Retirement Planning Questionnaire Form

What is the Retirement Planning Questionnaire

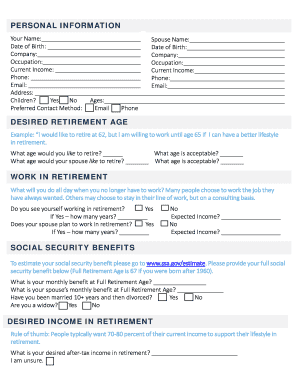

The retirement planning questionnaire is a structured tool designed to help individuals assess their financial readiness for retirement. It typically includes a series of questions that cover various aspects of an individual's financial situation, lifestyle preferences, and retirement goals. By answering these questions, users can gain insights into their savings, investments, and potential income sources during retirement. This questionnaire serves as a foundational step in creating a personalized retirement plan, ensuring that all critical areas are considered.

How to use the Retirement Planning Questionnaire

Using the retirement planning questionnaire involves several straightforward steps. First, gather all necessary financial documents, such as bank statements, investment accounts, and any existing retirement plans. Next, systematically go through each question, providing accurate and honest answers. It is essential to consider both current financial situations and future aspirations. Once completed, review the responses to identify areas where adjustments may be needed to align with retirement goals. This process can help clarify financial priorities and inform further planning decisions.

Steps to complete the Retirement Planning Questionnaire

Completing the retirement planning questionnaire can be broken down into a few key steps:

- Preparation: Collect all relevant financial documents and information.

- Questionnaire Completion: Answer each question thoroughly, considering both current circumstances and future plans.

- Review: Go through your answers to ensure accuracy and completeness.

- Analysis: Reflect on the insights gained from your responses to identify potential gaps in your retirement strategy.

Key elements of the Retirement Planning Questionnaire

Several key elements are typically included in a retirement planning questionnaire. These may encompass:

- Current Income: Information about salary, bonuses, and other income sources.

- Expenses: Monthly and annual expenses, including housing, healthcare, and lifestyle costs.

- Savings and Investments: Details about retirement accounts, savings, and other investment vehicles.

- Retirement Goals: Desired retirement age, lifestyle preferences, and travel plans.

- Health Considerations: Anticipated healthcare needs and long-term care planning.

Legal use of the Retirement Planning Questionnaire

The retirement planning questionnaire is not only a practical tool but also has legal implications. When completed accurately, it can serve as a record of an individual's financial intentions and plans. This documentation can be useful in discussions with financial advisors or legal counsel. It is important to ensure that the information provided is truthful and complete, as discrepancies may lead to complications in financial planning or legal matters in the future. Utilizing a trusted platform for digital completion can enhance the security and validity of the document.

Digital vs. Paper Version

When considering the retirement planning questionnaire, users have the option of completing it digitally or on paper. The digital version offers several advantages, including ease of access, the ability to save progress, and enhanced security features such as encryption and authentication. In contrast, paper versions may be more familiar to some users but lack the convenience and security of digital tools. Ultimately, the choice between digital and paper formats should align with personal preferences and comfort with technology.

Quick guide on how to complete retirement planning questionnaire

Effortlessly prepare Retirement Planning Questionnaire on any device

Digital document management has gained traction among companies and individuals alike. It offers a superb environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and safely keep it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly without delays. Manage Retirement Planning Questionnaire on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related procedure today.

How to modify and electronically sign Retirement Planning Questionnaire with ease

- Find Retirement Planning Questionnaire and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, monotonous form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Retirement Planning Questionnaire to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the retirement planning questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a questionnaire for retirement planning?

A questionnaire for retirement planning is a set of questions designed to help individuals assess their financial situation and retirement goals. It guides users in understanding their current savings, desired retirement age, and lifestyle expectations. Completing this questionnaire can provide valuable insights for creating a comprehensive retirement plan.

-

How can airSlate SignNow help with my retirement planning questionnaire?

airSlate SignNow streamlines the process of sending and eSigning your retirement planning questionnaire. Our platform allows you to create customizable forms, ensuring that all necessary information is captured efficiently. Additionally, our user-friendly interface simplifies collaboration with your financial advisors in real-time.

-

Is the questionnaire for retirement planning available for free?

While airSlate SignNow offers a variety of features, access to a comprehensive questionnaire for retirement planning may come with a subscription plan. However, the benefits gained from effectively organizing your retirement information can far outweigh the costs involved. Pricing plans are designed to be cost-effective for businesses and individuals alike.

-

What features are included in the airSlate SignNow questionnaire tool?

Our questionnaire tool includes customizable question formats, automated reminders, and secure eSignature capabilities. This ensures that your questionnaire for retirement planning can be tailored to meet personal requirements while maintaining a smooth user experience. These features actively enhance the efficiency of your retirement planning process.

-

Can I integrate the retirement planning questionnaire with other services?

Yes, airSlate SignNow offers numerous integrations with popular productivity and financial tools. By connecting your retirement planning questionnaire with other applications, you can streamline data flow and enhance your overall planning experience. This integration feature ensures you have a comprehensive report for better insights.

-

What are the benefits of using airSlate SignNow for my retirement planning needs?

Using airSlate SignNow for your questionnaire for retirement planning offers signNow benefits, including ease of use, improved accessibility, and secure document management. The automation features help reduce errors and save time, allowing you to focus on achieving your financial goals for retirement.

-

How secure is the data when using a retirement planning questionnaire with airSlate SignNow?

Data security is paramount at airSlate SignNow. We utilize advanced encryption protocols to protect your sensitive information when using the questionnaire for retirement planning. This commitment to security ensures that your financial data is safe and in compliance with industry regulations.

Get more for Retirement Planning Questionnaire

- Pagsasaling wika worksheet with answer form

- Radio talk show proposal sample pdf form

- Blue and gold sausage prices 2022 form

- Blank ze form s17

- Ron messner 6557 s betsie river rd interlochen mi 49643 form

- Grand traverse area retired school personnel application tbactc form

- Application for mechanical permit city of southfield form

- Florida supreme court approved family law form 12 984c parenting coordinator report of an emergency florida supreme court

Find out other Retirement Planning Questionnaire

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter