New Jersey Partner Form

What is the New Jersey Partner

The New Jersey Partner form is a crucial document for businesses operating in New Jersey, particularly partnerships. It is designed to facilitate the reporting of income, deductions, and credits for partnerships doing business in the state. This form ensures that partnerships comply with state tax regulations while providing transparency in their financial activities. Understanding the purpose of this form is essential for partners to fulfill their tax obligations accurately.

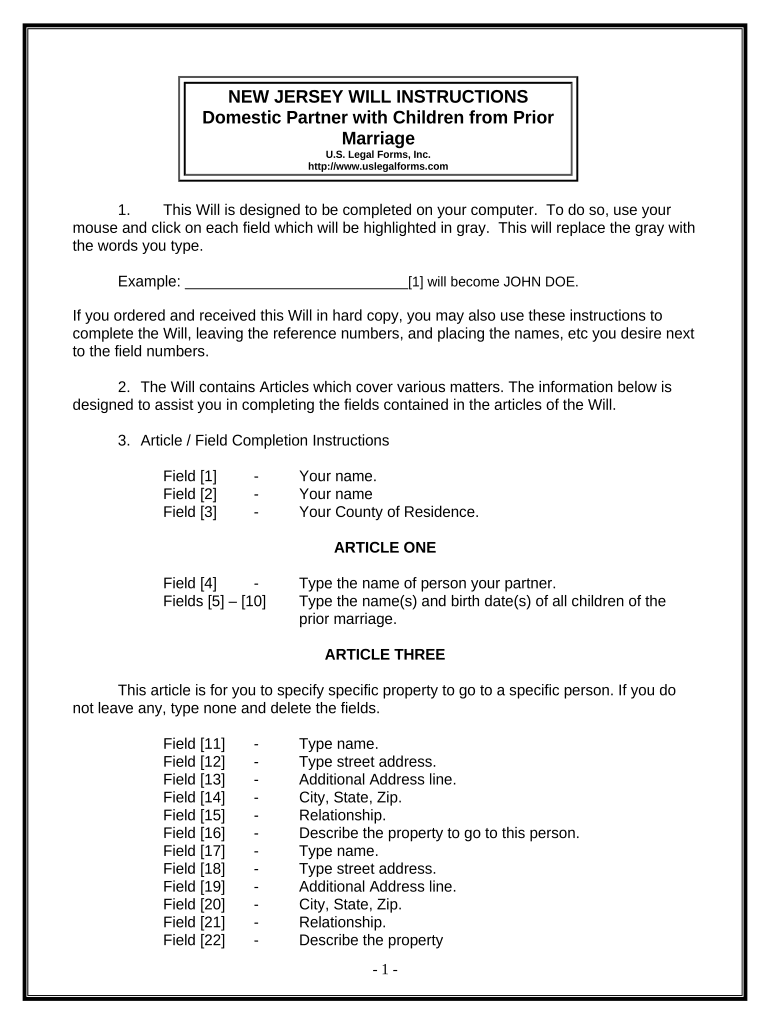

How to use the New Jersey Partner

Using the New Jersey Partner form involves several steps to ensure proper completion and submission. First, gather all necessary financial information related to the partnership, including income, expenses, and any applicable deductions. Next, fill out the form accurately, ensuring that all partners' information is included. It is important to review the completed form for any errors before submission. Finally, submit the form according to the specified method, whether online, by mail, or in person, to ensure compliance with state regulations.

Steps to complete the New Jersey Partner

Completing the New Jersey Partner form requires a systematic approach:

- Gather financial documents, including income statements and expense records.

- Fill in the partnership’s name, address, and federal identification number.

- Report total income and deductions accurately, ensuring all figures are supported by documentation.

- Include information for each partner, detailing their share of income and deductions.

- Review the form for accuracy and completeness before submission.

Legal use of the New Jersey Partner

The legal use of the New Jersey Partner form is essential for ensuring compliance with state tax laws. This form must be completed in accordance with New Jersey regulations, and any inaccuracies or omissions can lead to penalties. It is vital for partnerships to understand the legal implications of the information reported, as it affects both the partnership and the individual partners. Utilizing a reliable electronic signature solution can further enhance the legal validity of the submitted form.

Key elements of the New Jersey Partner

Key elements of the New Jersey Partner form include:

- Identification details of the partnership, including name and federal identification number.

- Income and deduction reporting sections that require accurate financial data.

- Partner information, detailing each partner’s share of income and deductions.

- Signature lines for authorized representatives, ensuring the form is officially executed.

Eligibility Criteria

To be eligible to file the New Jersey Partner form, a partnership must meet specific criteria. This includes being recognized as a partnership under New Jersey law and having a valid federal identification number. Additionally, the partnership must engage in business activities within New Jersey and be subject to state tax regulations. Understanding these criteria is essential for partnerships to ensure compliance and avoid potential issues with state tax authorities.

Quick guide on how to complete new jersey partner

Accomplish New Jersey Partner effortlessly on any gadget

Web-based document management has gained traction with businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and safely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your files swiftly and without interruptions. Manage New Jersey Partner on any gadget using airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

Steps to modify and eSign New Jersey Partner with ease

- Locate New Jersey Partner and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign New Jersey Partner and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the pricing options for airSlate SignNow in New Jersey?

As a new jersey partner, you can access flexible pricing plans tailored to meet your business needs. Our pricing is competitive and designed to offer signNow savings for teams looking to streamline their e-signature processes. We provide various tiers that include different features, allowing businesses of all sizes in New Jersey to choose a plan that fits their budget.

-

What features does airSlate SignNow offer to New Jersey partners?

AirSlate SignNow offers a comprehensive suite of features that benefit new jersey partners, including secure e-signatures, document templates, and automated workflows. These tools help businesses enhance their document management processes and improve productivity. The platform is user-friendly, making it easy for teams in New Jersey to adopt and start using right away.

-

How can airSlate SignNow benefit businesses in New Jersey?

Businesses in New Jersey can signNowly benefit from airSlate SignNow by improving their document turnaround times and reducing reliance on paper documents. Our solution enables quick, secure, and legally binding e-signatures, which streamline operations and enhance customer satisfaction. By partnering with airSlate, New Jersey businesses can focus more on growth and less on administrative tasks.

-

Can airSlate SignNow integrate with other software commonly used in New Jersey?

Absolutely! AirSlate SignNow seamlessly integrates with a variety of popular software in New Jersey, such as CRM systems, project management tools, and cloud storage services. This integration capability allows businesses to maintain their existing workflows while enhancing them with powerful e-signature functionalities. New Jersey partners can enjoy a connected experience that boosts efficiency.

-

Is there a free trial available for New Jersey partners?

Yes, airSlate SignNow offers a free trial for new jersey partners, allowing them to explore our platform without any commitment. This trial period helps businesses evaluate our features and understand how the solution can fit into their operations. We encourage New Jersey companies to experience firsthand the benefits of e-signatures and document management through our easy-to-use platform.

-

What kind of support does airSlate SignNow provide to partners in New Jersey?

AirSlate SignNow offers robust customer support for new jersey partners, including live chat, email assistance, and a comprehensive knowledge base. Our dedicated support team is here to help troubleshoot any issues and provide guidance on using the platform effectively. New Jersey businesses can rely on our support to ensure a smooth and successful partnership.

-

Are the e-signatures from airSlate SignNow legally binding in New Jersey?

Yes, e-signatures created with airSlate SignNow are legally binding in New Jersey, as they comply with the ESIGN Act and UETA. This means that businesses can confidently use our software for contracts and agreements without legal concerns. Our solution ensures that you're protected while streamlining your signing processes across New Jersey.

Get more for New Jersey Partner

Find out other New Jersey Partner

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free