Form it 213 Claim for Empire State Child Credit Tax NY Gov 2023-2026

What is the Form IT-213 for Empire State Child Credit?

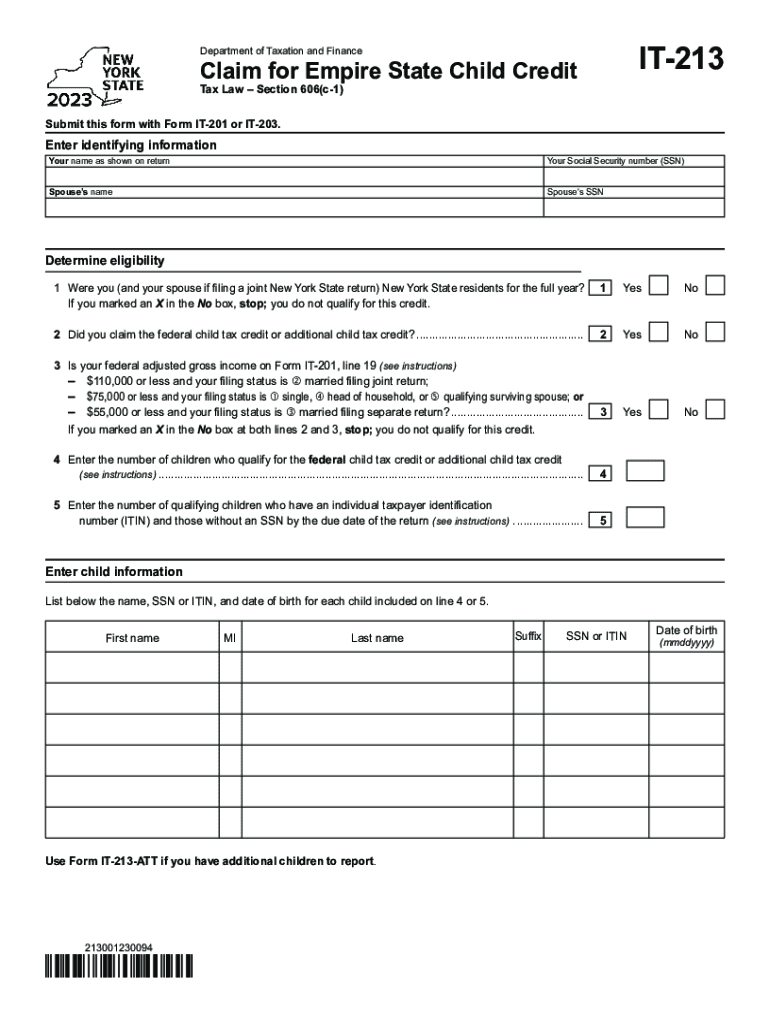

The Form IT-213, officially known as the Claim for Empire State Child Credit, is a tax form used by residents of New York to claim a credit for eligible children. This credit is designed to provide financial relief to families with dependent children under the age of 17. The Empire State Child Credit can significantly reduce the amount of state income tax owed, making it a valuable resource for qualifying families.

Eligibility Criteria for the Empire State Child Credit

To qualify for the Empire State Child Credit, taxpayers must meet specific eligibility requirements. These include:

- Being a resident of New York State for the tax year in question.

- Having a qualifying child under the age of 17 at the end of the tax year.

- Meeting the income thresholds set by the New York State Department of Taxation and Finance.

It is essential for applicants to review these criteria carefully to ensure they qualify before submitting the form.

Steps to Complete the Form IT-213

Filling out the Form IT-213 requires careful attention to detail. Here are the steps to complete the form:

- Download the Form IT-213 from the New York State Department of Taxation and Finance website.

- Provide your personal information, including your name, address, and Social Security number.

- List your qualifying children, ensuring you include their names, ages, and Social Security numbers.

- Calculate your credit amount based on the provided guidelines and your income level.

- Sign and date the form before submitting it to the appropriate tax authority.

How to Obtain the Form IT-213

The Form IT-213 can be easily obtained online. Taxpayers can visit the New York State Department of Taxation and Finance website to download the form. Additionally, physical copies of the form may be available at local tax offices or public libraries. It is advisable to ensure you are using the most current version of the form to avoid any issues during submission.

Form Submission Methods for IT-213

There are several methods available for submitting the Form IT-213. Taxpayers can choose to:

- File the form electronically through the New York State online tax filing system.

- Mail the completed form to the designated address provided on the form.

- Submit the form in person at a local tax office.

Each submission method has its own processing times, so it is important to consider these when filing.

Key Elements of the Form IT-213

Understanding the key elements of the Form IT-213 is crucial for successful completion. Important components include:

- Personal information section for the taxpayer and dependents.

- Income information to determine eligibility for the credit.

- Calculation section for determining the total credit amount.

- Signature line to certify that the information provided is accurate.

Reviewing these elements can help ensure that the form is filled out correctly and completely.

Quick guide on how to complete form it 213 claim for empire state child credit tax ny gov

Effortlessly Prepare Form IT 213 Claim For Empire State Child Credit Tax NY gov on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and safely store it online. airSlate SignNow provides all the tools you need to quickly create, modify, and eSign your documents without any hassle. Manage Form IT 213 Claim For Empire State Child Credit Tax NY gov on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Edit and eSign Form IT 213 Claim For Empire State Child Credit Tax NY gov with Ease

- Find Form IT 213 Claim For Empire State Child Credit Tax NY gov and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 213 Claim For Empire State Child Credit Tax NY gov to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 213 claim for empire state child credit tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the form it 213 claim for empire state child credit tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the New York Empire State?

airSlate SignNow is a powerful eSignature solution that streamlines document signing and management. For businesses in the New York Empire State, it offers a user-friendly interface that simplifies paperwork, making it ideal for professionals and organizations looking to enhance their efficiency.

-

How much does airSlate SignNow cost for users in the New York Empire State?

airSlate SignNow offers flexible pricing plans that cater to different business needs. For users in the New York Empire State, plans start at a competitive rate, providing access to essential features like eSigning and document sharing without breaking the bank.

-

What features does airSlate SignNow provide for businesses in the New York Empire State?

airSlate SignNow includes a range of features such as document templates, team collaboration, and real-time tracking. These tools are particularly beneficial for businesses in the New York Empire State seeking to streamline their processes and improve document management.

-

Can airSlate SignNow integrate with other applications used in the New York Empire State?

Yes, airSlate SignNow integrates seamlessly with a variety of applications commonly used in the New York Empire State, including CRM systems, cloud storage, and office productivity tools. This integration allows businesses to optimize their workflows and enhance productivity.

-

What are the security measures implemented by airSlate SignNow for New York Empire State users?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Users in the New York Empire State can rest assured that their documents are protected, ensuring confidentiality and integrity throughout the signing process.

-

What benefits does airSlate SignNow offer to companies in the New York Empire State?

Companies in the New York Empire State benefit from increased efficiency, reduced turnaround times, and enhanced customer satisfaction with airSlate SignNow. By digitizing the signing process, businesses can save time and resources, leading to improved operational workflows.

-

Is airSlate SignNow suitable for small businesses in the New York Empire State?

Absolutely! airSlate SignNow is designed to meet the needs of businesses of all sizes, including small enterprises in the New York Empire State. Its intuitive platform provides essential features without the complexity, making it perfect for smaller teams.

Get more for Form IT 213 Claim For Empire State Child Credit Tax NY gov

- Nc general warranty deed form

- Dance registration from form

- Dental registration forms

- Realidades 1 lesson plans form

- This post closing possession rider rider is made a part of and incorporated into that certain real estate contract form

- Attachment 5 darfur contracting act certification form california courts courts ca

- Conservatorship general plan alameda superior court state of bb alameda courts ca form

- Gc 400c6 schedule c disbursements investment expenses standard account judicial council forms

Find out other Form IT 213 Claim For Empire State Child Credit Tax NY gov

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later