New Jersey Lien Form

What is the New Jersey Lien

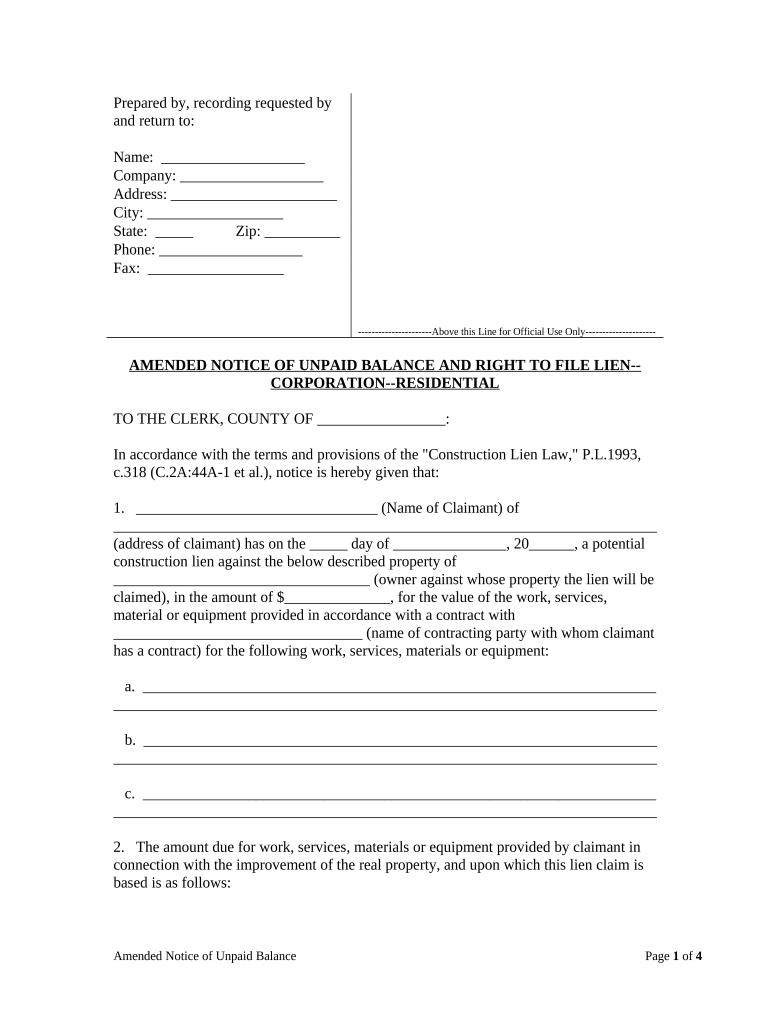

A New Jersey lien is a legal claim against a property or asset, typically used to secure the payment of a debt or obligation. This type of lien can arise from various situations, including unpaid taxes, loans, or other financial obligations. In New Jersey, liens are recorded to protect the interests of creditors and ensure that debts are settled before the property can be transferred or sold. Understanding the nature of a lien is essential for both property owners and creditors, as it affects property rights and financial responsibilities.

How to use the New Jersey Lien

Using a New Jersey lien involves several steps, primarily focused on ensuring that the lien is properly filed and executed. First, a creditor must determine the basis for the lien, such as an unpaid balance or a legal obligation. Next, the appropriate lien form must be completed accurately, detailing the debtor's information and the nature of the debt. Once the form is filled out, it should be submitted to the relevant county clerk's office for recording. This process officially establishes the lien and makes it a matter of public record, which is crucial for enforcing the lien in the future.

Key elements of the New Jersey Lien

Several key elements define a New Jersey lien, making it legally enforceable. These elements include:

- Identification of the debtor: The lien must clearly identify the individual or entity responsible for the debt.

- Description of the property: The lien should specify the property subject to the claim, including its location and type.

- Amount owed: The total amount of the debt must be stated, providing clarity on the financial obligation.

- Date of filing: The date the lien is recorded is essential for establishing priority over other claims.

These elements ensure that the lien is enforceable and can be acted upon if the debt remains unpaid.

Steps to complete the New Jersey Lien

Completing a New Jersey lien involves a systematic approach to ensure accuracy and compliance with state laws. The steps include:

- Gather necessary information: Collect all relevant details about the debtor and the debt.

- Fill out the lien form: Use the correct form and ensure all fields are completed accurately.

- Review for accuracy: Double-check the information to avoid errors that could delay processing.

- Submit the form: File the completed form with the county clerk's office, either online or in person.

- Pay any required fees: Ensure that all filing fees are paid at the time of submission.

Following these steps helps ensure that the lien is properly established and enforceable.

Legal use of the New Jersey Lien

The legal use of a New Jersey lien is governed by state laws that outline how liens can be established and enforced. Creditors must adhere to specific regulations regarding the filing process, including deadlines and documentation requirements. Additionally, the lien must be based on a legitimate debt, such as an unpaid balance or a contractual obligation. Misuse of a lien, such as filing without a valid claim, can result in legal penalties and the potential for the lien to be challenged in court.

Filing Deadlines / Important Dates

Filing deadlines for New Jersey liens can vary based on the type of lien and the circumstances surrounding the debt. Generally, it is crucial to file the lien promptly after the debt becomes due to maintain priority over other claims. For instance, tax liens may have specific deadlines set by the state, while other liens may be subject to general statutes of limitations. Keeping track of these important dates is essential for creditors to protect their rights and interests effectively.

Quick guide on how to complete new jersey lien 497319195

Complete New Jersey Lien seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle New Jersey Lien on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign New Jersey Lien effortlessly

- Find New Jersey Lien and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow has specially created for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal authority as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select how you would like to send your form—by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in a few clicks from any device you prefer. Edit and eSign New Jersey Lien to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it support New Jersey right customers?

airSlate SignNow is a comprehensive eSignature solution designed to empower businesses with seamless document management. For New Jersey right customers, it simplifies the signing process while ensuring compliance with state regulations, making it the ideal tool for any organization in need of efficient document handling.

-

How much does airSlate SignNow cost for New Jersey right businesses?

The pricing for airSlate SignNow is tailored to fit various business needs, including those of New Jersey right businesses. Plans are flexible, offering cost-effective solutions that cater to different usage levels, whether you're a small firm or a larger enterprise, ensuring affordability while maintaining quality service.

-

What features does airSlate SignNow offer for New Jersey right users?

airSlate SignNow provides a variety of features such as electronic signatures, customizable templates, and advanced authentication options. These features are particularly beneficial for New Jersey right users seeking to streamline their document workflows and enhance productivity while remaining compliant with local laws.

-

How can airSlate SignNow enhance my New Jersey right business operations?

Utilizing airSlate SignNow can signNowly enhance your New Jersey right business operations by reducing the time spent on paperwork and improving overall efficiency. With its user-friendly interface and automation capabilities, businesses can focus more on their core activities while ensuring a secure signing process.

-

Does airSlate SignNow integrate with other applications for New Jersey right businesses?

Yes, airSlate SignNow offers robust integrations with various applications commonly used by New Jersey right businesses, including CRM systems, cloud storage services, and productivity tools. This allows for a seamless flow of information and ensures that your document management systems work harmoniously to boost efficiency.

-

Is airSlate SignNow compliant with New Jersey right regulations?

Absolutely, airSlate SignNow is designed to be compliant with both federal and New Jersey right regulations regarding electronic signatures. This ensures that all documents signed through the platform are legally binding and valid, providing peace of mind for businesses operating in the state.

-

What benefits can New Jersey right businesses expect from using airSlate SignNow?

New Jersey right businesses can expect numerous benefits from using airSlate SignNow, including reduced turnaround times for document signing, enhanced security features, and improved customer satisfaction. By streamlining the signing process, businesses can foster better relationships with clients and partners.

Get more for New Jersey Lien

- California cpa education requirements worksheet form

- Macromolecule worksheet form

- Lincoln financial direct deposit form

- Uhc insurance enrollment form

- Transcript request form savannah state university savannahstate

- Pet overpopulation control program okvma form

- The lower extremity functional scale patient label must form

- Med form 502087347

Find out other New Jersey Lien

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself