Nm Withholding Form

What is the New Mexico Withholding

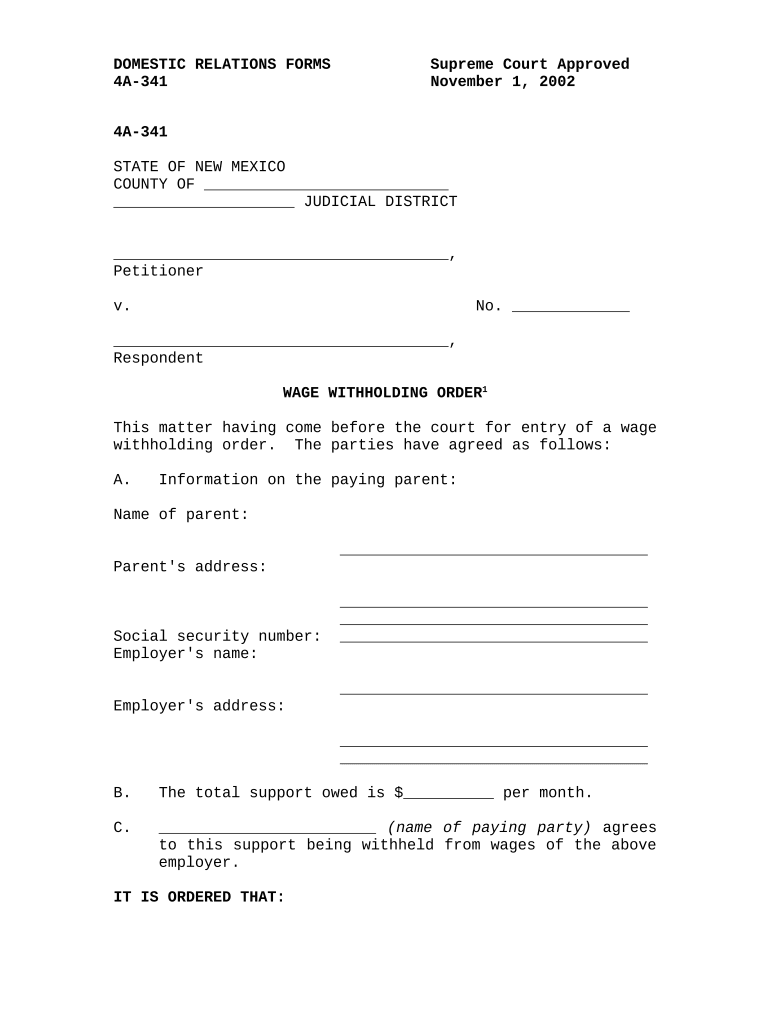

The New Mexico withholding refers to the state tax withholding process where employers deduct a portion of an employee's wages for state income tax purposes. This withholding is essential for ensuring that employees meet their tax obligations throughout the year. The New Mexico employee tax withholding form, commonly known as the NM withholding form, is used to determine the amount of state tax to withhold from an employee's paycheck based on their income level and personal circumstances.

Steps to Complete the NM Withholding

Completing the NM withholding form involves several straightforward steps to ensure accuracy and compliance with state regulations. First, gather necessary personal information, including your full name, address, and Social Security number. Next, indicate your filing status, which could be single, married, or head of household. Then, provide the number of allowances you wish to claim, which directly affects the withholding amount. Finally, sign and date the form to validate it. Once completed, submit the form to your employer for processing.

Legal Use of the NM Withholding

The NM withholding form is legally binding when completed correctly and submitted to the employer. To ensure its validity, the form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, as well as the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures and records hold the same legal weight as traditional paper documents, provided they meet specific criteria. Using a reliable e-signature platform can help maintain compliance and security during the signing process.

Who Issues the Form

The New Mexico withholding form is issued by the New Mexico Taxation and Revenue Department. This department is responsible for overseeing tax collection and ensuring compliance with state tax laws. Employers and employees can access the form through the department's official website or request it directly from their employer. It is crucial for employees to have the most current version of the form to ensure accurate tax withholding.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the NM withholding form is essential for both employers and employees. Typically, employees should submit their completed withholding forms to their employers as soon as they begin employment or whenever there is a change in their tax situation. Employers are required to withhold the appropriate taxes from each paycheck and remit them to the state by the specified deadlines. It is important to stay informed about any changes in tax laws or deadlines that may affect withholding practices.

Penalties for Non-Compliance

Failure to comply with New Mexico withholding requirements can result in significant penalties for both employers and employees. Employers who do not withhold the correct amount of state tax may face fines and interest on unpaid taxes. Employees may also face penalties if they under-withhold and fail to pay their tax obligations by the due date. It is crucial for both parties to understand their responsibilities regarding tax withholding to avoid these penalties.

Quick guide on how to complete nm withholding

Effortlessly Prepare Nm Withholding on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Nm Withholding on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to Edit and eSign Nm Withholding with Ease

- Locate Nm Withholding and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Modify and eSign Nm Withholding and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is new mexico withholding and how does it affect businesses?

New Mexico withholding refers to the state's requirement for employers to withhold a portion of their employees’ wages for state income tax. Businesses operating in New Mexico must comply with these regulations to avoid penalties. Understanding new mexico withholding is crucial for ensuring accurate payroll processing and maintaining compliance with state laws.

-

How does airSlate SignNow help with managing new mexico withholding?

AirSlate SignNow simplifies the management of new mexico withholding by allowing businesses to securely send and sign payroll documents electronically. Our platform can help streamline the collection of W-4 forms and other documents necessary for accurate withholding. This enhances efficiency and reduces the risk of errors associated with traditional paper methods.

-

What are the pricing options for airSlate SignNow regarding payroll features?

AirSlate SignNow offers various pricing tiers that cater to different business needs, including features for managing new mexico withholding. We make it affordable for businesses of all sizes to access essential tools for electronic signatures and document management. By choosing the right plan, you can ensure compliance with new mexico withholding requirements while staying within your budget.

-

Can I integrate airSlate SignNow with my existing payroll system for new mexico withholding?

Yes, airSlate SignNow offers seamless integrations with a variety of payroll systems to manage new mexico withholding effortlessly. This allows you to maintain accurate employee records and comply with state regulations without manual intervention. Our integration capabilities help streamline your workflow and reduce administrative burdens.

-

What are the benefits of using airSlate SignNow for new mexico withholding documentation?

Using airSlate SignNow for new mexico withholding documentation provides signNow benefits, including improved efficiency and compliance. Digital signatures eliminate the need for printing and mailing, speeding up the process while keeping your documents secure. Additionally, you can easily track and manage all paperwork related to withholding in one place.

-

Is airSlate SignNow compliant with new mexico withholding laws?

Absolutely! AirSlate SignNow is designed to comply with all relevant new mexico withholding laws. Our platform ensures that your electronic signature and document management processes meet the necessary regulatory standards, allowing you to focus on your core business activities with confidence.

-

What types of documents can I manage related to new mexico withholding?

You can manage a variety of documents related to new mexico withholding through airSlate SignNow, including employee W-4 forms, payroll agreements, and any other tax-related documents. Our platform allows you to create, send, and store these documents securely and efficiently. This helps ensure that all critical information is easily accessible and compliant with state regulations.

Get more for Nm Withholding

- Florida fort myers beach form

- Permit maintenance form pompano beach

- City of surfside building department form

- Electrical fill in the blanks 3 docx form

- Florida business certificate tax form

- Fillable online criminal record check consent form

- Remco lease addendum laundry room usagewpsdoc form

- Hblb alabama govwp contentuploadsinstructions to new inactive license application alabama form

Find out other Nm Withholding

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy