflow, making it easier to handle all aspects of lien documentation and management from a single interface.

-

What are the benefits of using airSlate SignNow for New Jersey lien processing?

Using airSlate SignNow for New Jersey lien processing offers numerous benefits, including enhanced efficiency, reduced paperwork, and faster signing processes. Our user-friendly platform simplifies the management of legal documents while improving collaboration among parties. This not only helps in attaining quicker resolutions but also leads to better compliance with laws.

Get more for New Jersey Lien

- Olathe community center ru under minors waiver olatheks form

- Nebraska fillable 1040n form

- Prodibing fkip unsri form

- Clinic sheet form

- Properties of integer exponents worksheet pdf 283113293 form

- Hopkins modules answers form

- Ecole dansereau meadows school form

- Barking dog complaint form baw baw shire council

Find out other New Jersey Lien

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile