4972 K Kentucky Tax on Lump Sum Distributions Form 42A740 Imap Taxhow

What is the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow

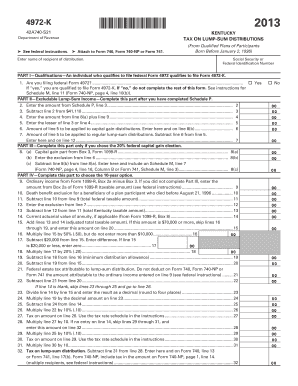

The 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 is a crucial document for taxpayers in Kentucky who receive lump sum distributions from retirement plans or other qualified plans. This form is specifically designed to calculate the state tax owed on these distributions. It helps taxpayers report the income accurately and ensures compliance with Kentucky tax regulations. Understanding this form is essential for proper tax reporting and to avoid potential penalties.

How to use the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow

Using the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 involves several steps. First, gather all necessary documentation related to your lump sum distribution, including any tax statements from your retirement plan. Next, complete the form by entering the required financial information accurately. After filling out the form, review it for any errors before submission. This ensures that the information is correct, which can help avoid issues with the Kentucky Department of Revenue.

Steps to complete the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow

Completing the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 involves the following steps:

- Obtain the form from the Kentucky Department of Revenue website or other official sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Report the total amount of the lump sum distribution received.

- Calculate the taxable amount and the corresponding state tax owed.

- Sign and date the form to certify that the information provided is accurate.

State-specific rules for the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow

Kentucky has specific rules governing the taxation of lump sum distributions. These rules dictate how distributions are taxed at the state level and may differ from federal tax regulations. It is important to be aware of any deductions or credits that may apply to your situation. Additionally, certain types of distributions may be exempt from state tax, so understanding these nuances can significantly impact your tax liability.

Penalties for Non-Compliance

Failing to accurately complete and submit the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 can result in penalties. The Kentucky Department of Revenue may impose fines for late submissions or inaccurate reporting. These penalties can include interest on unpaid taxes and additional fees. To avoid these consequences, it is essential to ensure that the form is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Timely filing of the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 is crucial. Generally, the form must be submitted by the same deadline as your annual state tax return. It is advisable to check for any specific deadlines that may apply, as these can vary based on individual circumstances. Keeping track of important dates can help ensure compliance and avoid penalties.

Quick guide on how to complete 4972 k kentucky tax on lump sum distributions form 42a740 imap taxhow

Complete [SKS] seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and eSign [SKS] to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow

Create this form in 5 minutes!

How to create an eSignature for the 4972 k kentucky tax on lump sum distributions form 42a740 imap taxhow

The way to make an e-signature for your PDF document online

The way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow?

The 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow is a specific tax form used to report and calculate taxes on lump sum distributions from retirement plans in Kentucky. This form is crucial for ensuring compliance with state tax regulations and accurately assessing potential tax liabilities on such distributions.

-

How can airSlate SignNow help with the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow?

airSlate SignNow can streamline the process of filling out and submitting the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow by providing an easy-to-use platform for document preparation and electronic signatures. Our solution enhances accuracy and ensures timely submissions, helping to avoid any potential penalties.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans to fit any budget, making it a cost-effective solution for managing tax forms like the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow. Our plans range from basic to advanced features, allowing businesses to choose the best option based on their needs.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow supports integrations with various software tools, enhancing your ability to manage tax documents like the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow seamlessly. This compatibility ensures that you can work within your existing workflows while benefiting from our powerful eSigning capabilities.

-

What are the benefits of using airSlate SignNow for the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow?

Using airSlate SignNow for the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow offers numerous benefits, including increased efficiency, improved document security, and the ability to eSign on the go. These advantages make the process of managing tax documents smoother and more reliable.

-

Is airSlate SignNow secure for handling tax-related documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all your tax-related documents, including the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow, are protected. We utilize robust encryption and secure storage solutions to safeguard your data at all times.

-

How does airSlate SignNow enhance collaboration on tax documents?

airSlate SignNow enhances collaboration by allowing multiple users to access, edit, and sign the 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow in real-time. This collaborative feature enables teams to work together efficiently, ensuring that everyone involved can share input and make necessary updates swiftly.

Get more for 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow

- Dod industrial plant equipment requisition dd form

- Special expense form 2013 2014 student financial aid siue

- Physical examination southern illinois university edwardsville siue form

- 104r online form

- Application for admission to the masteramp39s program curriculum and ci siu form

- Army 104 r form

- Snhu withdrawal form

- Job performance evaluation form exempt positions fac web spsu

Find out other 4972 K Kentucky Tax On Lump Sum Distributions Form 42A740 Imap Taxhow

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself