Arizona Form 140 IA Arizona Department of Revenue

Understanding the Arizona Form 140 IA

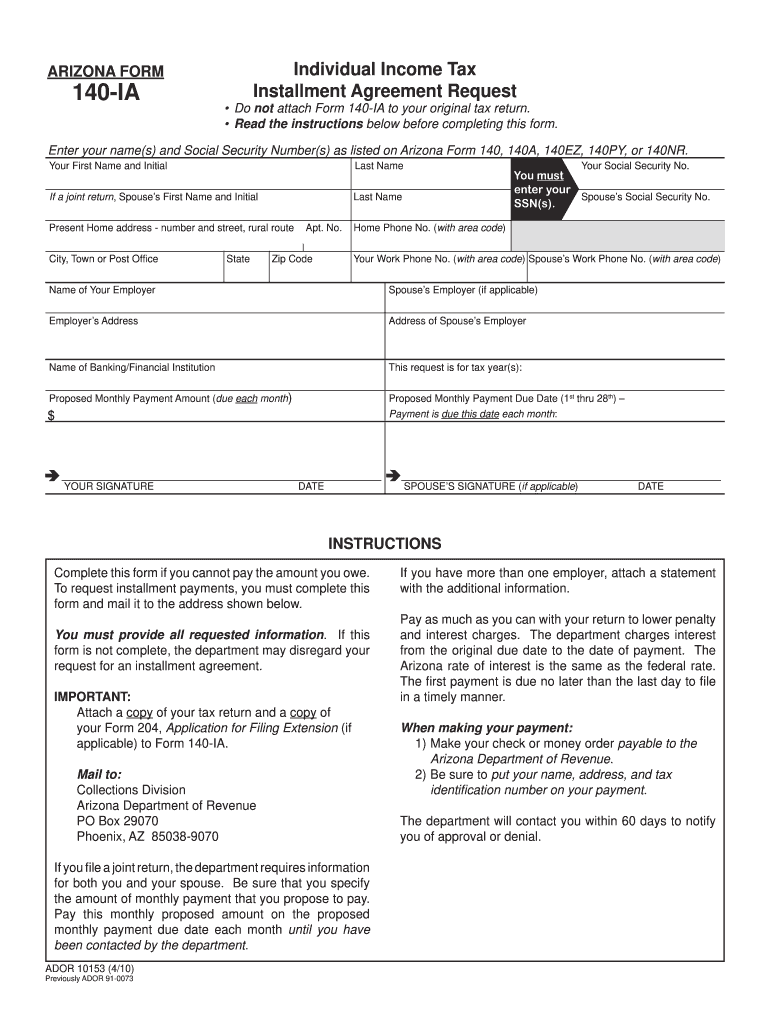

The Arizona Form 140 IA is an essential document used by residents of Arizona to report their income tax. This form is specifically designed for individuals who need to calculate their Arizona state income tax liability based on their federal adjusted gross income. The Arizona Department of Revenue provides this form to ensure that taxpayers can accurately report their income and claim any applicable deductions or credits. Understanding the purpose and structure of this form is crucial for compliance with state tax regulations.

Steps to Complete the Arizona Form 140 IA

Completing the Arizona Form 140 IA involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including your W-2 forms, 1099s, and any other income statements. Follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your federal adjusted gross income as the starting point for your Arizona income tax calculation.

- Apply any state-specific adjustments to your income, such as deductions for retirement contributions or other eligible expenses.

- Calculate your taxable income by subtracting any deductions from your adjusted gross income.

- Determine your tax liability based on the Arizona tax rates applicable to your income level.

- Complete any additional sections of the form, such as credits or payments made throughout the year.

- Review your completed form for accuracy before submission.

Legal Use of the Arizona Form 140 IA

The Arizona Form 140 IA is legally binding when completed accurately and submitted according to the guidelines set by the Arizona Department of Revenue. To ensure its legal validity, the form must be signed by the taxpayer, affirming that the information provided is true and complete. Additionally, compliance with eSignature regulations, such as those outlined in the ESIGN and UETA acts, is crucial when submitting the form electronically. Using a reliable eSignature solution can enhance the legal standing of your submission.

Filing Deadlines and Important Dates

Timely filing of the Arizona Form 140 IA is essential to avoid penalties and interest. The standard deadline for filing is typically April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to the filing schedule, especially for extensions or special circumstances that may apply to your situation.

Required Documents for the Arizona Form 140 IA

To complete the Arizona Form 140 IA accurately, you will need several key documents. These include:

- Your W-2 forms from all employers, detailing your income and withholding.

- Any 1099 forms received for freelance work or other income sources.

- Records of any deductions or credits you plan to claim, such as receipts for medical expenses or education costs.

- Proof of any estimated tax payments made throughout the year.

Having these documents ready will streamline the completion of your income tax form and help ensure that you do not overlook any important information.

Form Submission Methods

The Arizona Form 140 IA can be submitted through various methods to accommodate taxpayer preferences. You can file the form electronically using approved e-filing software, which is often the quickest and most efficient method. Alternatively, you may choose to print and mail your completed form to the Arizona Department of Revenue. If you prefer in-person submission, you can visit a local office of the Department of Revenue. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete arizona form 140 ia arizona department of revenue

Effortlessly Prepare Arizona Form 140 IA Arizona Department Of Revenue on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents promptly without delays. Manage Arizona Form 140 IA Arizona Department Of Revenue on any devices using airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

The Easiest Way to Edit and eSign Arizona Form 140 IA Arizona Department Of Revenue Effortlessly

- Find Arizona Form 140 IA Arizona Department Of Revenue and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Arizona Form 140 IA Arizona Department Of Revenue and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What form do I need for the Arizona Department of Revenue for a W-2?

The W2 is generic across all jurisdictions but they have supplemental tax data. If you have a Federal W2 use that. The big issue is did you have withholdings for Arizona? The state W2 would contain that data. Did you check the entire form?

-

How many boxes of cereal would it take to fill the Arizona meteor crater?

Here is some data for the volume of the Arizona Meteor crater approximately 37 miles (60 km) east of Flagstaff and 18 miles (29 km) west of Winslow in the northern Arizona desert of the United States.(Wikipedia)1975LPI.....6..680R Page 680(The data in the article above can be found on the second page table 3 under volume, the measurement is in Meters not centimeters, my apologies for my own mistake. In my own haste and excitement over this question, I rushed the gun and didn’t check my units)The volume Not including the ‘over turned flap’ is 126.5 X 10^6 m^3 (correction m, not cm) and a family sized box of fruit loops is around 26oz. Which if I haven’t made any mistakes in my conversion factors is equivalent to (I made a mistake) 0.000709765 m^3(changed cm to m), lol this is the corrected answer after fixing my mistake 178,228,005,044 boxes of fruit loops should do the trick.

-

Is it possible to take Uber out of state? If so how do I find out the cost of say going from California to Arizona?

There are multiple questions here:Is it possible to take a Uber out of state?Yes, this is possible, sort of.Drivers are permitted to take a passenger to any destination, even if it is outside of their working region. (Source)The catch is that there is actually a duration limit as to how long a ride can be. At some point, Uber app will automatically complete the ride. At that point, you can request another Uber, granted they have service there. (Source: Is there a maximum distance the driver will bring you?)How do I find out the cost?I attempted to use a RideGuru calculator, but the trip is too long. (which is fair) Given the above limitation, I think the best is to simply talk to your driver (whether he or she is with Uber or not) and come up with an arrangement.Fare Estimates from California to Arizona. Uber, Lyft, Taxis, Limos, and more

-

How can I send a bottle of wine as a gift from out of state to an adult of over 21 year in Phoenix, Arizona?

Very carefully. First make sure you have proper packaging. There is specialty packaging that must be used for wine bottles. Next, ship by UPS or FedEx. USPS will not transport alcohol in any shape. Then figure the heat factor in Phoenix. The quickest and easiest way to kill a bottle of wine is by heat. For most of the year, AZ is too hot to send wine that is not in climate controlled transport. Wine must be signed for when it is shipped. so figure that the bottle will be riding around in a not ac UPS truck for most of the day.Why not just call a local wine specialty shop and purchase a special bottle for your friend. They will hold it and your friend can just drive over and pick it up. Might be a lot easier.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Has anyone out there moved from Arizona to Seattle? How did you deal with the weather change and the lack of sunlight?

I actually did move “from Phoenix, AZ all the way to Tacoma”, back in 1997. It was an adjustment to say the least. One I rather enjoyed though. I was born and raised in the desert and was ready for a change though. I never knew a place could have so many trees and so much green. Going from the desert where you get two seasons: hot and hotter, I was introduced to real seasonal changes that opened my eyes. Rain is a nearly every day occurrence in Western Washington, but not hard rain, just sprinkles. It made everything so green and lush. There are days in Tacoma/Seattle where there is not much sunlight, but this didn’t bother me personally. Of course there are days when you wish it was more sunny, but the outdoor activities in the woods or near mountains were fantastic. I did a lot of biking, hiking and walking through some of the most beautiful places I’ve ever been too. I lived in various parts of Western Washington for two years and after returning to Phoenix, I really considered moving back long term.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140 ia arizona department of revenue

How to create an electronic signature for your Arizona Form 140 Ia Arizona Department Of Revenue in the online mode

How to generate an eSignature for your Arizona Form 140 Ia Arizona Department Of Revenue in Chrome

How to generate an electronic signature for signing the Arizona Form 140 Ia Arizona Department Of Revenue in Gmail

How to generate an eSignature for the Arizona Form 140 Ia Arizona Department Of Revenue straight from your mobile device

How to generate an eSignature for the Arizona Form 140 Ia Arizona Department Of Revenue on iOS

How to create an electronic signature for the Arizona Form 140 Ia Arizona Department Of Revenue on Android devices

People also ask

-

What is Arizona Form 140 IA and how do I access it?

Arizona Form 140 IA is a tax form provided by the Arizona Department of Revenue, used for individual income tax returns. You can easily access this form through the official Arizona Department of Revenue website or by using airSlate SignNow to securely manage and eSign your tax documents.

-

How can airSlate SignNow help me with Arizona Form 140 IA?

airSlate SignNow streamlines the process of filling out and submitting Arizona Form 140 IA by allowing you to eSign and send documents securely. Our platform helps ensure that your tax filings are timely and accurate, minimizing the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 140 IA?

Yes, airSlate SignNow offers a cost-effective solution for managing your documents, including Arizona Form 140 IA. We provide various pricing plans to suit your needs, ensuring you only pay for the features you require to efficiently handle your tax documentation.

-

What features does airSlate SignNow offer for filing Arizona Form 140 IA?

airSlate SignNow offers a range of features for filing Arizona Form 140 IA, including document templates, eSignature capabilities, and secure cloud storage. These tools simplify the tax filing process, making it easier to complete and submit your forms on time.

-

Can I integrate airSlate SignNow with other software for Arizona Form 140 IA?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, enhancing your experience when handling Arizona Form 140 IA. Whether you use accounting software or CRM systems, our integrations help streamline your tax filing process.

-

How does eSigning Arizona Form 140 IA work on airSlate SignNow?

eSigning Arizona Form 140 IA on airSlate SignNow is simple and secure. You can upload your completed form, add your signature, and send it directly to the Arizona Department of Revenue, all within a few clicks, ensuring a hassle-free filing experience.

-

What are the benefits of using airSlate SignNow for tax documents like Arizona Form 140 IA?

Using airSlate SignNow for tax documents like Arizona Form 140 IA offers numerous benefits, including enhanced security, easy accessibility, and time-saving features. Our platform allows you to manage your tax filings efficiently, ensuring compliance and reducing stress during tax season.

Get more for Arizona Form 140 IA Arizona Department Of Revenue

Find out other Arizona Form 140 IA Arizona Department Of Revenue

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure