Form ST16, Application for Nonprofit Exempt Status Sales Tax Revenue State Mn

What is the Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn

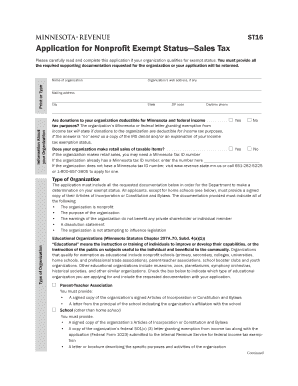

The Form ST16 is an official document used in Minnesota for nonprofits seeking exemption from sales tax. This application is crucial for organizations that qualify under specific criteria, allowing them to operate without the burden of sales tax on certain purchases. The form serves as a declaration of the nonprofit's status and outlines the types of purchases that may qualify for tax exemption. Understanding the purpose of this form is essential for nonprofits to ensure compliance with state regulations while maximizing their financial resources.

Steps to complete the Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn

Completing the Form ST16 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that verifies the nonprofit status, such as articles of incorporation or IRS determination letters. Next, fill out the form with accurate information regarding the organization’s name, address, and tax identification number. It is important to specify the types of purchases for which tax exemption is being requested. After reviewing the form for completeness, ensure that it is signed by an authorized representative of the organization to validate the application. Finally, submit the completed form to the appropriate state department for processing.

Eligibility Criteria for the Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn

To qualify for the Form ST16, organizations must meet specific eligibility criteria set by the state of Minnesota. Generally, eligible entities include charitable, religious, educational, and certain other nonprofit organizations that operate primarily for a public purpose. The organization must be registered with the state and possess a valid tax identification number. Additionally, the nonprofit should demonstrate that its activities align with the criteria for tax exemption, which may include providing services or benefits to the community. Ensuring that these criteria are met is vital for a successful application.

Required Documents for the Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn

When submitting the Form ST16, organizations must include several required documents to support their application. These typically include proof of nonprofit status, such as the IRS determination letter, articles of incorporation, and bylaws. Additionally, financial statements or budgets may be requested to demonstrate the organization’s operations and funding sources. Providing comprehensive documentation helps establish the legitimacy of the nonprofit and supports the case for sales tax exemption.

Form Submission Methods for the Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn

The Form ST16 can be submitted through various methods, ensuring convenience for organizations. Nonprofits may choose to submit the form online via the state’s official website, which often allows for quicker processing times. Alternatively, organizations can mail the completed form along with any required documents to the designated state office. In-person submissions may also be available at specific state locations, providing another option for those who prefer direct interaction. Each submission method has its own guidelines, so it is important to follow the instructions carefully.

Legal Use of the Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn

The legal use of the Form ST16 is governed by Minnesota state law, which outlines the requirements for nonprofit organizations to obtain sales tax exemption. Proper completion and submission of the form are essential for ensuring that the exemption is recognized by the state. Failure to comply with the legal stipulations may result in penalties or denial of the exemption. Therefore, understanding the legal framework surrounding the form is critical for nonprofits aiming to maintain their tax-exempt status and operate within the law.

Quick guide on how to complete form st16 application for nonprofit exempt status sales tax revenue state mn

Complete Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn effortlessly

- Locate Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st16 application for nonprofit exempt status sales tax revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn?

Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn is a document that nonprofit organizations in Minnesota must complete to apply for sales tax exemption. This form allows nonprofits to purchase goods and services without paying sales tax, helping them allocate more resources to their mission and community service.

-

How can airSlate SignNow help with the application process for Form ST16?

airSlate SignNow streamlines the application process for Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn by allowing users to easily prepare, sign, and send the form electronically. Our platform reduces paperwork and increases efficiency, enabling nonprofits to focus on their core activities while ensuring compliance with state requirements.

-

What are the costs associated with airSlate SignNow for processing Form ST16?

airSlate SignNow offers competitive pricing plans that cater to various organizational needs, making it cost-effective for nonprofits handling Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn. Interested organizations can choose from monthly or annual subscription options, and there’s often a free trial available to get started.

-

What features does airSlate SignNow offer for managing Form ST16?

airSlate SignNow provides essential features for managing Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn, including customizable templates, cloud storage, and real-time tracking of document status. These features enhance document management and simplify the signing process, making it convenient for users.

-

Is airSlate SignNow secure for handling Form ST16?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to ensure that your Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn, is protected throughout the signing process. Users can confidently submit sensitive information knowing that our platform adheres to industry-standard security measures.

-

Can I integrate airSlate SignNow with other software for Form ST16?

Yes, airSlate SignNow seamlessly integrates with various applications, enabling users to manage Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn alongside their existing tools. This integration supports a cohesive workflow by connecting to platforms such as CRM and project management software.

-

What are the benefits of using airSlate SignNow for nonprofits applying for Form ST16?

Utilizing airSlate SignNow for Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn provides nonprofits with a user-friendly solution that saves time and reduces errors in the application process. Additionally, the ability to access documents anytime and anywhere increases organizational efficiency and collaboration.

Get more for Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn

- Oasis surgical wound cheat sheet form

- Demographic form 299695076

- Psa authorization letter for japan visa form

- Specimen signature format in word

- Deadlands character sheet form

- Roofing certificate of completion form

- Special segments in triangles worksheet form

- Intervention report form central minnesota ems

Find out other Form ST16, Application For Nonprofit Exempt Status Sales Tax Revenue State Mn

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT