Nv Instructions Form

What is the NV Instructions?

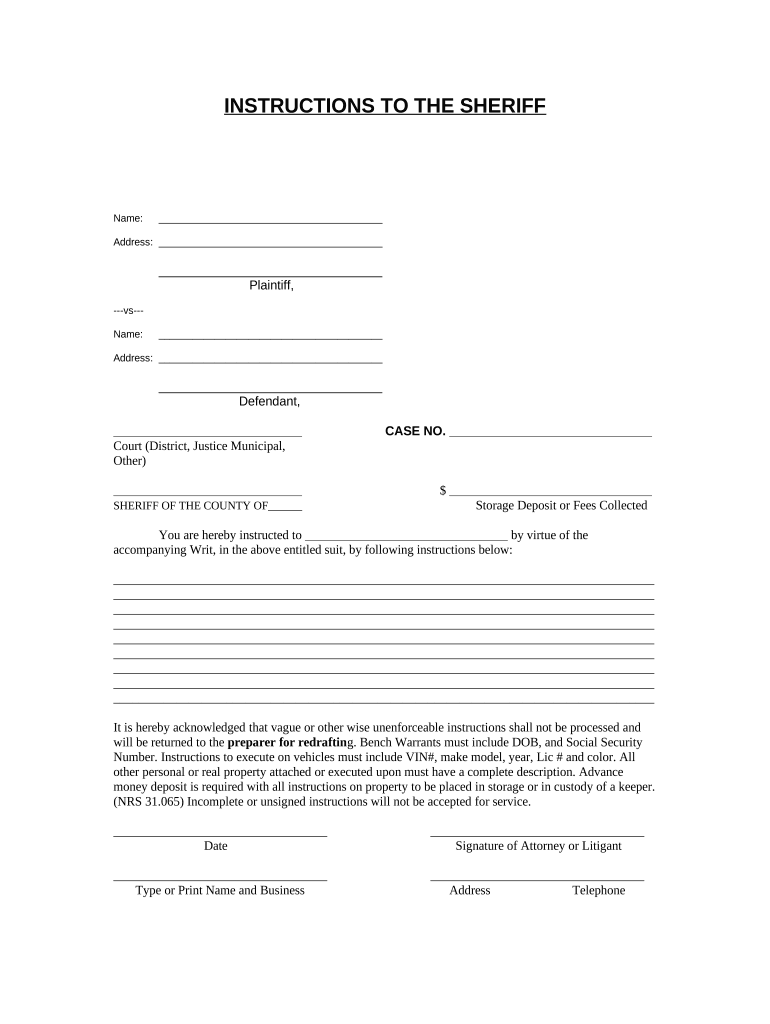

The NV instructions form is a crucial document for individuals and businesses in the United States, particularly when dealing with specific regulatory requirements. This form provides guidance on how to properly fill out and submit various types of applications or requests. It is essential for ensuring compliance with state and federal regulations, and it often serves as a roadmap for completing necessary paperwork accurately.

How to Use the NV Instructions

Using the NV instructions effectively involves understanding the document's structure and the specific requirements outlined within it. Users should carefully read each section to grasp the necessary steps for completion. It is advisable to gather all required information and documents before starting the process. Following the instructions closely can help avoid common pitfalls and ensure that the form is filled out correctly, thereby facilitating a smoother submission process.

Steps to Complete the NV Instructions

Completing the NV instructions involves several key steps:

- Review the form thoroughly to understand the requirements.

- Gather all necessary information and documentation needed for completion.

- Fill out the form according to the guidelines provided in the instructions.

- Double-check all entries for accuracy and completeness.

- Submit the form via the appropriate method, whether online, by mail, or in person.

Legal Use of the NV Instructions

The legal use of the NV instructions is vital for ensuring that the completed form is recognized by relevant authorities. Adhering to the guidelines helps in maintaining compliance with applicable laws and regulations. This includes understanding any specific legal implications associated with the information provided on the form. Utilizing a reliable electronic signature solution can further enhance the legal standing of the document.

Key Elements of the NV Instructions

Key elements of the NV instructions include:

- Clear definitions of terms used within the form.

- Detailed explanations of the information required from the user.

- Specific instructions on how to submit the form.

- Information on any associated fees or deadlines.

Who Issues the Form

The NV instructions form is typically issued by a designated state or federal agency responsible for overseeing the relevant regulatory processes. Understanding which agency oversees the form can provide clarity on submission requirements and any additional documentation that may be necessary. This ensures that users are informed about the proper channels for filing their forms.

Quick guide on how to complete nv instructions

Manage Nv Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Nv Instructions on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-driven workflow today.

The easiest way to alter and eSign Nv Instructions with ease

- Locate Nv Instructions and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, or an invitation link—or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nv Instructions while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are NV instructions in airSlate SignNow?

NV instructions refer to specific guidelines that help users navigate the document signing process effectively. By following these NV instructions, you can ensure that all signatures and necessary information are collected seamlessly, enhancing the efficiency of your document workflow.

-

How can I access NV instructions for using airSlate SignNow?

You can access NV instructions directly through the airSlate SignNow platform. Simply navigate to the help section or user manual where detailed NV instructions are provided, guiding you through each step of the document signing process.

-

Are there any costs associated with obtaining NV instructions?

No, accessing NV instructions within airSlate SignNow is completely free. Users can easily refer to these guidelines at any time without incurring additional costs, which makes implementing our features more accessible and user-friendly.

-

What features are included with NV instructions?

NV instructions encompass various features that streamline the signing process, including customizable templates, automated workflows, and advanced security measures. These features are designed to enhance user experience and ensure compliance with signing regulations.

-

Can NV instructions help improve my business’s document management?

Absolutely! Following NV instructions can signNowly improve your business’s document management by providing clear steps for efficient eSigning. This clarity reduces errors, speeds up turnaround times, and ensures that all required signatures are collected.

-

How do NV instructions integrate with other tools I use?

NV instructions are designed to integrate seamlessly with various tools and software within the airSlate SignNow ecosystem. This integration allows you to utilize existing workflows while benefiting from the enhanced efficiency provided by our eSigning capabilities.

-

What benefits can I expect from using NV instructions?

By utilizing NV instructions, you can expect faster document turnaround times, enhanced compliance, and a smoother signing experience for all parties involved. These benefits ultimately lead to improved operational efficiency for your business.

Get more for Nv Instructions

Find out other Nv Instructions

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage